Last night Jeff closed the opening session with a short presentation entitled “Election Perspectives from 50 Years on Wall Street,” followed by a workshop on “Tactical Investing And Sector Rotation: Avoiding Traps And Profiting From Trends” Shoot us an email if you’d like a copy of the slides. After mingling with attendees and other speakers in the morning, Jeff took the stage after lunch with the mission to corral this assembly of bright yet potentially long-winded market analysts.

Jeff shared our outlook that the typical correction in the two months before Election Day this election year has set up a quintessential October Buy for a post-election, yearend rally and the Best Six Months. He noted that the market being up about 4.5-5% year-to-date indicates the market is expecting another Democratic President. Jeff informed the room that while post-election years have been worse under new Republicans and midterm years have been worse for Democrats, either way the next bear market is likely to transpire over 2017-2018, setting up our

Super Boom Forecast.

Then we went down the line with outlooks from the panel and dove into the discussion. To sum it up, Boockvar, who contends that the long term bull market in bonds is officially over, backed up our bear call for the next two years after the Best Six Months and the first 100 days of the new President, saying that a bear market will likely be triggered by the imminent rise in long term interest rates and weaker economic growth.

Skousen was arguably the most bullish on stocks mostly due to the increase in the money supply, but is bearish on gold since his gold indicator recently gave a sell signal. (We are seasonally bullish on gold and own some GLD, as well as bullish on stocks for the next six months, unless the wheels come off.) We also discussed how his Gross Output (GO) metric is a better economic indicator than GDP and is indicating a slight weakening in the economy.

Mr. Grant maintains that it is not the level of money supply that is the issue, it is the rate at which it moves that matters most; hence the velocity of money, and that this whole negative interest rate environment is unhealthy and is likely not to end well. Grant, who is bucking for Fed Chair, is a firm believer that we should end the war on price discovery and leave it to the bond market to determine interest rates.

Peter Schiff asserted that the Fed may not even raise rates again in December and feels that even if they do; they will ease again real soon. Schiff is also concerned about the Fed’s talking-up-the-economy rhetoric. If the economy is so strong, why not raise rates more and sooner and faster?

We covered a great deal more on the economic and market prospects over the rest of the year and beyond including inflation and what the Fed and other central banks need to do to set things right and put us on better path to growth and a more robust economy. Thankfully the whole panel was recorded and will be available to stream or order online in the next week or so at

http://neworleansconference.com/ or you can call them at (504) 837-3033 to pre-order.

The market is likely to continue to waffle until after the election as the country and the world is a little on edge with this year’s unique circumstances. But after that we expect an upside move in November and through the Best Six Months and the first 100 days of the new President with some weakness in the first half of December and a January/February profit-taking break, save some longshot election result or a delay in the decision that derails the stock market.

Pulse of the Market

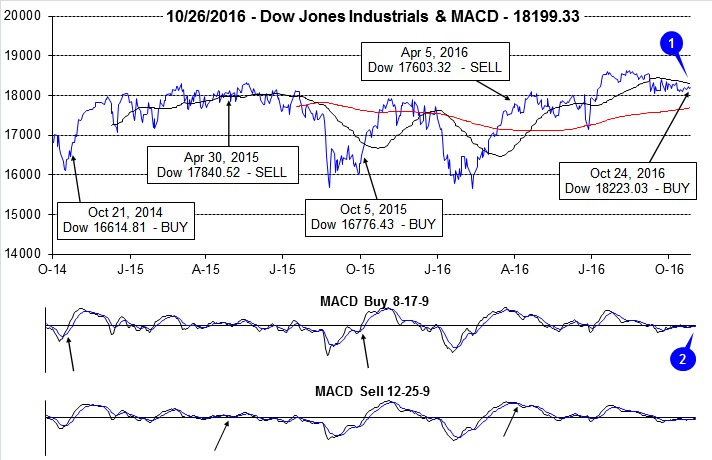

On the close of October 24, 2016, criteria were satisfied and our Season MACD Buy Signal was issued (1). DJIA closed that day at 18223.03 which is just 1.1% higher than it was the first time it closed above 18,000 on December 23, 2014. That is 671 calendar days to gain a meager 1.1% excluding dividends. Our last two

Seasonal MACD Buy signals went on to produce returns of 7.4% and 4.9% (also excluding dividends) for comparison.

As of yesterday’s close, both the faster and slower MACD indicators applied to DJIA were positive (2) and trending higher even with tepid upside momentum. After Election Day, provided economic data holds up and corporate earnings continue to trend toward improving, the market is likely to move higher into yearend.

DJIA performance on Fridays (3) and Mondays (4) remains troublesome and indicative of a heightened level of nervousness by traders and investors alike. Over the past 20 weeks, DJIA has fallen on Friday twelve times and the following Monday eleven times. On six of occasions, losses were back-to-back triggering a Down Friday/Down Monday warning of higher probability for weakness sometime during the next 90 calendar days. The fact that the market has avoided any significant or sizable pullback or correction is a testament to its resiliency and underlying strength. Further improvement on Fridays and Mondays would be a welcome sign that could aid in propelling DJIA and the broader market decisively to new all-time highs.

After a respectable finish to Q3 with three straight weekly gains, DJIA, S&P 500 (5) and NASDAQ (6) declined in two of the last three weeks. Those declines were sufficient to delay our Seasonal MACD Buy Signal and reverse gains since mid-September.

NYSE Weekly Advancers and Decliners (7) have been behaving as would be expected with one notable exception, the week ending September 30. In that week, DJIA, S&P 500 and NASDAQ managed modest gains, but NYSE Weekly Decliners outnumbered Weekly Advancers. It suggests the major indices moved higher on the backs of a fewer number of stocks. Meaningful advances typically require broader participation and the three week rally ended that week.

NYSE Weekly New Highs (8) have been steadily slipping since their peak in mid-July at 659. Weekly New Lows have also been on the rise, albeit rather slowly. A reversal in both of these trends would assist in confirming the rally has resumed.

New this month (9), Moody’s AAA Corporate Bond Rate has been replaced with the 30-Year Constant Maturity Treasury Rate. Both rates typically move in similar direction and magnitude. The primary reason for the change is Moody’s AAA Corporate Bond Rate is no longer being tracked by the Fed. A daily value is still available from Moody’s, but the weekly value would need to be calculated by tracking a daily update from Moody’s while the 30-Year Treasury Rate (weekly) is still readily available at

https://fred.stlouisfed.org/series/WGS30YR.

Click for larger graphic…