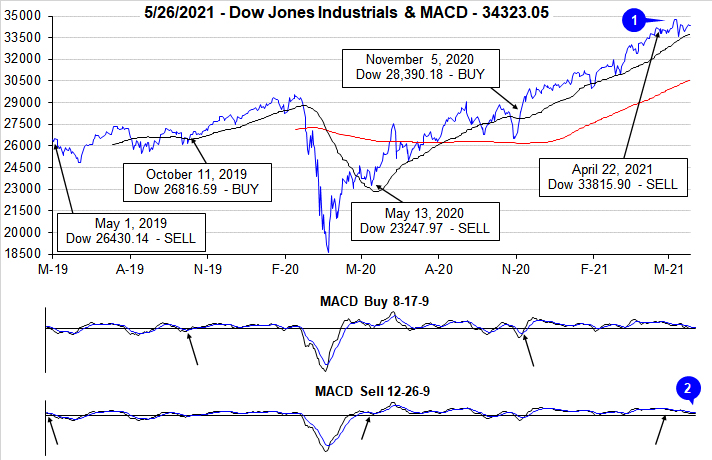

Stocks have gone virtually nowhere since our April 22

Best Six Months MACD Seasonal Sell Signal. Trading volume has already begun to slowdown as it tends to do from Memorial Day to Labor Day in what we refer to as the summer doldrums. This reduction in trading volume (page 48, STA 2021) both contributes to and is emblematic of seasonal market weakness during the Worst Six Months May-October (page 147, STA 2021) and the Worst Four Months July-October (page 148, STA 2021).

The market continues to follow seasonality albeit with a greater magnitude of gains this year and for the Best Six Months November-April than the average year. As you can see in the chart here of the S&P 500 comparing 2021 to the historical seasonal pattern we have also begun to track the typical sideways action the market experiences over the Worst Months of the year.

Several factors at play, especially during this unique post-COVID-19-pandemic, economic-reopening year, continue to support our near-term sideways market outlook on the backdrop of our overall bullish outlook for the year as a whole in keeping with the base and best case scenarios of our

December 17, 2020, 2021 Annual Forecast. We still expect to see the S&P 500 finish the year above current levels in the 4300-4500 range, more in line with our best case scenario. In the near term, however, the market is primed to remain range-bound and bounce around between the April/May highs and the March lows.

The Fed’s still prudent accommodative stance will ensure the economic recovery is not undermined by a hasty response to transitory inflation pressures. This also helps keep a floor under the market – The Powell Put if you will. Fiscal spending from existing COVID-19 stimulus packages, likely infrastructure spending package soon, as well as

fiscal stimulus from G20 nations will also support the market. Further fundamental support comes from increased consumer spending, a healthy employment market and robust numbers from corporate America.

On the lid side of the equation folks are coming out of their pandemic shells in droves. This is great news for the travel industry, but it means that usual exodus from The Street could potentially be more dramatic as people turn away from the market and turn towards visiting family they have not seen in over a year, vacations and all sorts of leisure activities.

Inflation fears, the slowing pace of vaccinations, troubling global COVID hotspots, technical resistance and rich valuations are also likely to keep market gains at bay over this seasonal weak period through Q3. Market rotation from the tech-oriented stay-at-home stocks into reopening stocks is also conspiring to hold back broad market gains until the summer travel seasons winds down.

End Best 8 Months

June 1 is the earliest NASDAQ’s Seasonal Sell can trigger as NASDAQ’s Best Eight Months ends in June. The signal will be emailed to subscribers after the close on the day it triggers. That will be our signal to increase our defensive stance. We will make portfolio adjustments accordingly and seek new portfolio recommendations in top worst month sectors, especially Consumer Staples, Utilities and Healthcare, as well as dividend paying stocks.

Remember cash is king this time of year. This is the season to sell losers, tighten up stops and raise some cash for the perennial better buying opportunity in the weak August/September timeframe and turnaround October.

June is a tough month for DJIA and S&P 500, but not so bad for NASDAQ and Russell 2000. This year June starts right after Memorial Day, which is not the most bullish post-holiday trade so, the usual strength on the first two trading days of June may be muted as folks get back into the swing of things after the long weekend.

Christmas in July: NASDAQ’s Mid-Year Rally

In the mid-1980s the market began to evolve into a tech-driven market and the market’s focus in early summer shifted to the outlook for second quarter earnings of technology companies. Over the last three trading days of June and the first nine trading days in July, NASDAQ typically enjoys a rally. This 12-day run has been up 28 of the past 36 years with an average historical gain of 2.6%.

After the bursting of the tech bubble in 2000, NASDAQ’s mid-year rally had a spotty track record from 2002 until 2009 with three appearances and five no-shows in those years. However, it has been quite solid over the last eleven years, up ten times with a single mild 0.1% loss in 2015. Last year, NASDAQ advanced a solid 4.7% during the 12-day span.

Pulse of the Market

Early strength did give way to typical “Sell in May” pressure as spiking inflation drew the attention of traders and investors just before mid-month. Prior to the brief retreat, DJIA (1) and S&P 500 both closed at new all-time highs on May 7. Currently DJIA is recovering, but still remains below its previous closing high. With the exception of a few trading days ahead of mid-May, both the faster and slower MACD indicators (2) applied to DJIA have been negative since issuing our Seasonal MACD Sell for DJIA and S&P 500 on the close on April 22. DJIA appears to be slipping into a typical sideways trading pattern often seen during the “Worst Six Months.”

Since issuing our Seasonal MACD Sell, DJIA (3) has only advanced once in the last five weeks. S&P 500 (4) has declined during three of the last five weeks and was flat during the last week of April. NASDAQ (5) has also declined in four of the last five weeks. If current gains hold, DJIA, S&P 500 and DJIA are on track for a modest gain this week. It would appear the rotation from stay-at-home stocks to reopening stocks continues. This rotation is likely to keep a lid on upside as COVID-19 restrictions slowly ease. The slowing pace of vaccinations could cause the pace of lifting restrictions to slow as well.

In spite of market weakness over the last five weeks, market breadth measured by NYSE Weekly Advancers and NYSE Weekly Decliners (6) was positive in four of the last five weeks. The advantage held by Weekly Advances does appear to be narrowing and is consistent with a market that could be slipping into a trading range. Absent a significant deterioration in the Weekly Advance/Decline line, the market is not likely to suffer a sizable and/or damaging pullback.

As DJIA and S&P 500 reached new highs ahead of mid-May, Weekly New Highs (7) climbed to 911. This was short of the 951-peak reached in March. This also appears consistent with a market that is entering a phase of sideways trading and consolidation. Weekly New Highs have declined over the last two weeks while New Lows have expanded modestly. Neither level is overly concerning and suggests underlying support.

Inflation has picked up, but much of the gain could be attributed to year-ago comparisons. A little over a year ago, the global economy was largely shutdown due to COVID-19 restrictions. Demand plunged then while now demand is surging as economies slowly attempt to return to normal. The Fed’s view that the recent spike seen in headline CPI and PPI figures is transitory is likely correct. One confirming indication thus far is the 30-year Treasury bond yield (8) appears to have stabilized in the 2.20 to 2.40 range. Low rates, ample liquidity and fiscal stimulus are also providing a solid floor of support under the market reducing the risk of any major market downturn in the near-term.

Click for larger graphic…