|

February 2016 Trading & Investment Strategy

|

|

By:

|

January 29, 2016

|

|

|

|

|

January Barometer 2016 Official Results: Late-Month Rally Not Enough

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

January 29, 2016

|

|

|

|

Devised by Yale Hirsch in 1972, the January Barometer has registered eight major errors since 1950 for an 87.9% accuracy ratio. This indicator adheres to propensity that as the S&P 500 goes in January, so goes the year. Of the eight major errors Vietnam affected 1966 and 1968. 1982 saw the start of a major bull market in August. Two January rate cuts and 9/11 affected 2001.The market in January 2003 was held down by the anticipation of military action in Iraq. The second worst bear market since 1900 ended in March of 2009 and Federal Reserve intervention influenced 2010 and 2014. Including the eight flat years yields a .758 batting average.

At this juncture there is not a great deal left to be said about January this year. Following Santa’s “no-show,” January’s First Five Days were the worst on record. DJIA violated its December closing low of 17128.55 on the third trading day and today the January Barometer is officially negative. Our January Indicator Trifecta is negative across the board.

Since 1950, this is only the eighth time that all three indicators were negative and DJIA’s December closing low was violated. Of the previous seven occasions, February was up just twice with an average loss in all seven of 1.9% for S&P 500. However, the next 11 months and full-year S&P 500 was mixed, up four and down three albeit with a negative average performance.

As recently as yesterday’s alert we expressed our concern for the short-term and beyond. The market’s valiant attempt at reclaiming some of this month’s losses the past few sessions is noteworthy, but has been accompanied by some disappointing earnings and economic data. When we released our annual forecast a little over six weeks ago we saw two potential scenarios for 2016. The first agreed with the Fed, commodity rout and resulting deflation are most likely transitory, in which we expected mid-single digit gains for 2016. The second scenario assumed the Fed was wrong and a mild bear market would be the most likely outcome.

Our indicators are suggesting that the Fed is likely wrong and there will be more pain in 2016. Frankly it is too early to say with a great deal of confidence that this is the case. Oil appears to be finding some stability this week and the U.S dollar index appears to be settling into a trading range between 95 and 100. The Fed also appears to have recognized that its previous interest rate tightening schedule may have been too aggressive.

A mild bear market is still on the table at this juncture. What exactly does this mean? We do not anticipate another 2008 style total global meltdown, we envision something more akin to the 1980-1982 bear market that ended the last secular bear market. Back then DJIA shed 27.1% in 622 calendar days (page 132 2016 STA) as the Fed finally got inflation under control and the development of the semiconductor began to accelerate towards the creation of the modern chip-enabled, connected world. This is what we have been looking for since May 13, 2010 when we forecast the next great Super Boom that would lift DJIA to 38820 by 2025.

In the short-term we would expect market volatility to remain elevated as the market wrestles with incoming data and Fed “speak.” Fundamentals are mixed and the technical picture is not great, but DJIA, S&P 500 and NASDAQ have not all violated their respective October 2014 lows, which still leaves the door open to a year like 2005, not a banner year, but still modestly positive.

Despite the pile of negative indicators, and as long as all three major indices do not meaningfully violate their respective October 2014 lows, the scenario of transitory effects remains in play and mid-single-digit full-year 2016 is still the most likely outcome.

|

Market at a Glance - 1/28/2016

|

|

By:

Christopher Mistal

|

January 28, 2016

|

|

|

|

1/27/2016: Dow 15944.46 | S&P 1882.95 | NASDAQ 4668.17 | Russell 2K 1002.75 | NYSE 9373.78 | Value Line Arith 3946.98

Psychological: On edge. No Santa, First Five Days down, DJIA’s December low violated and, barring a highly unlikely mega one-day rally, a down January. Individually each of these indicators has been wrong, but collectively the case is compelling for more weakness. The problem is, the market rarely does what the crowd is expecting and the crowd is clearly expecting further downside. There likely will be more weakness ahead, but a brisk unexpected rally could cause plenty of pain for all the celebrating bears now.

Fundamental: Murky. According to the Atlanta Fed’s GDPNow, real GDP for 2015 Q4 is forecast to be just 1% which is actually up from one week ago when it was 0.7%. Not exactly the robust growth that would necessitate higher interest rates or support a strong U.S. dollar, but nonetheless both exist. The stronger dollar has led to significant revenue declines for numerous multi-national corporations which in turn is pressuring earnings and making valuations appear rich.

