History may not repeat itself exactly to the letter, but the market certainly has been following along rather closely. Two patterns we have been monitoring recently,

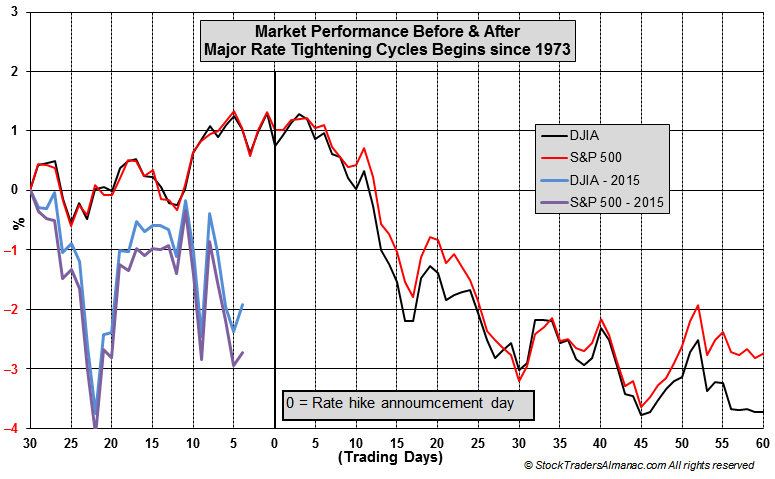

Market Performance Before & After Major Rate Tightening Cycles and

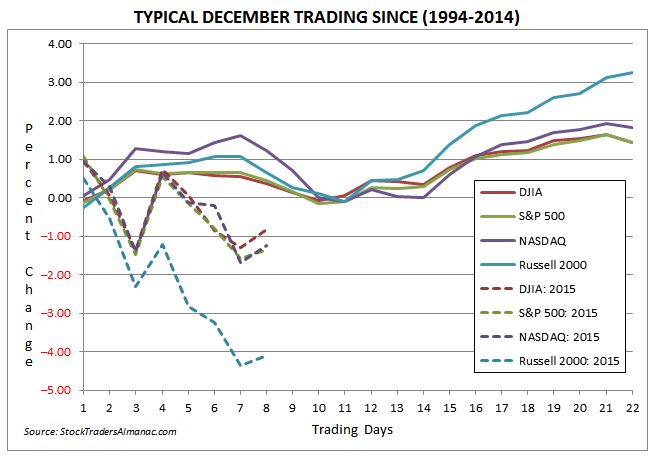

Typical December Trading, have been unfolding reasonably closely this month. The former pattern suggested choppy trading with a mild upside bias ahead of the Fed’s up-coming December meeting where the probability of the first rate hike in nearly a decade is high. The latter pattern suggested a weak first half of December due to tax-loss selling and early year-end portfolio restructuring. Both of these patterns have been updated in the following to charts to include December’s trading action through today’s close.

As you can see in both charts, the market is running below average. A typical December would have the market floating around unchanged on the eighth trading day of the month which would be better than the down roughly 1% that it is today. Russell 2000 is the worst performer by a wide margin, currently down 4.1% this December. Small-cap underperformance in the first half of the month is actually quite normal and does potentially set up that index for solidly outperforming in the second half and potentially beyond.

This rate hike cycle has been the mostly widely debated and telegraphed in the history of the Fed and yet it is still not a 100% forgone conclusion it will begin on December 16. Based upon Fed funds futures pricing listed on

www.cmegroup.com, the current probability of a Fed rate hike is now 83%. This uncertainty combined with previously mentioned tax-loss selling and year-end portfolio moves is the most likely cause for the elevated market volatility seen so far this month. Once December 16 passes on the calendar, market volatility will likely begin to diminish and typical holiday cheer and year-end buying will probably kick in, taking the market higher to finish up the month and the year. Suggested weakness after the rate hike will likely be offset by the positive effect created by the removal of rate increase uncertainty.

Stock Portfolio Updates

Over the past four weeks, the Stock Portfolio slipped 1.3% while S&P 500 and Russell 2000 dropped 1.3% and 2.7%, respectively, as of yesterday’s close. Small-, Mid- and Large-cap sub-portfolios suffered declines. Mid-caps were hit the hardest, off 2.8%. Group 1 Automotive (GPI) was stopped out on November 13 when it closed below $78.88. GPI’s return was reduced to 25.8% since addition, excluding dividends and fees. Amerco Inc (UHAL), Cal-Maine Foods (CALM) and Team Health (TMH) were also drags as these shares slid the most. Bright spots included Lithia Motors (LAD), which held its ground and Sunoco (SUN) that climbed 5% in the face of falling crude oil prices and general energy-sector malaise.

Large-cap holdings collectively shed 1.2% as recently added positions (from October stock basket) weakened modestly with the broader market. Older holdings, Fidelity National Finance (FNF) and UnitedHealth (UNH), climbed slightly higher, but not enough to offset the drag from other positions. This month’s Seasonal Sector Trades’ idea, Southern Copper (SCCO) was added to the portfolio on December 8 when it traded below its buy limit of $25. At yesterday’s close, it was up $0.21 or 0.8%.

Our Small-caps performed the least bad, down 0.8% combined. Newtek Business Service (NEWT) is issuing a special dividend consisting of cash and/or stock in the amount of $2.69 per share (approximate value of $34 million). However, only 27% of the dividend will be paid in cash, the balance will be paid in shares. Shareholders are to receive election forms to decide which they prefer, all cash or all stock. If enough shareholders opt for stock, then those that opt for cash will receive all cash. If too many shareholders request cash such that the 27% limit would be exceeded then payment will be cash and shares. Based upon the reason for this special dividend and the fact that NEWT has paid a generous dividend already this year, taking the additional shares appears to be the appropriate action. NEWT’s original price and stop loss have been adjusted for this special dividend. Additional information can be found on their website here: http://investor.newtekbusinessservices.com/index.cfm.

Other notable happenings in the small-cap portfolio include some rather volatile moves by Century Community (CSS) and LGI Homes (LGIH). CCS was pulled even further lower than last update while LGIH initially shot higher only to be sharply sold off to much lower levels. LGIH appears to be finding support now right around $27. CCS is back at the level it broke out from back in February. Finally Walker & Dunlop (WD) was picked up on November 13 at $26.90.

In last month’s update, based on previous research, we were anticipating some weakness to present creating an opportunity to make some additional purchases on dips in November and in early December. That weakness has materialized. As a result many of the more recent trade ideas can be considered either at current levels or on dips below their respective buy limits. Please note, Buy Limits and Current Advice are based upon the closing prices from December 9. Positions may have moved higher or lower today.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in CALM, CCS, CNC, CVS, DHI, HBI, LGIH, MMSI, NTRS, PLOW, SUN, TMH, TSCO and VSR.