|

Seasonal Sector Trades: Seasonal Support for a Tradable Crude Oil Bottom

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

January 19, 2016

|

|

|

|

CBOE Weekly Equity Only Put/Call spiked to 0.93 last week. That’s the highest since June 2011. It hit 0.93 the week ending June 17, 2011. Put/Call also hit 0.90 November 13, 205. Both of these last two readings above 0.90 preceded some nice weekly gains. However, the market continued lower after both respites.

In 2011 the market suffered a summer/ fall selloff of 19.4% on the S&P 500 for what we declared in the Stock Trader’s Almanac as a “Ned Davis Research” bear market (A 13% DJIA decline after 145 calendar days) posting the last major bottom October 3, 2011. At Friday’s close the DJIA was down 12.7% after 241 calendar days. So we are getting close to a low, at least for the short term.

Crude oil also has some rather negative sentiment at the moment, but has not reached extreme levels as far as the COT report goes. Large and small speculators remain net long though the trend has been lower since 2014 and lower still since last fall. Commercial hedgers remain negative though trending higher. In 2008/2009 at the last major crude oil low both spec groups went negative and commercials turned positive. Last January the COT report was at similar levels as it is now, suggesting a tradable rally, which coincides with the seasonal low.

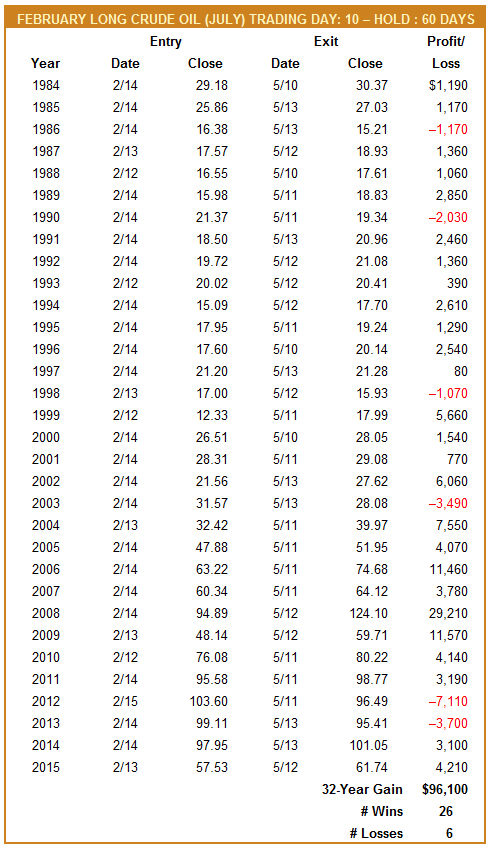

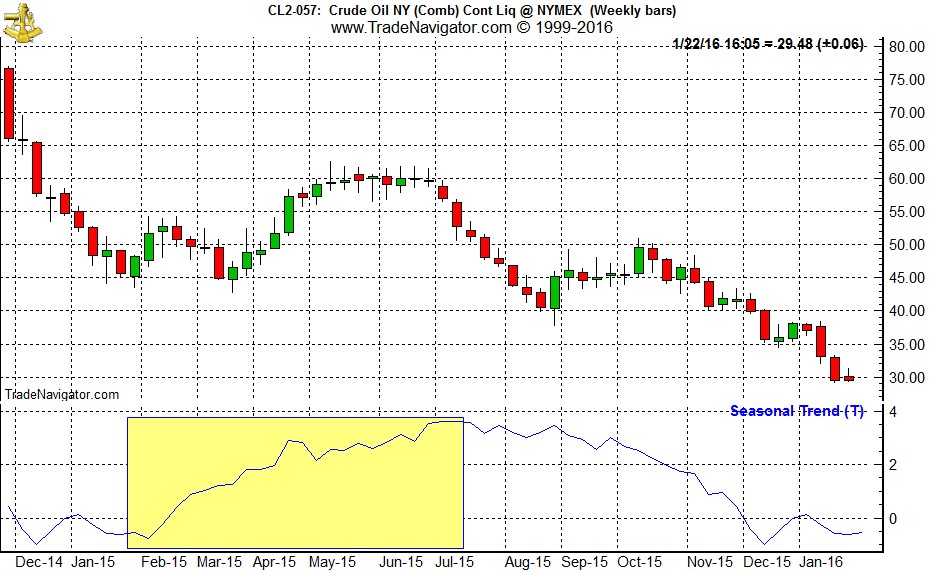

Crude oil has a tendency to bottom in mid-February and then rally through July (highlighted in yellow in second chart below) with the bulk of the seasonal move ending in late April or early May. It is that early February low that can give traders an edge by buying ahead of a seasonally strong period. Going long crude oil’s July contract on or about February 13 and holding for approximately 60 days has been a profitable trade 26 times in 32 years, including last year in 2015, for an 81.3% win ratio with a cumulative profit of $96,100 (based upon a single futures contract excluding commissions and taxes).

Crude oil’s seasonal tendency to move higher in this time period is partly due to continuing demand for heating oil and diesel fuel in the northern states and partly due to the shutdown of refinery operations in order to switch production facilities from producing heating oil to reformulated unleaded gasoline in anticipation of heavy demand for the upcoming summer driving season. This has refiners buying crude oil in order to ramp up production for gasoline. In recent years, crude has been finding a bottom earlier. Last year, crude double bottomed in late January and mid-March rallying from about $50 to just over $60 per barrel in May/June before rolling over last summer.

United States Oil (USO) is the largest and most liquid of the futures-backed ETFs. It trades in excess of 30 million shares daily and has net assets exceeding $2 billion. USO is once again off nearly 60% from its 52-week high reached last year in May. Its stochastic, relative strength and MACD indicators are deeply into oversold territory. USO can be purchased below $9.00. It will be added to the Almanac Investor ETF Portfolio at today’s closing price.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held a position in USO.