The technical breadth thrusts we discussed in the

May Outlook and on the

monthly member’s only webinar are indeed being verified. As you can see from the S&P 500 technical chart below the market has reclaimed several resistance levels. At the end of April S&P climbed above 5500 at the bottom of the old W-1-2-3 failed swing bottom, moving back above the April-August 2024 uptrend line in the process. In early May S&P reclaimed the descending 50-day moving average (pink line) which now has turned slightly upward. Then after dancing with 5670 last week, which was last July’s peak, we gapped above the 200-day moving average (red circle), the top of the W-1-2-3 pattern and into the Election Day gap (orange circle). The November 6 close (red arrow) around 5929 and the old highs are now in our sights.

![[S&P Technical Chart]](/UploadedImage/AIN_0625_20250515_SP500_Technical_900.jpg)

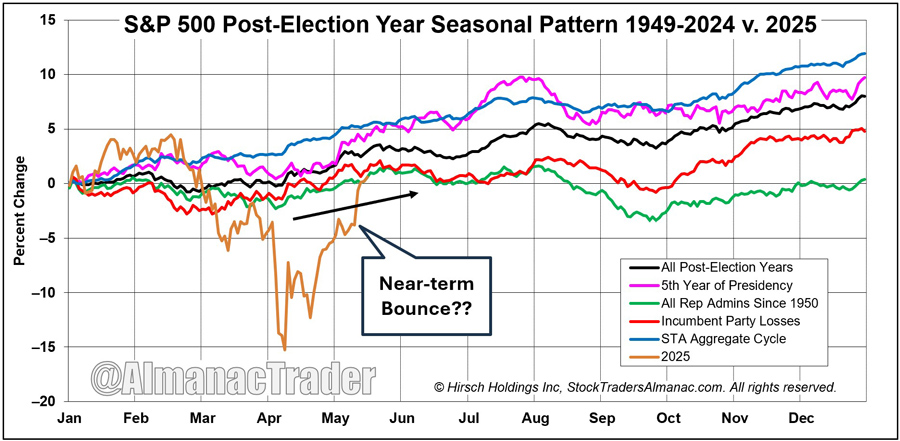

The CBOE Volatility index (VIX) falling below 20 is also constructive. The V-shaped recovery from the April lows has put S&P fractionally in the black for 2025 year-to-date and back on track with the Incumbent Party Losses (red line) and All Republican Admins Since 1950 (green line) patterns in the S&P 500 Post-Election Year Seasonal Pattern chart below. This market action continues to support our view that the relief rally off the tariff tumble has legs, and we expect it to continue through June and perhaps into July, but not without a healthy dose of chop.

When typical seasonal weakness and post-election Q3 weakness collide with the end of the tariff pauses the market may be prone to another correction in the August-October timeframe. We are bullish short term but remain cautious with this market. The relief rally is encouraging, but the performance so far this year is reminiscent of old-school Republican administration post-election year weakness (

2025 Stock Trader’s Almanac, page 28), so our

outlook has improved slightly to 50/50 base case/worst case. If we can reclaim the February highs our base case of 8-12% gains for the year become more likely, if not then the odds of our worst case for a flat to slightly negative year remain high.

The magnitude of the rally this week is “off the charts,” but it is still on trend with the superlative post-election year May pattern. After a brief pause here in mid-May as the market consolidates the massive turnaround gains from the April lows, we expect the relief rally to continue through early summer before the next correction ensues. We would not be surprised if the rally stalled in mid-July as we have seen in recent years after NASDAQ’s perennial mid-year rally that we call

Christmas in July.

All things considered our April 17 Issue recommendations to get back into Invesco QQQ (QQQ) and iShares Russell 2000 (IWM) for the remainder of NASDAQ’s Best 8 Months November-June are working out quite well with QQQ up 19.7% at today’s close and IWM up 13.9%.

Our most dire concerns we conveyed in the May Outlook with respect to down Aprils after down Q1s and down Best Six Months appear to have been alleviated. DJIA’s swift and strong rebound off the April 8 low of 12.7% to the May 12 recovery high so far moves this market action more toward the 2009 and 2020 down Best Six Months camp though both of those were official bear market bottoms in our book and the 2025 selloff is just a bull market correction in our view.