Technical: Oversold. Intraday, DJIA, S&P 500 and NASDAQ were all down greater than 10% year-to-date by the middle of January. The brisk selloff sent MACD, Stochastic and relative strength indicators all plunging. These indicators have only just begun to show any sign of improvement. DJIA and NASDAQ have found support just above their respective lows from last August. S&P 500 has flirted with its October 2014 low. The current lines in the sand are the October 2014 lows. Should DJIA, S&P 500 and NASDAQ all meaningfully break below those levels a bear market would be the most probable outcome.

Monetary: 0.25-0.50%. If the Fed is still on course to normalize rates, the journey just got longer. The Fed did not raise rates during its recent meeting. Instead they choose to acknowledge recent global market turmoil and the potential risks it creates. Inflation is still below target, but the Fed insists this is due primarily to the transitory effects of falling energy and commodity prices. The Fed’s creditability was already questionable. The longer it takes for inflation to accelerate, and/or should the labor market begin the falter, what creditability remains could disappear entirely.

Seasonal: Luke Warm. The Best Consecutive Three Month Span, November to January, comes to an end. February can be the soft patch in the Best Six/Eight Months. Since 1950, February performance: DJIA +0.2%, S&P 500 +0.1%, NASDAQ +0.7% (since 1971). Typically bullish election-year forces do little to improve results; DJIA –0.1%, S&P 500 +0.1% and NASDAQ +2.8% (largely because of 19.2% advance in 2000).

|

February Outlook: Early Indicators Suggest Continued Weakness

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

January 28, 2016

|

|

|

|

We got an interesting call from our friends at

Ned Davis Research this week. Our recent declarations that we entered a

Ned Davis Research defined bear market in January on the internet last week and on

CNBC this past Monday needs to be redacted and has inspired NDR to clarify their bull and bear market definition criteria. The criteria have not changed, but they have added new language to clarify the definition.

They have always marked bull and bear markets from peak and trough dates, but saw how confusing the existing language could be during time periods like this one. “A cyclical bull market requires a 30% rise in the DJIA after 50 calendar days or a 13% rise after 155 calendar days. Reversals of 30% in the Value Line Geometric Index since 1965 also qualify. A bear cyclical market requires a 30% drop in the DJIA after 50 calendar days or a 13% decline after 145 calendar days. Reversals in the Value Line Geometric Index also qualify.”

They have now added the following clarifying statement to the criteria. “Bull and bear markets are measured at peak and trough dates, so both the time and price criteria must be met as of the peak and trough dates.” We hope this clarifies it for everyone.

With respect to the current case: Since August 25 is still the low date, the appropriate date range is 5/19/15 – 8/25/15. The market had met the percent decline criterion on August 25 (-14.4%), but not the time criterion (98 calendar days). On January 20 the DJIA was down -13.9% after 246 calendar days, but it was not a new trough. So, if the DJIA closes below its 8/25/15 closing low, then both the time and price criteria will be met.

We are flattered and humbled to be the inspiration for this clarification and love the fact, that when people question why NDR does not use 20% declines to define bear markets, They say something to the effect of, “The Stock Trader’s Almanac uses our definition.” We remain big fans of NDR, fantastic research and analysis and cycles and seasonal pattern proponents.

Down January Negative Readings

But let’s face it, DJIA may not have violated its August low, but all the other averages have. All of our seasonal market indicators have given negative readings so far and our flagship full- month January Barometer is about to do the same at the close tomorrow unless the S&P 500 can rally about 8% from current levels to close above 2,043.94.

This is not impossible, but it would be a top 20 S&P 500 day of all time. All but three of the previous top 20 occurred in the 1930s with two in October 2008 and one in October 1987. You get the picture; we do not appear to be at similar junctures at the present time, so 8% tomorrow is going to be a stretch.

So let’s review where we are at. Last June 2 when we put the 2016 Almanac to bed, we noted in our Outlook on page 6 that “Unfortunately, our outlook for 2016 is less than sanguine.” In our 2016 Annual Forecast made 6 weeks ago we said, “We see two scenarios for 2016. If the Fed is right and the energy and commodities price decline proves transitory and prices stabilize, we expect average election year gains in the mid-single digits. If the Fed is wrong and oil and commodities suffer further declines and the junk bond scenario unravels we may begin a mild bear market next year.”

