|

Mid-Month Update: Market Still Trying to Breakout

|

|

By:

Christopher Mistal

|

May 14, 2015

|

|

|

|

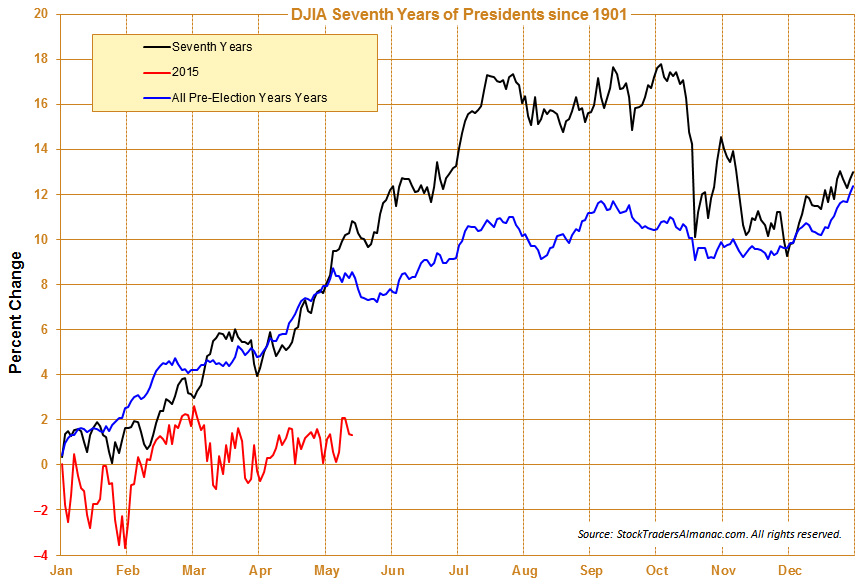

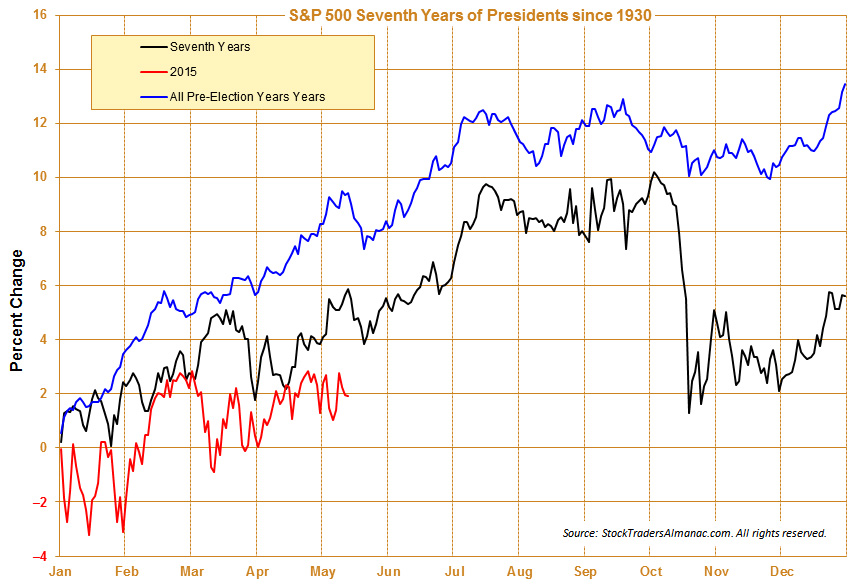

Once again this pre-election year, the market is making a run at new all-time highs. Today, DJIA threatened its March 2 closing high of 18288.63 while S&P 500 closed a few points above its April 24 high of 2117.69. But for all the attempts this year, no breakout has stuck. At yesterday’s close DJIA was up just 1.3% year-to-date and S&P 500 was a little better at 1.9%. This performance is well below the average pre-election year performance. Typically, by mid-May of a pre-election year, DJIA and S&P 500 would be showing gains of approximately 9%.

Some of this year’s laggard performance is likely due to the above-average performance of post-election-year 2013 and midterm-year 2014. Sluggish Q1 growth, perhaps due to harsh winter weather, has weighed on corporate earnings causing valuations to drift away from neutral toward a bit rich. “Sell in May” seasonality is also a headwind as many traders and investors are reluctant to put new money to work at the start of a seasonally weak period, especially with the market struggling to breakout. Considering the time the market has been stuck in a range, the direction of the move out is likely to be course of the market for summer and early fall.

Valuation at a Premium

According to

S&P Capital IQ, first quarter 2015 earnings have beaten the low bar that existed at the end of March. Q1 estimates are now showing EPS growth of 2.9% compared to the expected 3% decline from a few months above. However, due to a large expected decline in energy sector earnings, Q2 2014 earnings estimates are now predicting a 4% decline. Based upon a S&P 500 close of 2100, S&P Capital IQ calculates the S&P 500 (at 21.1x) is currently trading at a whopping 33% premium to the median of 15.9x earnings since 1936 using the S&P 500’s P/E on trailing GAAP EPS. This may not be the highest premium on record, but it certainly yet another reason to hold off on new buying. Equities are no longer cheap.

Bullish Sentiment Eases

Following early month market weakness,

Investor’s Intelligence Advisory sentiment survey did show a decline in % bullish advisors from 52.5% to 47.5%, but % bearish advisors are still tiny at just 15.8%. This leaves the difference between the two at a still worrisome 31.7%. Sentiment suggests now is not a great opportunity for establishing new long positions.

The combination of deteriorating seasonality, still frothy sentiment and a rather tepid Q2 earnings outlook is not positive for the market. The unofficial start of summer, Memorial Day weekend, is just a week away. Trimming long exposure and moving to the sidelines (or to a more defensive posture) remains the best course of action now and the market is providing ample opportunity to exit near all-time highs.