Unfortunately the February weakness we warned about last issue began to materialize mid-month and accelerated into month-end. The “excuse du jour” is rising bond yields as the 10-Year Treasury climbed above 1.5%. The reaction to the 10-Year yield moving above 1.5 could be a little overblown. It’s barely back to pre-Covid levels. Perhaps it’s more a sign of a healthy economy and rising inflation expectations, which is precisely what the Fed has been trying to foster. We’re not overly concerned about the steepening yield curve.

But the market has been overbought and extended all year and arguably for several months in late-2020. February is the weak link in the “Best Six Months” and even weaker in Post-Election Years. After the big run-up in the first half of February folks have been looking for an excuse to take profits.

Sentiment had become rather exuberant with the Weekly CBOE Equity-Only Put/Call ratio near historic lows around and below 0.40 indicating a dearth of put-buying bears and a plethora of bulls in classic contrary indicator fashion. Our other favorite reverse psychology gauge

Investors Intelligence Advisors Bullish % had been above 60% from Thanksgiving through January with the difference between Bulls and Bears above 40 from mid-November until mid-February. Excessive bullish sentiment has receded a tad, but remains elevated.

March is also softer in Post-Elections and often prone to weakness in the Week After Triple Witching with DJIA down 22 of last 33. Typical March trading comes in like a lion and out like a lamb with strength during the first few trading days followed by choppy to lower trading until mid-month when the market tends to rebound higher. But the last few days often succumb to end of Q1 selling pressure.

As you can see in our One-Year Seasonal Pattern chart of the S&P 500, 2020 in the orange line was a couple of standard deviations above the typical year and even more as compared to historical Post-Election Year patterns. In fact on a relative trend basis this February selloff is par for the course as compared to all Post-Election Years (green line), 1st Year Democratic Presidents (purple line) and Post-Election Years After Incumbent Party Losses (red line).

![[S&P 500 One-Year Seasonal Pattern Since 1949]](/UploadedImage/AIN_0321_20210225_1-Year_S&P_Pattern.jpg)

On the technical front we continue to track the big tech leading NASDAQ 100 Index (NDX). Recent selling has breached support levels at 13,000 and is now looking for support near 12,720 as shown in the blue line in the accompanying NDX chart. NDX 12720 is right at the mid-December/early-January consolidation level as well as December pivot-point resistance (red dotted line) and the January monthly pivot point (blue dotted line). The old September high of 12420 still holds as major support and is just below the 10% correction level from the February 16 high of 13,774.

Bottom line, the market has been overdue for a pullback and has entered a historically weak stretch in the Best Six Months and Post-Election years. Covid vaccine rollout delays continue to be a concern as perfect execution has been baked into stock prices since December and any setbacks are likely to give the market jitters.

The end of Q1 has always been a volatile time for stocks as institutions shore up positions ahead of earnings season. Further consolidation is likely in March, but we expect the market to find support shortly and subsequently challenge the recent highs again in April (the Dow’s best month) as the Best Six Months comes to a close. Additional weakness can also be expected in the Worst Six Months May-October.

Pulse of the Market

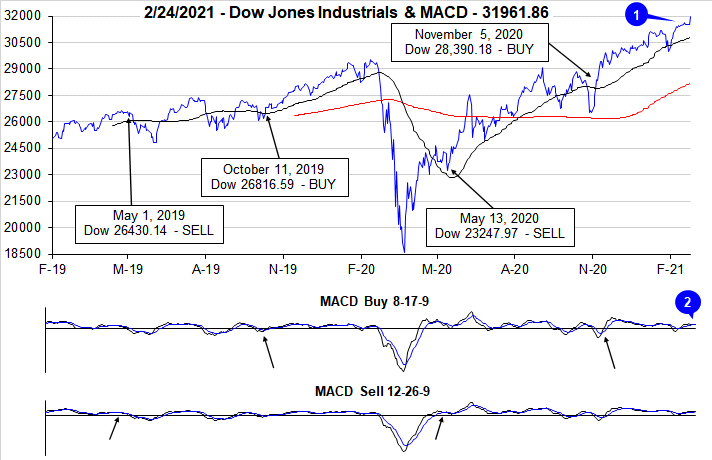

February is still on track for above historical average gains for DJIA and S&P 500 with a single trading session remaining. Even though gains are better this time around than average the pattern of early strength followed by late-month weakness has held up. This adds to the growing list of evidence that seasonality has returned and is encouraging going forward. DJIA reached a new, all-time closing high just shy of 32,000 this week (1), but the majority of gains occurred earlier in the month.

Both the faster and slower MACD indicators were positive as of this Wednesday’s close (2). Should the market continue to exhibit weakness over the next few trading days, both indicators could turn negative as their recent trend has been weak. As a reminder, for our Tactical Seasonal Switching Strategy the earliest date possible to issue our Seasonal MACD Sell signal is April 1 this year.

At three straight weeks, DJIA is enjoying its longest streak of positive Fridays and Mondays since November 2019 (3). We continue to monitor the first and last trading days of each week for early signs of potential weakness. When both Friday and Monday are down, it triggers a Down Friday/Down Monday (DF/DM) warning. Strength on Friday followed by strength on Monday is not exactly the opposite of a DF/DM, but it does signal that confidence was improving and further gains are likely. For DJIA, all three weeks when Friday and Monday were positive produced a weekly gain as well. S&P 500 (4) and NASDAQ (5) also logged solid gains in two of those three weeks.

Market breadth measured by NYSE Weekly Advancers and NYSE Weekly Decliners (6) was positive in two of the last four weeks. During the week ending February 5, Weekly Advancers reached their highest reading since April 10, 2020, when DJIA, S&P 500 and NASDAQ all rallied over 10% in a week. A large number of advancing issues is typically indicative of broad participation in the rally and it is more common to see large readings near the beginning of a bullish move not at its end.

Weekly New Highs (7) had expanded to their highest level since May 2013 two weeks ago. Weekly New Lows have also remained subdued. This is generally a bullish indication as well. If New Lows begin to expand that could be a cause for concern. However, as of today, it does appear the market is consolidating recent gains and digesting the recent improvements in economic data.

The 30-yearTreasury bond yield has been on the rise since record a historic low last August (8). More recently the pace of the rise has accelerated, and the yield curve has steepened. Higher bond yields during the “Best Months” are not unusual, but some are starting to worry that the rapid rise could cause trouble for the Fed and an economy that is still not fully recovered. Stocks could continue to be volatile until Treasury bond yields show signs of stabilizing.

Click for larger graphic…