Our

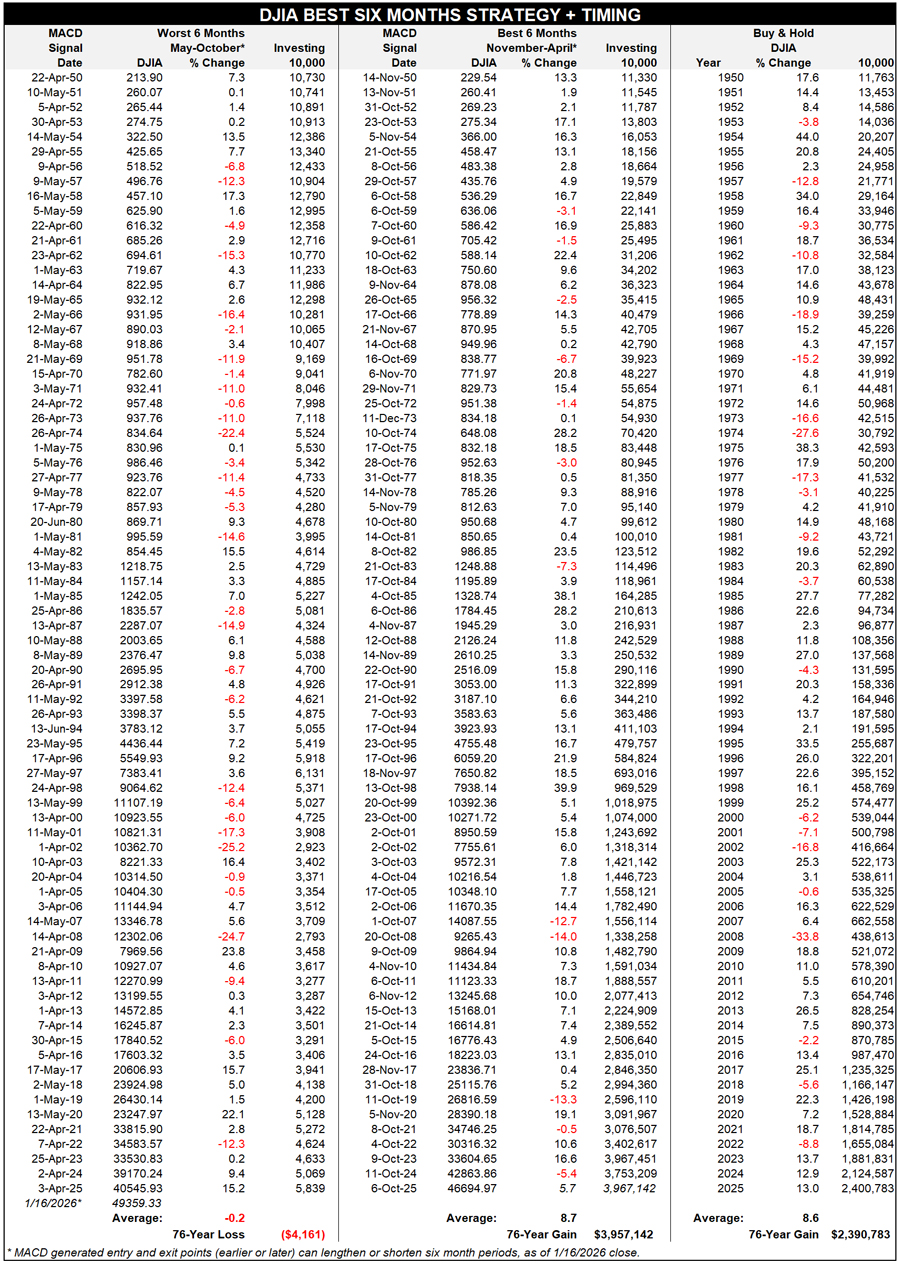

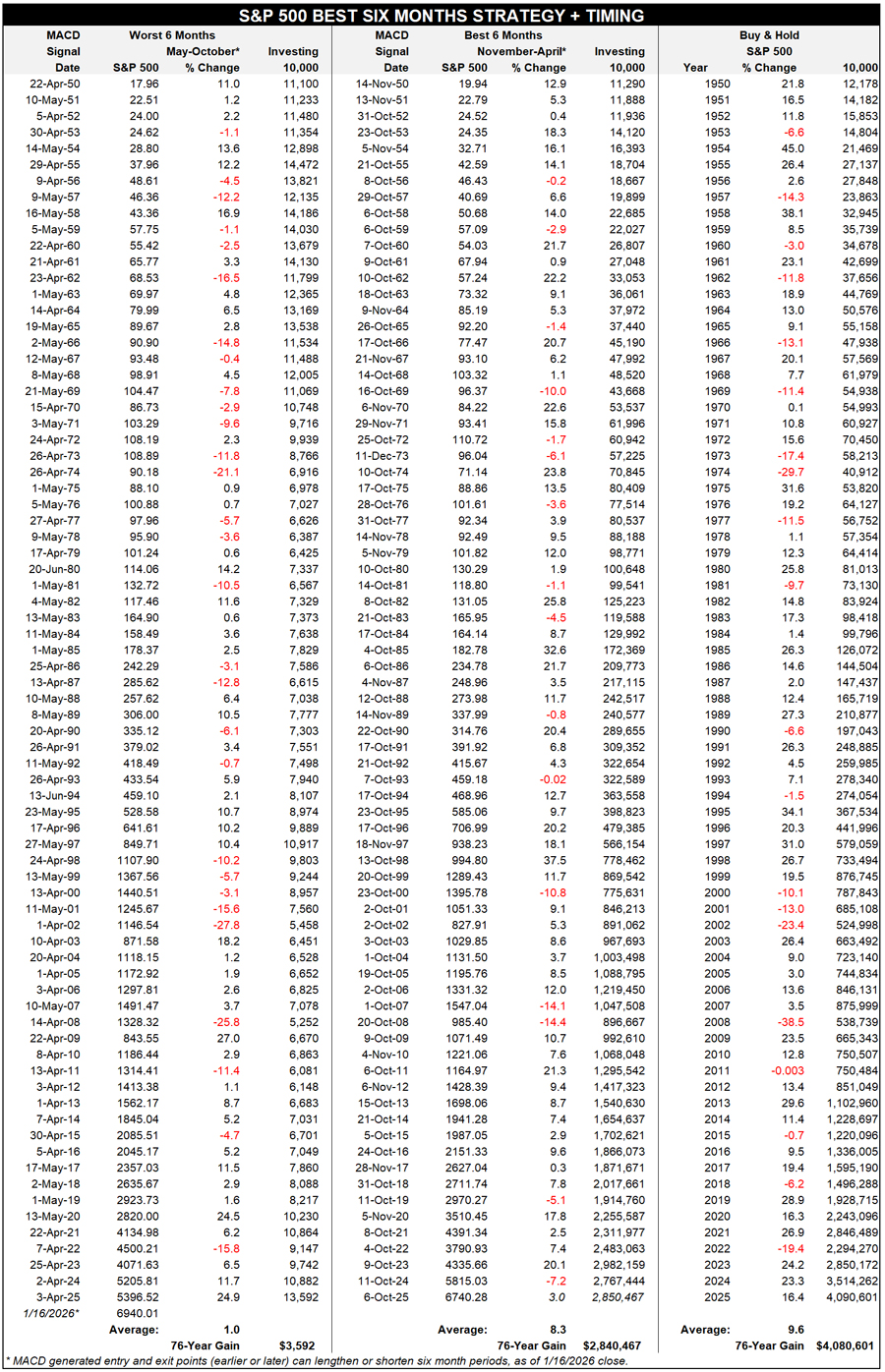

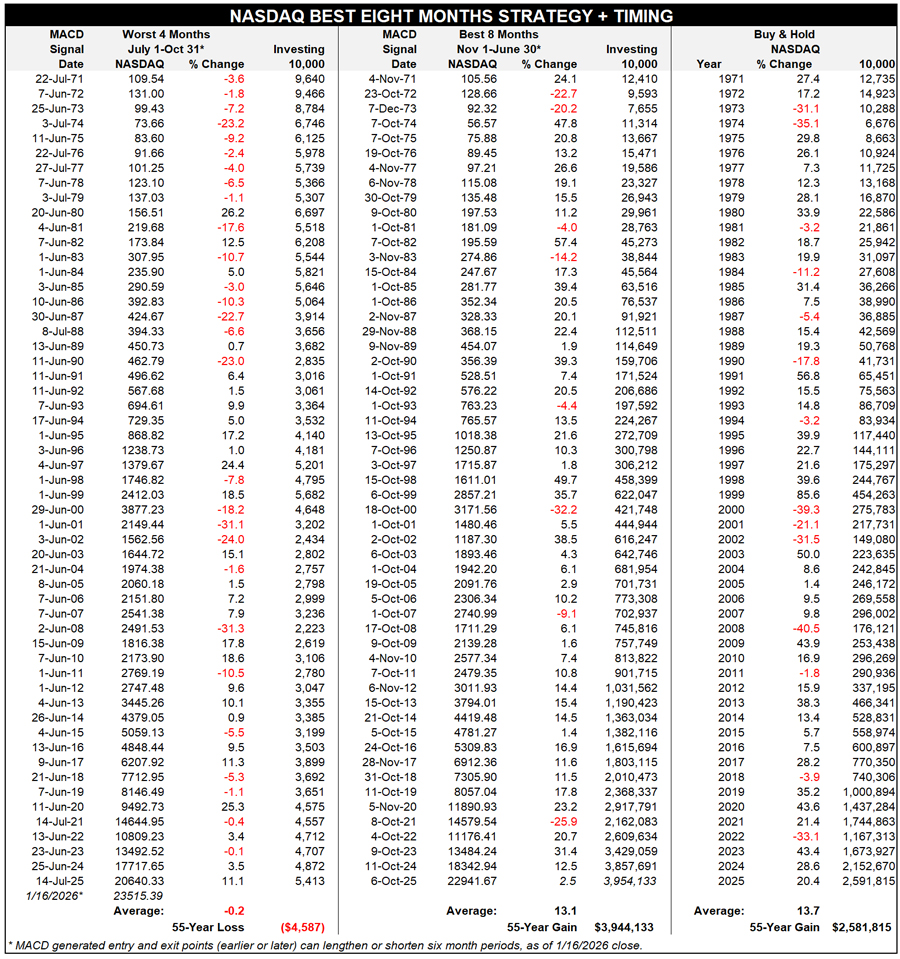

Tactical Seasonal Switching Strategy is derived from the “Best Six Months” switching strategy found in our annual

Stock Trader’s Almanac which is basically the flipside of the old “sell in May and Go Away” adage. After decades of historical research, we discovered that most market gains occur during the months November through April. Investing in the Dow Jones Industrial Average between November 1st and April 30th each year and then switching into fixed income for the other six months has produced reliable returns with reduced risk since 1950.

Thus far we have failed to find a similar trading strategy that even comes close over the past six decades. And to top it off, the strategy has only been improving since we first discovered it in 1986.

Exogenous factors and cultural shifts must be considered. “Backward” tests that go back to 1925 or even 1896 and conclude that the pattern does not work are best ignored. They do not take into account these factors. Farming made August the best month from 1900-1951. Since 1987 it is the second worst month of the year for Dow and S&P. Panic caused by financial crisis in 2007-08 caused every asset class aside from U.S. Treasuries to decline substantially. But the bulk of the major decline in equities in the worst months of 2008 was sidestepped using these strategies.

