Publication Note: The Free Lunch Menu of bargain stocks will be served via Almanac Investor Email Alert prior to the market’s open on December 21st. Tuesday, December 22nd will be our last regularly scheduled Alert of 2015. Our next email will be on January 5, 2016. However, if market conditions warrant an interim update, one will be sent. Happy Holidays and Happy New Year!

All year long we have been tracking the divergent pattern of the 7th year of a 2-term president in the chart below in this space, illustrating how 2015 has been tracking the weaker track of the 7th year of the president’s term instead of the higher trajectory of the pre-election year, or 3rd year of the term, pattern. As of the close today the S&P 500 is back in the red.

Our good friend

Dan Turov, who publishes the stellar

Turov on Timing service, took an excellent poll on Tuesday. He asked all his subscribers of which we are one, “

On Wednesday, I believe the stock market will advance/decline in response to the Federal Reserve’s raising/not-raising interest rates.” We responded that we believed that the market would advance in response to the Fed’s raising rates.

Despite the market’s positive reaction yesterday to the Fed’s first rate increase in nine and half years after seven years at zero, volatility is still with us. Today’s 1.5% drubbing may be disconcerting, but this is not out of the ordinary following a big up day on

FOMC announcement days. While for much of this year we had not been expecting the first Fed rate hike until 2016, recently it became apparent that it was going occur at yesterday’s meeting.

As time is running out 2015 is on pace to be the first losing pre-election year for the DJIA since war-torn 1939 when Germany invaded Poland. If 2015 ends in the red, that would not be a great sign. 1939 was the seventh year of FDR’s Presidency, his second pre-election. The S&P 500 was down 5% in 1939 and as WWII broke out in Europe the stock market was down double digits the next two years.

So Santa Claus better get his act down to Wall Street stat. For as you all know from our missives early this week and over the past two months and page 114 of the 2016 Almanac, “If Santa Claus should fail to call, bears may come to Broad and Wall!” (Yale Hirsch defined the Santa Claus Rally, in 1972, as a seven-trading-day period that spans the last 5 trading days of the year and the first two of the New Year.)

2015 Forecast Recap

Before we reveal our outlook for 2016 let’s examine how our 2015 forecast panned out. Last year at this time we said:

The end of quantitative easy, a plunge in the price of oil and several geopolitical and exogenous issues seem to have been shrugged off by this market. We expect the usual 50% move from the midterm low to the pre-election year high to be below average in the 20-30% range as Fed rates hikes loom large. Toward the later part of 2015 the economy is prone to slowing as Republicans and Democrats begin the next battle for the White House.

We expect a high most likely in the first half of 2015 around Dow 19000, S&P 2250 and NASDAQ 5000, slightly higher or lower than NASDAQ’s all-time high. Then we look for a move sideways to slightly higher throughout the last half of 2015 with an ultimate high near yearend 2015.

We made new highs on all the major averages, clearing 5000 on NASDAQ, but the DJIA and S&P 500 came up a bit short of our forecast at 18312 and 2131 respectively. So far the Dow is up 19% from its 2014 midterm year low to this year’s high – S&P 22%. The economy is arguably slowing and the battle for the White House raging. So all in all, not perfect but not too shabby.

Four Horsemen of the Economy

The Unemployment Rate has been in a steady downtrend for the past six years and below the Fed’s threshold for over a year and at the current 5% rate since the summer. Though the labor participation rate shows that the economy is battling to expand, which is a good sign. Despite likely layoffs in the energy patch, solid hiring in other sectors like health care and tech are picking up the slack.

Inflation is another matter entirely and this aspect of the Fed’s dual mandate was clearly driving the Fed’s long delay on raising rates. Both PPI and CPI have been sliding lower for years and after a brief respite in mid-2014 CPI has drifted to the low single digits, while PPI has taken a nose-dive into negative territory as low oil and commodities prices have put pressure on inflation. Now that the Fed raised rates 0.25% perhaps the low CPI inflation and negative PPI will prove transitory, but it is rather worrisome.

Consumer Confidence continues to trend higher and is now above the critical 90 level, though threatening to breakdown at a moment’s notice. While we finally experienced the long awaited 10% correction this summer DJIA and the US stock market bounced back and are threatening a move to new all-time highs if we get some good data and Santa comes back to town.

Existing home sales and Housing starts remain on the rise with sales of existing homes being by far the shining data point of the housing market, coming in at well over the seasonally adjusted annual rate of 5 million for the last year and a half. Starts have not been able to gain as much traction.

New home sales remain in the toilet and this is the major concern for the housing market. This is usually the last indicator to turn, but will provide an important confirmation when the housing market, the economy and the market have entered the next secular boom.

While the housing market is doing better overall, NAHB Housing Market Index (HMI) may be rolling over in the face of the lagging new home sales and housing starts. HMI is the best indicator of the overall housing market – it led all the other indicators before the meltdown and recovered fastest. Look for HMI to hold above its midpoint line and gain ground for a clear indication that the housing market and the economy are staying healthy.

