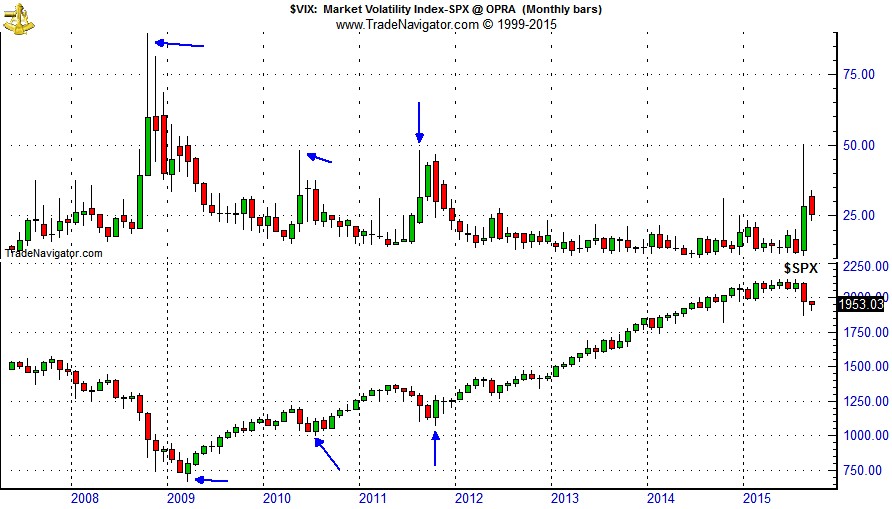

The market’s wild ride since the middle of August has held the CBOE Volatility index (VIX) above 25 for 10 straight trading sessions. It initially spiked above 40 on August 24. Historically, when VIX has spiked, the market was at or very near a bottom. Past spikes were representative of extreme levels of fear and panic that were typically only seen at major bottoms. But, in the chart below showing the monthly bars of VIX v. S&P 500 this has not been the situation since financial crisis stuck the markets in 2008.

At the height of the financial crisis, VIX nearly reached 90 during the week ending October 24, 2008, but the market did not find bottom until nearly five months later on March 9, 2009 when the VIX had retreated into the 50’s (still elevated). The May 6, 2010 “flash crash” pushed VIX to 48.20 during the week ending May 21, 2010, but the S&P 500 did not reach bottom until July 2, 2010. Then again in 2011VIX spike to 48 in August and the market did not bottom until early October when VIX had modestly retreated.

An exact explanation as to why the correlation between VIX and the market has changed is elusive, but it could be the result of the increase in high frequency trading and trend following. Although there have only been a few examples in recent history to draw conclusions from, it is quite likely that this trend will persist and the final bottom of this market correction is still several weeks to a month or more in the future (late September, October or even early November).

ETF Portfolio Updates

Positions in SPDR Consumer Staples (XLP) and SPDR Healthcare (XLV) were stopped out in the market’s late August nosedive. Excluding any dividends and/or trading fees, XLP was closed out for a modest 1.7% gain and XLV an 11.1% gain. Both positions had been performing admirably well right up until mid-August. We will look to re-enter these positions later this month, in October or when or Seasonal MACD Buy signal triggers.

Of the three outright short positions held in the portfolio, only iShares DJ Transports (IYT) remains. During the mini crash of August 24, it just missed trading at or below its auto-sell price of 127.79 by less than 50 cents. SPDR Materials (XLB) and SPDR Financial (XLF) however did fall below their auto-sell prices and were covered. XLF has bounced while XLB remains under pressure due to ongoing Chinese economic concerns. XLF and XLB short trades netted a handsome 17.2% and 16.9%.

Other defensive positions in HDGE, TLT and AGG continue to mostly tread water. HDGE has made some headway and is now up 6.9%, but TLT and AGG are being held in check by the possibility of a Fed rate increase. Factoring in dividends, TLT and AGG are essentially flat. Given tepid inflation here in the U.S. and outright deflation worries in other parts of the globe, any rate increase is likely to be small in nature and likely to occur over a lengthy period of time. HDGE, TLT and AGG are on Hold.

Maintaining the position in ProShares UltraShort S&P 500 (SDS) proved prescient. Even with a relatively loose 5% trailing stop loss (based upon closing prices), SDS was not stopped out until the markets snap-back rebound on August 26. This brief trade resulted in an 18.8% gain while the market was momentarily in freefall.

It has been nearly two months and United States Natural Gas (UNG) has refused to trade below its buy limit. It has not gone up either. At this time, the UNG trade idea is cancelled.

During the August market rout, open trade ideas iShares NASDAQ Biotech (IBB), iShares US Tech (IYW) and SPDR Retail (XRT) were added to the portfolio when they all traded below their respective buy limits. Both the magnitude and swiftness of the market decline was not fully anticipated. IBB, IYW and XRT could have been, and in the case of IBB and IYW can still be, purchased for less. IBB, IYW and XRT on Hold. Additional purchase will be considered once the all clear has been sounded.

See table below for updated stop losses.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control did not hold any position in the ETF’s mentioned above.