Perhaps this afternoon’s market rally will be the start of something meaningful after the worst start to a New Year on record. The apparent and broadly accepted reason for this year’s slide is a slowdown in China’s growth that triggered a market rout there, has sent crude oil and other manufacturing-based commodities tumbling. This has led to falling global growth estimates and weakness across major commodity suppling nations. This certainly appears to be a sizable portion of the reason for all the weakness.

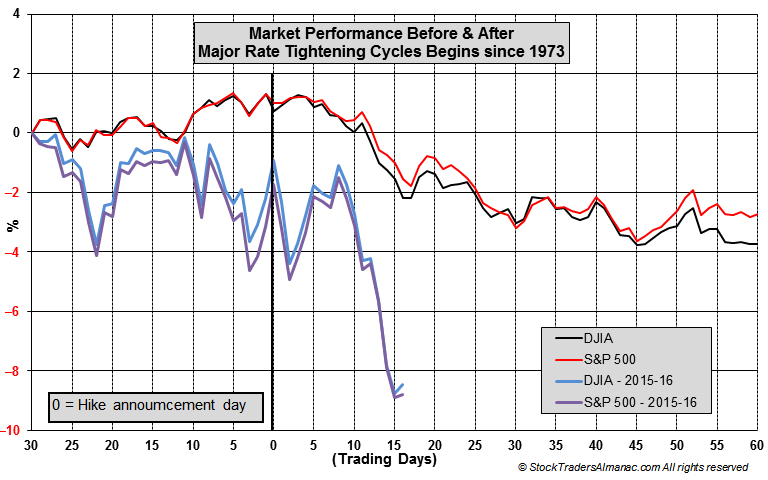

Further compounding the market’s woes is the Fed. Even though their December rate increase and the start of the first tightening cycle since 2004 was the most well-telegraphed move in history, the market may not have been totally prepared for the move. Based upon the previous five major rate tightening cycles since 1973, the market generally moved higher in the 30 days before the start of the tightening cycle and was weak during the 60 trading days immediately following the rate hike announcement.

In the above chart, DJIA and S&P 500 performance during the 30 trading days before and the 16 trading days since the Fed’s December announcement have been plotted against the previous five cycles. This time the market was weak ahead of the announcement and due to China concerns even weaker than average afterwards. If growth concerns ease and the market were to return to the average post-rate-hike decline, it would represent a rally of around 6% from DJIA and S&P 500 closes yesterday, January 11.

Stock Portfolio Updates

Over the past four and a half weeks since last update, S&P 500 has dropped 6.1% and Russell 2000 is off a whopping 9.1% as of yesterday’s close. Small-, Mid- and Large-cap portfolios all suffered declines. Mid-caps were hit the hardest, off 8.9%. Large-caps dropped 7.9% and Small-caps fell 7.6%. Much of the portfolio’s decline was due to the addition of

December’s Free Lunch Stocks. Initially the basket was performing exceptionally well, up 6.3% on average on January 4 close. But, once crude broke down towards $30 per barrel, early gains quickly faded and became losses.

This year’s basket is a near-textbook example of why you need to be nimble, take gains when presented, cut losses early and not get attached to the stocks. Many of the names in the basket were from the energy and materials sectors and were down for good reason late last year.

The entire basket has been added to the Almanac Investor Stock Portfolio, per the original Alert. As of yesterday’s close, just 12 remain and only Eclipse Resources Corp. (ECR) had a gain. Closed positions will not be reconsidered. Those that remain on are Hold for now. Crude oil may hold $30 per barrel and bounce and small-caps also appear poised for some type of bounce as well.

Beyond the Free Lunch stocks, recent broad market weakness resulted in six previous positions being stopped out; two in the Small-cap section of the portfolio (CCS & LGIH), three in Mid-caps (JBLU, LAS & CALM) and one in Large-caps (FNF). Centene Corp. (CNC) was the only non-Free Lunch stock to post a gain over the past four and a half weeks.

All positions in the portfolio are on Hold. No Santa Claus Rally, a down First Five Days and DJIA’s December closing low has been violated. Of the

January Trifecta indicators, only the January Barometer remains to either confirm or possible reverse all of the negative indicators.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in CALM, CCS, CNC, CVS, DHI, HBI, LGIH, MMSI, NTRS, PLOW, SUN, TMH, TSCO AND VSR.