Pulse of the Market

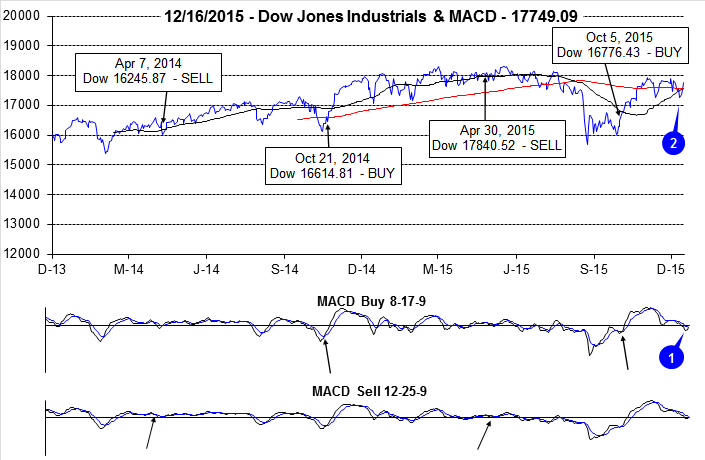

Seemingly heavier than usual tax-loss-selling pressure in the first half of December generated above average weakness this year. Virtually on cue, weakness did come to an end right around the middle of the month, this past Monday. Three straight days of DJIA gains had brought both the faster and slower moving MACD indicators to the verge of turning positive (1). Today’s decline will delay the bullish crossover at least another day or two.

A second bullish, albeit lagging crossover, will trigger today. DJIA’s 50-day moving average has finally risen back above its 200-day moving average (2). This crossover event is bullishly known as a “golden cross.”

Our research found recent “golden crosses” to be reasonably indicative of further upside as the last four have preceded extended moves higher.

Early-December weakness was foreshadowed this year by the eleventh DJIA Down Friday/Down Monday (DF/DM) (3) of 2015 on the last trading day of November. DJIA’s subsequent low on December 11 was within the realm of recent post DF/DM weakness in a bull market supported by highly accommodative monetary policy. DJIA’s December 11 close (4) capped one of 2015’s worst weeks and will likely be an important level to remember during the first quarter of 2016. S&P 500 (5) and NASDAQ (6) declined 3.8% and 4.1% respectively last week. Interestingly, last week’s heavy losses were just the second weekly decline in the last nine weeks for S&P 500 and NASDAQ.

Market breadth, measured by NYSE Weekly Advancers and Decliners has been all over the place. In weeks with solid upside moves, Advancers have held the clear advantage while in sharply down weeks, Decliners lead. Last week’s big decline was preceded by a modest weekly advance where Decliners heavily outnumbered Advancers (7). This would seem like it could be a worthwhile indicator until you look back further (week ending October 30) and see a similar meager weekly gain and lopsided ratio, but the following week was up. Broad energy and materials sector weakness is likely responsible for the chaos that weekly metrics have been displaying recently.

New NYSE Highs (8) have yet to show any sign of life as the broader indices have been muddling around well below their respective highs. Should New NYSE Highs begin to expand meaningfully, new all-time highs could be around the next corner.

In anticipation of this week’s Fed meeting, and widely expected rate hike, the 90-Day Treasury rate (9) rose to its highest level since 2009 at 0.26%. After seven years essentially at zero, the move likely feels much more significant than it actually is. The Fed is still highly accommodative within longer-term historical context.

Click for larger graphic…

2016 Forecast

Even if DJIA ends the year down for the first time since FDR’s 7th year in office in 1939, it does not necessarily imply that the next two years will be horrible like 1940 and 1941. There is no world war raging and while ISIL is a concern, they are not the Third Reich or Axis Powers and we will not wait as long to deal with them as we did with the Axis in WWII.

In fact, don’t be surprised if Putin takes care of ISIL unilaterally or with a coalition sooner rather than later. He wants stability in the region – his backyard and he does not care which despots are in charge as long as there is stability in the region. This was the same wisdom of Bush 1, Colin Powell and Schwarzkopf in 1991. They dismantled Iraq so they could not threaten the world but left them in power to keep order among the warring tribes and radical groups.

Election years average 4.8% on the DJIA, but 8th years, the last year of a two-term presidency average -13.9%, down 5 of the last 6. So we see two scenarios for 2016. If the Fed is right and the energy and commodities price decline proves transitory and prices stabilize, we expect average election year gains in the mid-single digits. If the Fed is wrong and oil and commodities suffer further declines and the junk bond scenario unravels we may begin a mild bear market next year.

As we do every year we will reassess at end of January with our indicator trifecta of the Santa Claus Rally, the First Five Days, and the full-month January Barometer as well as the December Low Indicator. We will also take into consideration at the end of next month all the economic data that has been released since as well as policy commentary from Washington and geopolitics.

The next bear market may begin in 2016 and could take the market 20-30% lower into 2017-2018 in the last cyclical, garden-variety bear market that finally puts an end to this secular bear that began in early 2000. We do not expect much upside over the next few years in the market. But after the next bear market our Super Boom forecast should kick in. We have raised the floor on our initial forecast, but the 500+% move to Dow 38820 by 2025 is still on target.

Happy Holidays & Happy New Year, we wish you all a healthy and prosperous 2016!