The rotation back into tech and growth stocks has picked up momentum on the prospects that recent rampant inflation fears are a bit overblown. The retreat in Treasury bond yields and the more tranquil bond market suggests the spike in prices is more transitory than the extremes some market observers and investors have been suggesting. In turn,

NASDAQ’s midyear rally appears to be running ahead of schedule.

We remain in the transitory inflation camp. Sure it will likely be higher than the recent past. The recent uptick of 5% CPI growth is more a product of the historic reopening. The job market, especially in the service industry, remains tight. The service industry was clearly hit the hardest. Soaring demand as the economy reopened quickly caught a lot of businesses flat-footed. Price gains also reflect temporary supply bottlenecks and sharp price drops in 2020 make inflation comparisons to 2021 look larger. When the dust settles the rate of inflation is likely to cool down later this year if the bond market is any indication.

Seasonality and cycles have been back on track since September 2020, but pent-up demand, free money, business innovation and some stellar science that created the vaccines have continued to keep stock prices elevated during the first two months of the Worst Six Months. This red-hot economy is not likely to cool down until next year. However, we do expect a pause and some sideways movement after mid-July.

In the updated chart here of the “S&P 500 One-Year Seasonal Pattern” we have highlighted the midyear rally with a yellow oval. Also noted is the mid-July peak. It is after this peak that the “

Summer Market Volume Doldrums” detailed on page 48 of the

2021 Almanac begins in earnest.

If we have truly made it to the other side of the pandemic and the market and economy are beginning to return to their normal cycles and seasonal patterns, the prospects for a pullback during August and September are higher as illustrated by the red line post-election year pattern. Post-election year Augusts rank #11 for S&P 500 and NASDAQ, and #12 for the Dow. September is not much better in post-election years ranking 9th for S&P 500 and DJIA, 10th for NASDAQ.

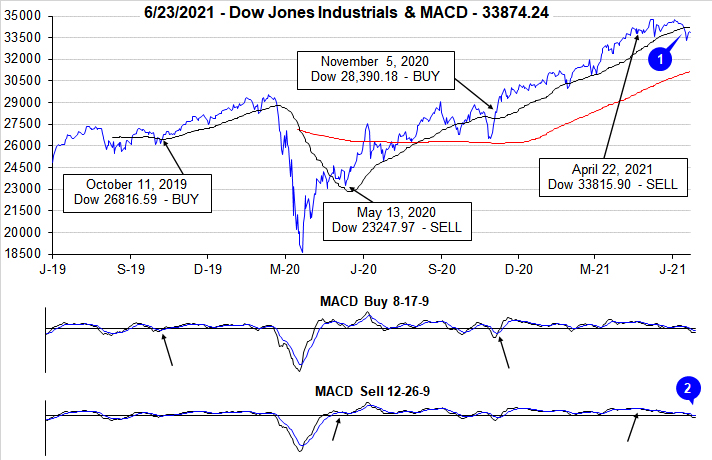

NASDAQ Best 8 MACD Sell Signal Update

Our bias for the year remains clearly bullish in keeping with the base and best case scenarios of our

December 17, 2020, 2021 Annual Forecast and we still expect to see the S&P 500 finish the year above current levels in the 4300-4500 range or higher. But after mid-July the market is poised for a pullback during the weaker end-of-summer months August and September as perennial vacation and leisure seasons kicks into post-pandemic high gear.

We are still waiting for our NASDAQ Best 8 Months MACD Seasonal Sell Signal to trigger. Until it triggers we remain in our neutral stance. We have trimmed our stock and ETF portfolios a bit since the Best Six Months Sell Signal on April 22, but many of our defensive stocks and ETFs are on buy and below their buy limits. So check our latest stock and ETF updates and the “Current Advice” in the portfolios. With NASDAQ’s midyear rally picking up steam at today’s close it would take a one-day decline of 475.36 points or 3.31%

Today’s news on the deal struck between President Biden and the bipartisan Senate infrastructure group for a major infrastructure initiative is long overdue and welcome news indeed. We have been clamoring for this for years over the past several administrations. If they can really pull it off it will be a boon for the country, the economy and market over the long haul. We are rooting for this, but delays, setbacks and partisan bickering could spur a market pullback.

Positives abound with improving employment numbers, robust GDP forecasts, strong earnings and guidance from Wall Street and rising vaccine rates. But negatives from inflation, international machinations especially with China, Russia and Iran, Covid-19 variants, supply bottlenecks and tougher year-over-year comps. Consider using this midyear rally to reposition your portfolio for the August/September summer doldrums and prepare to pounce on our next Best 6/8 Months Buy Signal for the yearend rally.

Pulse of the Market

Historically, June has been a challenging month for DJIA, especially in post-election years. That was certainly the situation earlier this month as DJIA shed nearly 1500 points (–4.2%) from its June 4 closing high through its June 18 closing low. During the slide lower, DJIA did fall below its 50-day moving average (1) by the largest margin since last October. DJIA has rebounded this week but has not yet reclaimed its 50-day moving average. DJIA’s recent weakness has kept both the faster and slower moving MACD indicators (2) negative and still generally trending lower.

Since issuing our Seasonal MACD Sell, DJIA (3) has only advanced three weeks of the last nine. S&P 500 (4) and NASDAQ (5) have also exhibited choppy trading over the last nine weeks however they have been modestly healthier with five and four weekly gains respectively. This type of trading is common during May/June especially following solid, above average gains during the “Best Six Month.” NASDAQ has closed at new all-time highs this week and S&P 500 has done the same today.

In spite of general market softness over the last nine weeks, market breadth measured by NYSE Weekly Advancers and NYSE Weekly Decliners (6) was positive in seven of the last nine weeks. This pattern is consistent with the extensive support the economy and market have, and continue to receive, from monetary and fiscal policy. As long as the Weekly Advance/Decline remains positive, the market is not likely to experience any significant or prolonged retreat.

Weekly New Highs (7) continue to run below their peak reached in mid-March at 951. A reading above this level would suggest the market is poised to make a sizable move higher while readings below that level suggest sideways to only modestly higher levels. New Weekly Lows are also remaining stubbornly elevated which also hints at continued sideways trading with a slight bias to the upside.

Many metrics of inflation have been running hot but the Treasury bond market and the 30-year Treasury bond yield (8) do not appear to believe higher levels of inflation are back and here to stay. The stabilization and recent down trend in yields has breathed new life into growth stocks which is confirmed by the NASDAQ reaching new all-time highs this week. Low rates, ample liquidity and fiscal stimulus are providing a solid floor of support under the market reducing the risk of any major market downturn in the near-term.