Finally, if you look closely at the “When Bullish April is Down After Q1 Weakness” table in the

May Outlook and plug in April 2025’s final S&P performance of -0.8% instead of the -2.3% it was at on April 24 four trading days prior it looks more in line with years in the table with milder April losses and more solid yearly performance. Expect some economic, earnings and market adjustments related to tariffs and trade and geopolitics ahead, but the huge turnaround from the lows, dovetails with the end of the Best 8 Months and keeps us bullish near term but cautious about Q3.

Stock Portfolio Updates

Over the past five weeks, through the close on May 14, the Almanac Investor Stock Portfolio advanced 2.4% compared to an 8.0% advance by S&P 500 and an 8.9% gain by Russell 2000. Overall performance was limited by the sizable cash balance in the portfolio. Focusing on just the stock positions held, they collectively advanced an average of 9.8%. The lone small-cap, advanced 8.0%, Mid-Caps jumped 15.3% and Large-Caps rose 6%.

HealWell AI (HWAIF) has rebounded back above $1.00 after reporting record revenue growth in its Q1 of 208% earlier this week. Its acquisition of Orion Health was completed on April 1, and it is expected to contribute around $100 million in annual revenue starting in Q2 which should bring HWAIF close to being profitable. In addition, the acquisition of Orion Health expanded HWAIF’s reach globally by adding 70 large customers across 11 countries. HWAIF can still be considered on dips below its buy limit of $1.

Super Micro Computer (SMCI) is on hold. There is no suggested stop loss as it continues to trade in a wide and volatile range. It is also just a one-fourth position as profits have been taken twice since it was added to the portfolio in November 2022. Profits were taken when SMCI first doubled and a second time when it was trading around $900 (before its recent 10 for 1 split). After a modest retreat today, SMCI is still up over 37% this week. The catalyst for the jump was a rather bullish analyst call. If the analyst is reasonably correct in their calculations, SMCI has around a 9% market share in the AI race.

Grand Canyon Ed (LOPE) is on hold. LOPE reported Q1 results a little over a week ago on May 6 that were overall better than expected. Revenue growth was in line with estimates while earnings were better than forecast. On the news, LOPE traded at new all-time highs last week. Shares have modestly consolidated this week.

InterDigital (IDCC) is on hold. IDCC earnings were somewhat of a mixed bag but nonetheless appear to have been well received. It missed revenue estimates but surprised on earnings. The earnings surprise was sufficient to lift it back above its 50-day moving average, but short of its previous highs. Earnings estimates are rising but still remain negative.

OSI Systems (OSIS) is on hold. Fueled by solid revenue and earnings growth, OSIS broke out to new all-time highs earlier this week. Other positive takeaways from its May 1 earnings report include improving margins and a bump in full-year guidance. However, shares appear to have also stalled out this week, failing to follow through with more new highs.

Skyward Specialty Insurance (SKWD) is on hold. Shares of SKWD have also broken out to new all-time highs this week. Most recent earnings were solid with double-digit revenue and earnings growth and estimates are on the rise. However, the recent rise and breakout has caught the attention of analysts that have boosted their price targets. Expectations may be too high at this point.

AT&T (T) is on hold. This is the oldest holding in the portfolio. It was originally added for its dividend which is still respectable at just over 4%. T is also outperforming the S&P 500 year-to-date by a substantial margin. Should tariff, inflation, geopolitics, and/or economic data cause another bout of market weakness, T will likely weather any future storm like it has managed in 2025 so far.

EMCOR Group (EME) is on hold. Earnings were acceptable and likely aided in its recent share price rise, but EME has not yet returned to its recent highs. EME was swept up in AI-driven mania and it may not see new highs until the AI sector does.

ICICI Bank (IBN) can be considered on dips below its buy limit of $30.00. If you are looking for exposure to India’s financial sector, IBN is a position to consider. It is currently trading near all-time highs, and its reported earnings were better than expected, but its 12.4% gain since last October is not all that impressive when compared to OSIS.

Disclosure note: Officers of Hirsch Holdings Inc held positions in HWAIF, IWM, and QQQ in personal accounts.