Even before the month of December arrived, expectations were running high for the market in the final month of 2015. Historically, the market is rarely down in December and when it is it is usually just barely. Remember, this is for the full month. History has also shown a tendency for the market to be weaker during the first part of the month as tax-loss selling and yearend portfolio restructuring has been happening sooner and sooner in recent years.

It seems reasonable to assume that some of this has been taking place already this month. Some of the year’s biggest losers have been hit the hardest lately specifically, energy-related stocks and crude oil. Tax-loss selling appears to only be exacerbating broad commodity weakness that has existed all year. It does not look like the global economy is decelerating further. As long as the market can hold its November lows between now and mid-month December, then the market is still on track for a typical yearend rally that has

historically commenced around mid-month.

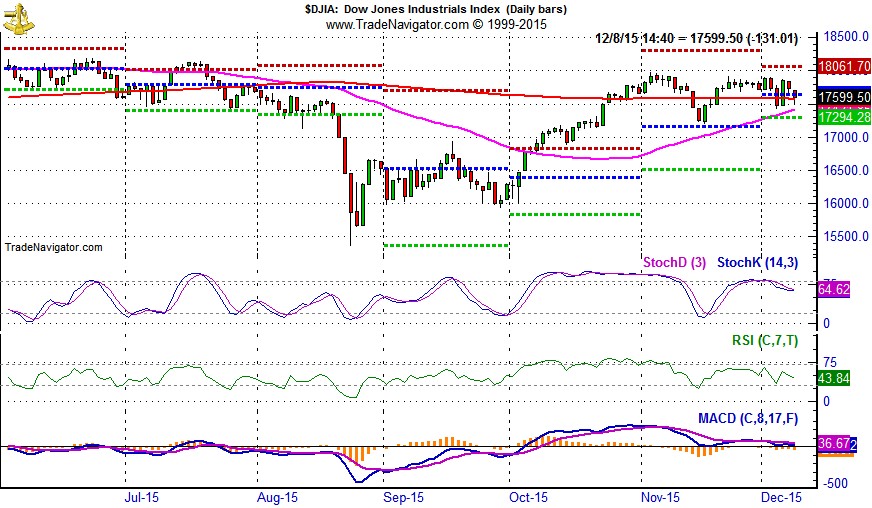

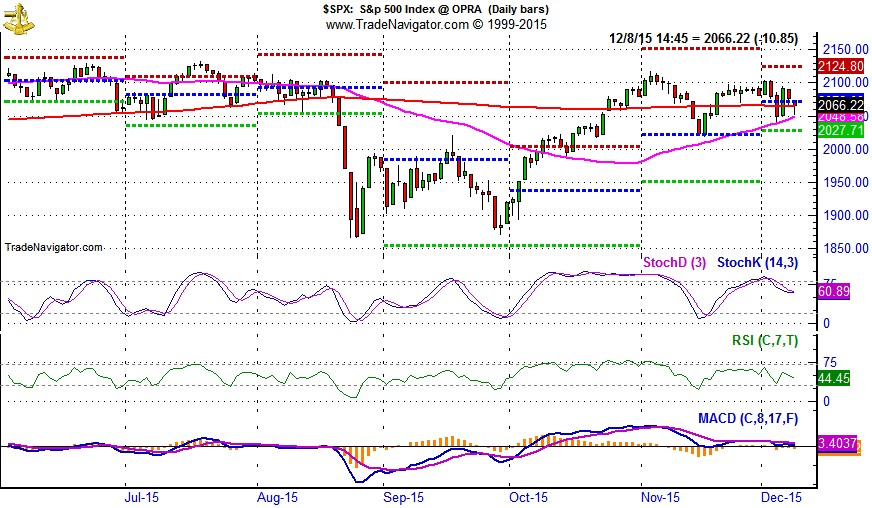

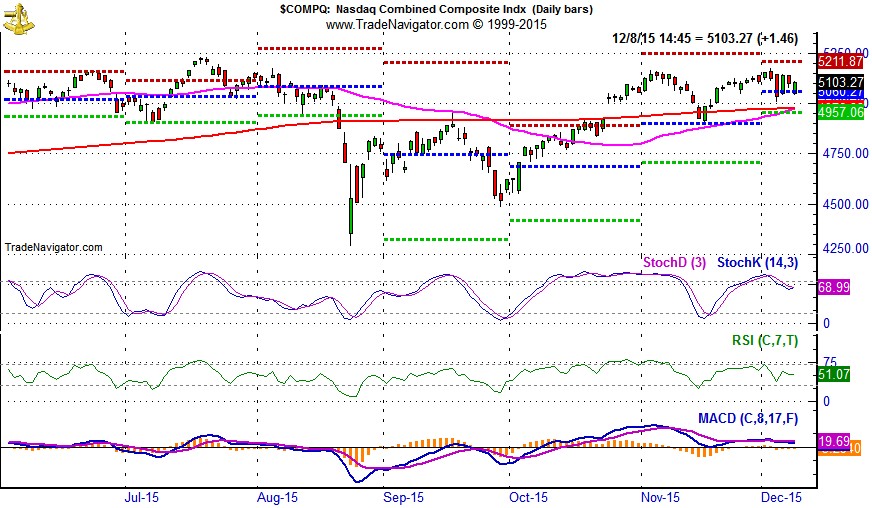

In the above three charts, November’s lows were all right around the projected monthly pivot-point (blue-dashed line). Those levels were DJIA 17159, S&P 500 2022 and NASDAQ 4900. Over the past four trading sessions, DJIA, S&P 500 and NASDAQ have been on either side of December’s projected monthly pivot point which is also roughly where DJIA’s and S&P 500’s 50-day moving averages currently sit. NASDAQ, the best performing index year-to-date of the three, has not touched its 50-day moving average since mid-November and is on the verge of registering a bullish golden cross, when its 50-day moving average crosses back above its 200-day moving average.

Contrarian View of Interest Rates and the U.S. dollar

This year the catalyst for a yearend rally beginning in mid-December could be stronger than usual. Besides the slowing of usual tax-loss selling and end-of-year portfolio restructuring, the Fed could finally announce the first rate hike in nearly a decade on December 16. Conventional thought expects an increase in interest rates will lead to a stronger U.S. dollar. This may not be the case though. Currency values are based upon much more than just interest rates. Economic growth and inflation, actual and expected, are also integral to a currency’s value. Politics, government policies, leadership and debt burden also play a role.

