We're dedicated to arming traders and investors with the information and insights to make more profitable trades and investments. Here, you can learn how the stock market's historically proven cyclical and seasonal tendencies can be applied to today's markets to make you a more successful investor.

Bit about Our History

This web site is a natural outgrowth of the Stock Trader's Almanac book. Created by Yale Hirsch in 1967, the Stock Trader's Almanac has delivered money-making insights and strategies to investors for more than six decades. The Almanac originated such important market phenomena as the "January Barometer" and the "Santa Claus Rally" and was instrumental in popularizing other tradable strategies, such as "The Best Six Months Strategy" (commonly known as "Sell in May and Go Away") and the four-year Presidential Election Cycle.

To provide more timely advice and historical data and research tools, we created The Almanac Investor digital subscription service and stocktradersalmanac.com. With alerts delivered twice a week, we show investors how to implement in real-time the strategies that have made The Stock Trader's Almanac a must-have for active investors for nearly 50 years.

On the web site, you'll find a rich trove of important market information and research tools. You can investigate the data underlying the January Barometer, one of the most accurate tools for forecasting the market ever devised. Or you can see year-to-year how The Best Six Months Strategy has generated extraordinary returns from 1950 to today. All of our strategies are backed by extensive historical information. You can implement our strategies exactly as we do through our Almanac Investor service or you can study the underlying research and fine-tune the strategies in your own way or even devise your own strategies.

The original impetus behind the Stock Trader's Almanac was Yale Hirsch's lifelong interest in stock market history, cycles, and patterns and his passion to create a practical working tool for the average investor. He succeeded mightily. By organizing a wealth of usable information on a calendar basis, the Stock Trader's Almanac became an immediate hit in the late 1960s.

From the beginning, Mr. Hirsch consistently improved the Stock Trader's Almanac to make it more useful to investors. Early on, he discovered that some days of the week (and some months of the year) are better for stocks than others. Most remarkably, he discovered that the stock market tends to make almost all its gains during just six particular months of the year. Mr. Hirsch calls this the Best Six Months strategy - and its performance over time has been staggering.

Where We Are Today

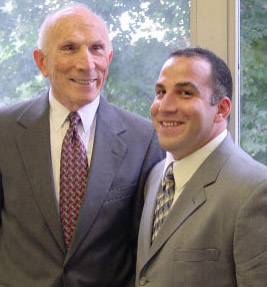

Mr. Hirsch imparted his knowledge of the stock market to his son, Jeffrey Hirsch. Jeff joined the organization as a market analyst and historian under the mentorship of his father in 1990 and became editor-in-chief some years later. He carried on his father's tradition of constantly improving the Stock Trader's Almanac and has been tireless in his efforts to explain how investors can use the Stock Trader's Almanac to beat the market. He regularly appears on major news networks such as CNBC, CNN and Bloomberg; he is quoted extensively in major newspapers and financial publications; and he is in high demand as conference speaker. In short, he is the media's "go-to guy" on all things related to applying the lessons of history to today's stock market.

Backed by nearly 50 years of research, it's fair to say that today's Stock Trader's Almanac is better than ever. We have become the number one information source on stock market history, cycles, and seasonal tendencies. With our extensive market data bank, we show the market's likely direction every day, week and month based on historical precedent, allowing shrewd investors to make better, more profitable decisions.

With the growing importance and price volatility of commodities since 2000, we decided to publish a historical analysis of the commodities market to help investors understand and profit from market developments. Accordingly, in 2007, we inaugurated the Commodity Trader's Almanac. Readers will find that the Commodity Trader's Almanac provides the same type of important historical information and analysis on commodities as the classic Stock Trader's Almanac does for stocks, alerting them to little-known market patterns and tendencies to help them forecast trends with accuracy and confidence.

In today's age of instant, digitized communication, the importance of history sometimes is overlooked. Our stock-in-trade is our conviction that markets follow historical cycles and tendencies. While the patterns don't repeat with mathematical certitude, they do recur often enough to provide an edge to savvy, disciplined investors. Our commitment to you is to identify the patterns; conduct extensive research to validate the patterns; and to alert you on how to profit as these patterns unfold in today's markets.