Ah, summer on Wall Street hazy, hot, humid and volatile. Volatility as measured by the dreaded VIX has not really been that high historically, the major averages and the shares that make them up sure have been bouncing around and trending lower, though not down by much. The DJIA has been leading the downdraft, off about 3% from the late-May high at the low last week.

Several items are likely weighing on stocks. The Fed’s big two-day midyear meeting started today. This is the first meeting in nearly a decade where rate hikes are on the table. We do not expect an increase tomorrow. This meeting is also associated with a Summary of Economic Projections and a press conference by the Chair, Janet Yellen. So it’s kind of a big deal.

Then there is the Greek debt fiasco, the trade agreement showdown in Washington, plus the recent ramp up of the 2016 Presidential Election Campaign. Jeb Bush is now officially running, bringing the number of Republican candidates to eleven– in the words of Spinal Tap’s Nigel Tufnel, “These go to eleven.” Get ready for the mudslinging. Economic readings have been less than sanguine. GDP looks negative for Q1 and other metrics like Housing Starts today have been falling. While there are positive data out there it is clear the economy could be on surer footing.

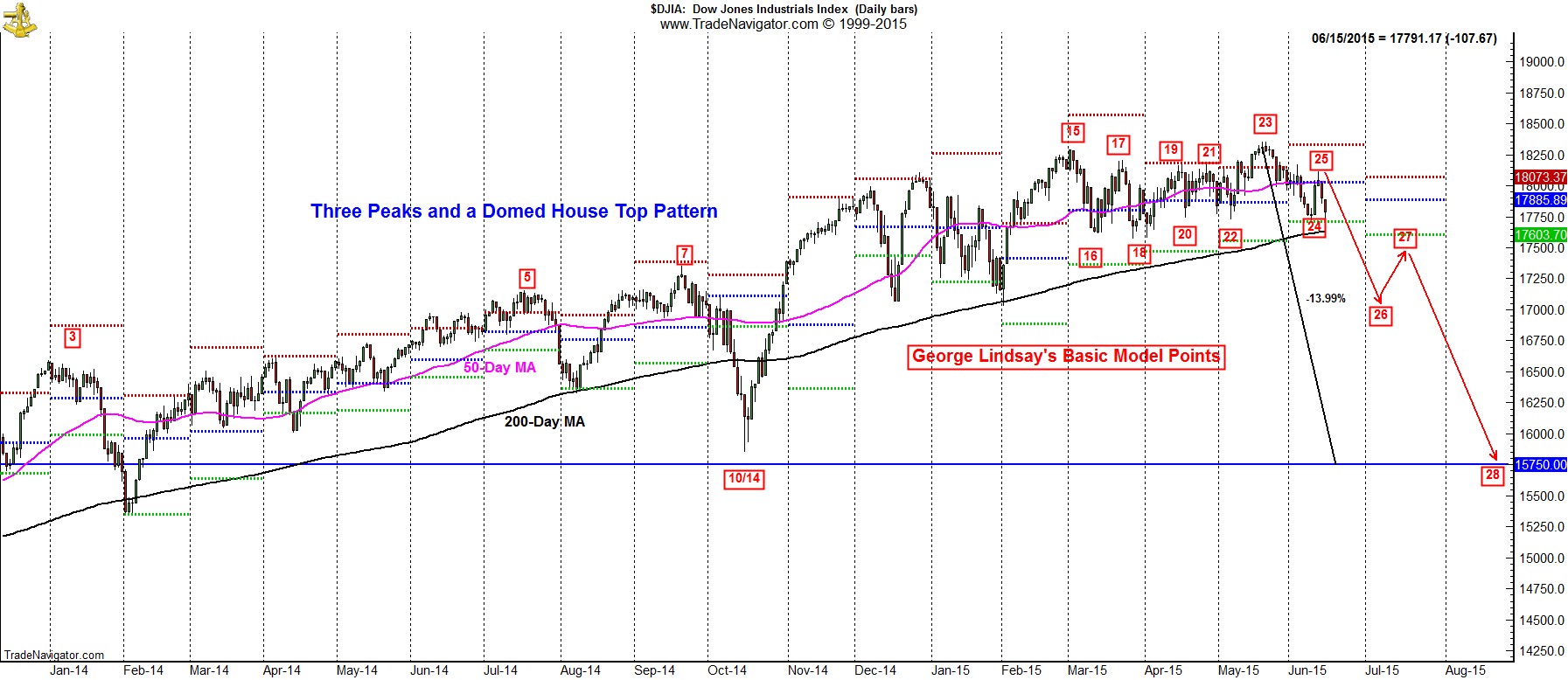

So fundamentals and politics are sketchy. Market valuations are a bit high and internals have not been incredibly robust with NYSE decliners outpacing advancers last week and new lows beating highs and up to nearly 300 last week. Technically the market is looking precarious, drifting sideways pretty much since March and unable to break through resistance. There is also a potential Head-And-Shoulder Top forming, not to mention a possible Three Peaks and a Domed House Top. (Did you see the

tweet from Bill Gross on technical analysis?)

However, it is also the Worst Six Months (AKA “Sell in May”) and we would contend that negative market seasonality is playing a role in the market’s recent struggles. Hopefully, we have helped you prepare over the past several months with the portfolio adjustments we’ve made. While holding on to a host of winning stock positions and a handful of ETF sector positions, we’ve taken some respectable gains, cut losers and weaker positions and implemented a few shorts and defensive plays.

Let’s review. On October 21, 2014 we issued our Best Six and Eight Months MACD Seasonal Buy Signal. On April 30, 2015 we issued the

Sell Signal for the Dow & S&P. On June 4 we issued the

Sell Signal for NASDAQ. From their respective buys to sells S&P 500 was up 7.4% and NASDAQ is up about 14.5%. From the sells to today, S&P is up 0.4% and NASDAQ is down about 0.7%.

We’ll be looking for additional shorting opportunities over the next few months, but for now stick to the game plan and stick to the drill. Hold on to big winners, tighten stops, limit new longs, and consider some of the bond ETF we have suggested and some of the shorts and downside plays. Or sit tight in cash and let the summer market storms wash over you and be ready for the next seasonal buying opportunity later in the year after a pullback or correction.