[

Editor’s note: Early next week we expect to ship 2016 Stock Trader’s Almanacs

to all active subscribers. To ensure we ship your FREE bonus copy to the proper address, please take a moment to login to your account at www.stocktradersalmanac.com and verify and/or update your address information. Your address can be found after logging by clicking on “My Account” at the top right of the page. Also, click on “Subscriptions” and verify that you will be active through at least October 31, 2015. If your subscription expires in the next few days, you will miss out on the free bonus Almanac

. If you have any troubles accessing your account, password reset is available here: https://www.stocktradersalmanac.com/RetrievePassword.aspx.]

Earlier this week Jeff ventured down to Charleston, South Carolina for a little keynote presentation to our friends at

Ausdal Financial Partners. Every year they hold their annual meeting, which they call Rumpus, somewhere fun for their advisors to go over the latest compliance requirements, attend product and information presentations, exchange notes and have little fun.

Jeff is pleased to report that Rumpus 15 in Charleston was a brilliant event, featuring classic Low Country fair and a fantastic opportunity to meet and mingle with a class organization and some of the sharpest independent advisors out there. Rob Ausdal, AFP President and CEO, and Jeff are both members of the

Probabilities Fund Management LLC investment committee.

AFP’s Rumpus was the perfect occasion for Jeff (and Rob) to further impart to advisors the benefits of using our brand of historical, seasonal, trend and cycle research in conjunction with fundamentals, technicals and macroeconomic analysis – and how they are implemented with Probabilities Fund Management investment products.

In addition to the AFP Rumpus, Jeff was able to meet with an independent advisor team, not affiliated with AFP, from

RS Wealth Management out of Wrightsville Beach, North Caroling who uses the Almanac and Probabilities products already. These two gentlemen trekked down to Charleston and provided much insightful feedback and Jeff was able to clarify and shed light several market pattern nuances.

Late-Day Smart-Money Rally Bodes Well For Stocks

The market spent most of the day in the red until it rallied in typical fashion in the last hour to move into positive territory before closing fractionally in the red, down less than a point on the S&P 500. One of the most consistent market patterns we track in the Almanac and use when exiting or entering positions is the intraday market patterns.

Despite the prevalence of high-frequency, program and algorithmic trading, the market’s intraday pattern, which is driven by the collective behavior and daily routines of all the individual participants, continues to persist. As illustrated in the chart below from page 139 of the 2016 Almanac, you can see the so called “dumb” money which often comes in scared in the morning and selling, then a rally until the lunchbreak pause, a post-lunch rally, the afternoon coffee run selling and then a rally to the close with “smart” money buying.

This late-date rally today, while not resulting in a positive day, is emblematic of the market’s underlying strength. However, after expected turn-of-the-month bullishness as illustrated on our

November and

October Strategy Calendars, a minor pullback after the

banner October gains this year is too be expected.

Pulse of the Market

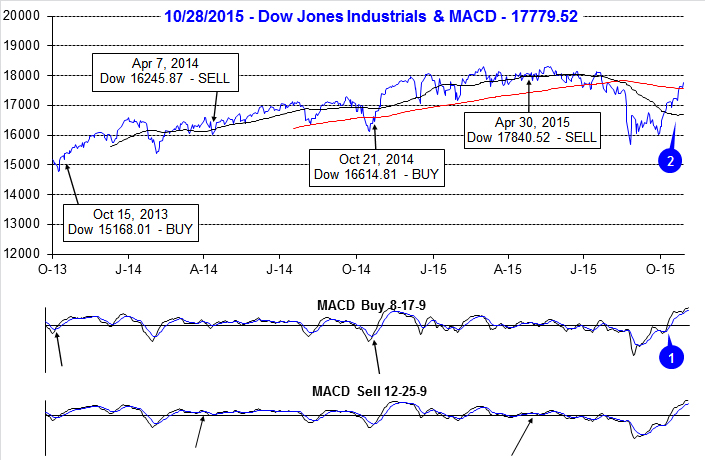

Through yesterday’s close, DJIA has gained 6%, S&P 500 has added 5.2% and NASDAQ was up 6.6% since we issued our

Seasonal MACD Buy Signal when the market closed on October 5 (1). Barring any significant decline tomorrow, October 2015 will go on the record as DJIA’s biggest monthly point gain ever and will be just the third time in history it has gained more than 1000 points in a single month. The previous two occasions were October 2011 and April 1999.

When the month began, DJIA was trading below its 50- and 200-day moving averages (2). As of yesterday, DJIA has reclaimed both of these key levels (2), successfully completed the “W” or “1-2-3” bottom pattern we were tracking and is trading above the level it was at before the mini waterfall decline of August. All of this gives us greater comfort in our currently bullish outlook for the rest of 2015 and Q1 2016.

Further confirmation of October’s strength and the apparent improvement in investor/trader confidence can be seen in the Pulse below. DJIA, S&P 500 (4) and NASDAQ (5) have all logged weekly gains for four weeks straight and these gains were accompanied by strength on Fridays and Mondays with only this past Monday suffering a modest DJIA decline (3). We have repeatedly noted the importance of Friday and Monday trading and the past four weeks are a perfect example. It is bullish when traders and investors are buying on Friday, holding over the weekend and then buying again on Monday.

Looking back through nearly 15 years of Pulse history, the last time a four week span had just a single red blemish in it, like the last four weeks, was in March of 2010 when DJIA, S&P 500 and NASDAQ all advanced for five straight weeks.

NYSE Weekly Advance, Decline, High and Low metrics have all improved substantially during the current rally. NYSE Weekly Advancers have outnumbered Decliners for three straight weeks (6). Weekly New Highs (7) have been expanding for three straight weeks as well. New Lows fell abruptly the second week of October and have crept higher, but remain subdued. The number of New Highs and Lows are currently at neutral levels leaving room for the market to continue its climb.

Weekly CBOE Put/Call Ratio (8) has remained stubbornly elevated throughout October. For some this could be a worrisome sign, but it is more likely a healthy amount of skepticism. As long as the ratio hangs out around its current reading, the rally is most likely to remain intact.

Click for larger graphic…