Consider what just happened to the euro when the ECB cut rates and pledged additional QE. The euro spiked 3% on the day and has managed to hang on to most of the gains in the days since. Some will say it spiked because the ECB did not do as much as expected, but it looks more like short-covering than disappointment. A single-day move of 3% is substantial in the currency markets and even more so when it is the euro. The decision to cut rates and expand QE was well telegraphed resulting in a sizable drop in the euro before the official announcement was even made. This seems like a classic example of “buy the rumor, sell the fact.”

The U.S. dollar index has enjoyed a vigorous rally over the past 16 months from around 80 in July 2014 to just over 100 this month. It would seem a series of rate hikes may already be baked into the cake.

Furthermore, during the last rate hike cycle the Fed embarked upon from June 2004 to July 2006 (shaded in yellow in chart above), the U.S. dollar index actually declined. Granted it was not a straight line lower nor was it by a massive amount. Nonetheless, by the time the Fed moved interest rates from 1% to 5.25%, the U.S. dollar was weaker. The USDX closed May 2004 at 88.95 and was at 85.30 at the end of July 2006 and reached a high of 92.63 in November 2005.

That rate hike cycle was well telegraphed and orderly. The next rate hike cycle has been expected for even longer and is likely to be even slower. Giving the surge of the U.S dollar in anticipation of the first hike it seems quite possible that the U.S. dollar could actually weaken instead of strengthening further as profits are taken “on the news.” A weaker dollar would give commodities a much-needed boost and would also aid our manufacturing sector by making our exports more attractive overseas, which could eventually lead to new all-time market highs in the near-term.