Our “Best Months” Switching Strategy will not make you an instant millionaire as other strategies claim they can do. What it will do is steadily build wealth over time with half the risk (or less) of a “buy and hold” approach. This strategy is used in conjunction with the MACD indicator to confirm or assist in timing buy and sell decisions. So once we enter April or October we begin tracking MACD for a confirming “buy” or “sell” signal and issue an Almanac Investor Alert when it occurs.

Use of the words buy and sell has created some confusion when used in conjunction with our Tactical Seasonal Switching Strategy. They are often interpreted literally, but this is not necessarily the situation. Exactly what action an individual investor or trader takes when we issue our official fall buy or spring sell recommendation depends upon that individual’s goals and, most importantly, risk tolerance.

A more conservative way to execute our switching strategy, the in-or-out approach as we like to refer to it entails simply switching capital between stocks and cash or bonds. During the “Best Months” an investor or trader is fully invested in stocks. Index tracking ETFs and mutual funds are an easy and inexpensive way to gain stock exposure. During the “Worst Months” capital would be taken out of stocks and could be left in cash or used to purchase a bond ETF or bond mutual fund.

This approach works very well for retirement accounts where the goal is to build wealth over time. It comes with the added advantage of half the risk (or less) of a “buy and hold” approach. Of further benefit, you will probably find summertime vacations and activities much more enjoyable because you will not be concerned with stock market gyrations while your nest egg is parked in the safety of cash or bonds.

Another approach involves making adjustments to your portfolio in a more calculated manner. During the “Best Months” additional risk can be taken as market gains are expected, but during the “Worst Months” risk needs to be reduced, but not necessarily entirely eliminated. There have been several strong “Worst Months” periods over the past decade such as 2003 and 2009. Taking this approach is similar to the in-or-out approach however; instead of exiting all stock positions a defensive posture is taken.

Weak or underperforming positions can be closed out, stop losses can be raised, new buying can be limited, and a hedging plan can be implemented. Purchasing out-of-the-money index puts, adding bond market exposure, and/or taking a position in a bear market fund would mitigate portfolio losses in the event a mild summer pullback manifests into something more severe such as a full blown bear market. This is the approach that we use in the Almanac Investor Stock and ETF Portfolios.

Almanac Investor subscribers receive specific buy and sell recommendations based upon the Best Months Switching Strategies online and via email. Sector Index and select Commodity Seasonalities, are also put into action throughout the year with ETF recommendations. Buy limits, stop losses, and auto-sell price points for the majority of seasonal trades are delivered directly to your inbox.