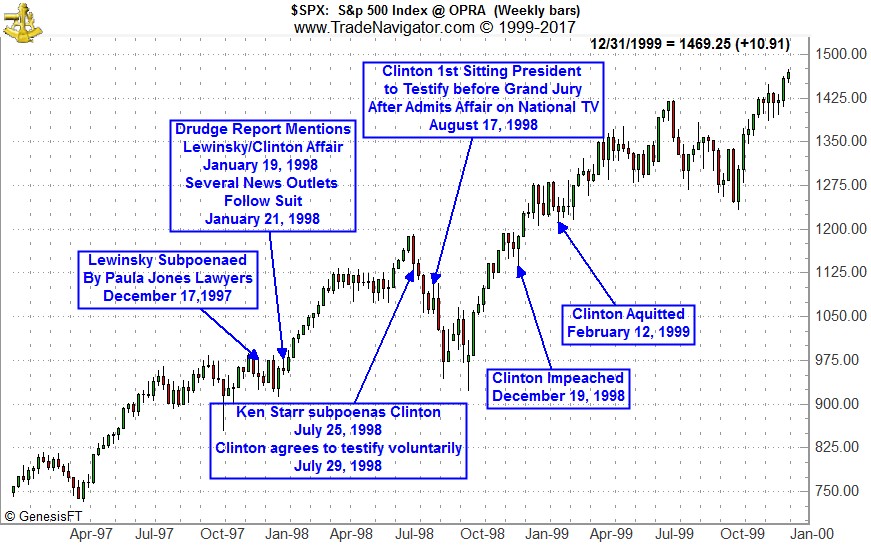

All of the scuttlebutt in DC these days has created a form of gridlock that is keeping any changes at bay and companies and markets like the status quo. But if the situation in the US federal political arena unravels as it did for Bill Clinton in the summer of 1998 with the Lewinsky Scandal and for Richard Nixon in 1973 with the Watergate hearings, the market would likely be at least mildly adversely impacted.

It remains to be seen what will come of special prosecutor Mueller’s investigation if anything at all, but one thing is sure, whatever it is it will take some time to develop. A comparison of the timelines of the Clinton and Nixon scandals versus this Trump Russia probe investigation reveals that at a bare minimum, if anything ever comes of this it will likely not influence the market negatively in a major way for some time to come.

It is even likely to take longer now that Mueller has just expanded the investigation into all of Trump’s business dealings. And it could end up more like Lewinsky/Clinton for the market which was the shortest bear market on record. But if there is a trail of collusion it could be ugly. Only time will tell. But as you can see from the charts below of the Clinton and Nixon scandal timelines it will be the better part of a year before we know.

We are not big bears here. Yes we expect the next 5-10%, or 15% move for the market to be lower. We do not expect this imminent summer slump to be the end of the bull market, but a solid buying opportunity for the next and final leg of the bull market that we expect will end with a bear market that begins in middle of 2018.

Readings from our Five Market Disciplines (Psychological, Fundamental, Technical, Monetary and Seasonal) in our

Market at a Glance point to a correction over the next 2-3 months. While the market has continued to log new all-time highs, which in and of itself is bullish, stocks appear stuck and struggle to make any significant headway higher.

Swirling currents of news, investigations and a stalled legislative agenda in Washington are not poised to help the market power through this upcoming historically weak period from mid-July through October. The market has been on quite a run since the election but now that valuations are a bit rich and sentiment is pretty high the timing is right for the froth to come off and a summer shakeout to begin soon that is likely to give us the first 10% correction since February 2016.

Let’s review all the different seasonal patterns we have been tracking vis-à-vis the current year: Post-Election Years, Seventh Year of Decades, Positive January Trifecta and First Elected Republicans. Take out the Positive January Indicator Trifecta and things look scary over the next four months. That is one of the main reasons we don’t expect a major bear market at this juncture. If not for the market’s positive performance through January and its continued rise to a 10.5% gain for the S&P 500 so far this year, we’d be more concerned. However, all the patterns below suggest some sort of pause.

Overlaying the prospects in the above chart with our understanding of the troublesome and volatile nature of the market from this point in the year through Labor Day, the end-of-Q3, and Octoberphobia; on top of the political maelstrom at home and abroad combined with tepid fundamentals, frothy sentiment and an overbought, cantilevered market, we are ripe for a fall.

More bulls piled on the bandwagon last week as noted by

Investors Intelligence Bullish Advisors %, which jumped from 50.0% to 57.8%. Most of the new bulls came out of the correction camp and the Bearish Advisors % fell slightly to 16.7%, widening the bull-bear spread to an alarming 41.1%. For the record, we are obviously counted in II’s correction camp.

The VIX is below 10% at historically low numbers and everyone is jumping in the pool. As folks head for the beaches and mountains and other vacation destinations and more focus is directed more toward the Mueller investigation, look for stocks to retreat in the near term. Remember the first nine trading days of August are notoriously weak and we’ve had plenty of trouble in August and September over the years, recent years included.

So, if you have not shored up your portfolio for the usual summer storm now is as good a time as any. Check out our

portfolio updates, take some risk off, get rid of your losers, tighten stops, raise some case and put on some prevent defense with our bond positions and perhaps some shorts.