|

DJIA Closes Below December Low

|

|

By:

Christopher Mistal

|

February 08, 2018

|

|

|

|

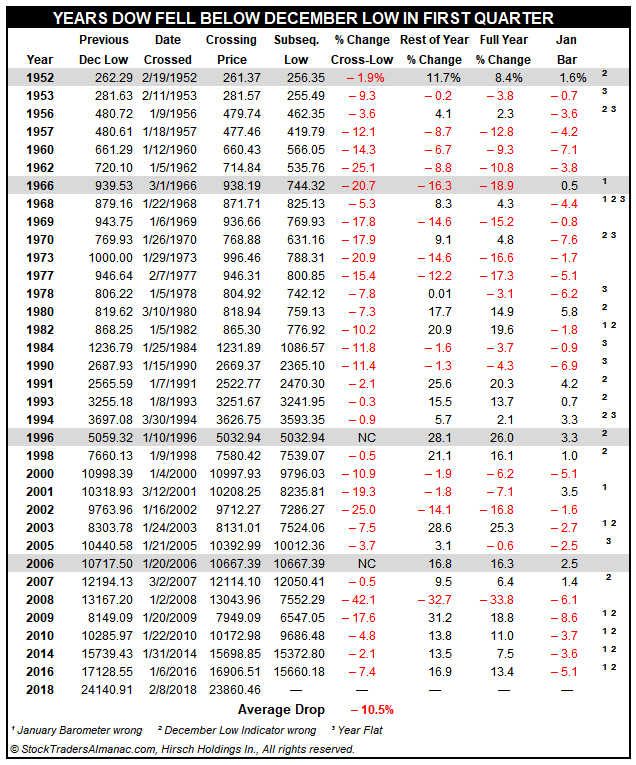

Historically, when DJIA closes below its December closing low in the first quarter of the New Year it was frequently an excellent warning sign. Since 1950, this has occurred 35 times, including today. Of the previous 34 occurrences, all but two of the instances experienced further declines, as DJIA fell an additional 10.5% on average. The two years where DJIA did not fall further were 1996 and 2006 (see page 38 of Stock Trader’s Almanac 2018).

All instances of DJIA closing below its December low are in the following table. “Rest of the Year % Change,” “Full Year % Change” and January Barometer (“Jan Bar”) are also included. Twenty of the years still logged gains for the rest of the year while eighteen full years finished positive. Years where the January Trifecta was also positive are shaded in grey. Escalation in Vietnam with U.S. planes bombing Hanoi likely contributed to losses in 1966. Increased Federal spending also pushed interest rates and inflation modestly higher that year. There is the possibility that this year could see some further declines, but as long as economic data remains on firm footing then the current pullback is likely to be just a reversion to the trend that has been in place since November 2016. Markets had gotten ahead of the trend in January and are now below it.