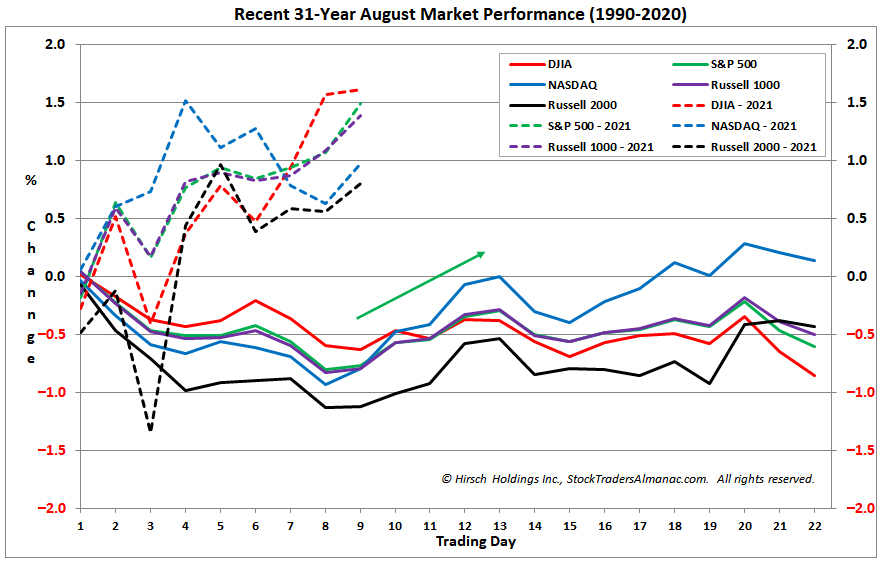

With about a third of August already in the record books, the market has thus far avoided typical seasonal weakness. August got off to a choppy start, but as of yesterday’s close DJIA, S&P 500, NASDAQ, Russell 1000 and 2000 are all positive and well above historical average performance for the full month of August. Fueled by the prospect of more fiscal spending, in the form of a much-needed infrastructure bill, DJIA is leading the way higher this month, up nearly 1.6% as of today. S&P 500 and Russell 1000 are a close second up around 1.5%. NASDAQ and Russell 2000 are the laggards, both with gains just under 1%.

Compared to the historical average performance in August over the past 31 years, all five indexes are currently comfortably outperforming and are on course for a respectable month provided nothing pops up to knock them off their current course. Having already successfully sidestepped the usually weak first nine days of August, the market could be set for further gains to finish this week and next as mid-August has historically been the bright spot of the month. However, after a mid-month run the market has tended to stumble and drift sideways to lower through the end of the month. On average, only NASDAQ and Russell 2000 have managed to climb above their respective mid-month highs by month’s end.

Late August is prime vacation time for many. Historically it is during this time when trading activity and volume tends to make its annual bottom (page 48 of 2021 STA). In the absence of volume, small misses in economic data and/or exogenous events can have a greater impact on markets. This combined with August’s historically poor track are why it is part of the “Worst Months” and why a cautious stance remains the prudent course of action.

Stock Portfolio Updates

Over the last five weeks since last update through yesterday’s close, S&P 500 climbed 1.9% higher while Russell 2000 dipped 0.6% lower. During the same time period the entire portfolio advanced 0.8% excluding dividends and any fees. Mid- and Large-cap positions were responsible for the vast majority of gains by the portfolio. Mid-caps climbed 3% while Large-caps advanced 2.9%. Our Small-cap stocks collectively slipped 0.9% lower.

Weakness in the Small-cap portion of the portfolio was the result of a sharp and swift decline by Avid Tech (AVID). Quarterly earnings were better than estimates and guidance was at least good relative to many other companies, but apparently none of this was good enough to quash some aggressive profit taking. The magnitude of recent gains undoubtedly contributed as AVID was up 177.5% last update after accounting for selling half of the original position when it first doubled. As a result of the selloff, AVID was stopped out of the portfolio when it closed below its stop loss on August 4 for a total gain of 132.4%.

The recent modest rebound in the 10-year Treasury bond yield appears to have given most financial stocks in the Small-cap portfolio a nice boost. Shares of Atlantic Union (AUB), WSFS Financial (WSFS) and Customers (CUBI) all advanced nicely over the last five weeks. South State (SSB) would be the exception. Its recent decline could be the result of its primary location and Covid-19, Florida. Mixed second quarter earnings could also be weighing on shares. SSB did exceed earnings per share estimates, but revenues were lighter than anticipated. AUB, WSFS, CUBI and SSB are on Hold.

Mid-cap portfolio standouts over the past month include Algonquin Power (AQN), Valmont Industries (VMI) and Black Hills (BKH). AQN and BKH are both utilities and likely rallied in response to gains across the broader sector. VMI is in the metal fabrication industry and is likely on the rise in anticipation of the pending infrastructure bill slowly working its way through Congress.

Stepan Co (SCL) is the worst performing Mid-cap stock, off 6.4% as of yesterday’s close. SCL’s specialty chemical products are used by a wide variety of industries and this diversity likely helped it beat revenue estimates for the most recent quarter, but rising costs ate away at revenues resulting in a miss on the bottom line. For now we will continue to Hold SCL in the expectation that as headline inflation begins to moderate, SCL could find footing and reverse course.

Our Large-cap portfolio consists largely of defensive and/or dividend yielding positions (shaded light grey in table below). Even with major indexes advancing, most of these positions performed well over the past month as yield hungry investors returned and started picking up these positions. AT&T (T) is the only Large-cap position in the red when its dividend yield is excluded. T is something of a boring company and it was added primarily for its dividend and the possibility that 5G service could potentially pull in some new subscribers. We will need to wait and see. In the meantime T’s price has been relatively stable and its dividend sizable.

All positions in the portfolio are on Hold. Please see table below for specific stop losses and current advice for each position.