Now that the end of January is upon us and our indicator trifecta of the Santa Claus Rally, the First Five Days, and the full-month January Barometer are negative and the DJIA December Low has been violated we are not any more bullish. In tomorrow’s Official January Barometer Reading special email alert we will take into consideration all the economic data, market behavior, market internals and geopolitics and make any necessary adjustments to our forecast. As we warned last month, the next bear market may be underway.

Pulse of the Market

January 2016 is on the verge of being the worst January ever for DJIA and S&P 500. January 2009 currently holds this dubious honor with losses of 8.8% for DJIA and 8.6% for S&P 500. The rout began at the end of December and only accelerated during the first week of the New Year. Both the faster and slower moving MACD indicators have been negative and falling since early November, but appear to be on the verge of turning (1). The faster moving MACD indicator flashed a buy signal on January 26 however there has been little market follow-through since.

A golden cross, defined as the 50-day moving average crossing above the 200-day moving average, did briefly appear on DJIA’s chart (2). It proved fleeting as January’s losses quickly caused the 50-day average to plunge back below the 200-day triggering the once dreaded “death cross.” Historically, many “death crosses” appeared not long in advance of the ultimate bottom.

Back-to-back Down Friday/Down Mondays (DF/DM) (3) wrapped the last week of 2015 and the first week of 2016. This cluster preceded DJIA’s third worst weekly point decline on record back to 1900 and the worst weekly January loss ever (4). Six consecutive down Fridays is further evidence of the lack of confidence traders and investors have.

After advancing in nine out of 10 weeks from early October to early December, S&P 500 (5) and NASDAQ (6) have been down during five of the last seven weeks. Although not an official Ned Davis defined bear market yet, the market has been trading as such since mid-December.

Weekly Advance/Decline metrics have been firmly negative (7). Weekly Decliners have substantially outnumbered Advancers during down weeks while Advancers have only modestly outnumbered Decliners during up weeks. A greater number of Advancers during up weeks would be a positive sign and could potentially indicate the market is being to recover. This has not yet occurred.

New Weekly Highs have not exceeded 500 since last January while New Weekly Lows (8) have swelled to the highest level since last August. New Highs are likely to remain subdued for some time as the broader market is well off of its all-time highs. A steady decline in New Lows would be an encouraging sign that could indicate the bulk of the market decline is over.

Weekly CBOE Put/Call spiked to 0.93 (9) during the week ending January 15. This was just the third time since the bull market began in March of 2009 above 0.90. The previous two spikes above 0.90 were in June 2011 and November of last year. Last November’s spike was followed by a tradable bounce higher that lasted three weeks for S&P 500 and NASDAQ.

Click for larger graphic…

|

February Almanac, Vital Stats & Strategy Calendar: Marginal Average Gains

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

January 26, 2016

|

|

|

|

February is up slightly more than half the time since 1950, with marginal average gains for DJIA and S&P 500. However, small cap stocks, benefiting from “January Effect” carry over; tend to outpace large cap stocks in February. The Russell 2000 index of small cap stocks turns in an average gain of 1.3% in February since 1979—just the seventh best month for that benchmark.

A very strong February in 2000 boosts NASDAQ and Russell 2000 rankings in election years. Otherwise, February’s performance, compared to other presidential-election-year months, is mediocre at best with no large-cap index ranked better than seventh (DJIA and S&P 500 since 1952, Russell 1000 since 1980).

February also does not have a solid long-term track record when full-month January was negative. Going back to 1950, DJIA has declined 24 times in January, S&P 500 26 times and NASDAQ (since 1971) 16 times. Regardless of index, the following February was down more often than up and the average performance was solidly negative. However, the last three down Januarys have been followed by substantial February gains.

The first trading day is bullish and DJIA, S&P 500 and NASDAQ have traded higher in 11 of the past 13 years. Average gains on the first day over this 13-year period are right around 0.5%. Strength then tends to fade after that until the stronger eighth, ninth and eleventh trading days. Expiration week has a spotty longer-term record, but the week after has a clear negative bias with averages losses across the board over the past 26 years.

Presidents’ Day is the lone holiday that exhibits weakness the day before and after (Stock Trader’s Almanac 2016, page 88). The Friday before this mid-winter three-day break is exceptionally treacherous and average declines persist for three trading days after the holiday going back to 1980.

| February (1950-2015) |

| |

DJI |

SP500 |

NASDAQ |

Russell

1K |

Russell 2K |

| Rank |

|

8 |

|

9 |

|

9 |

|

9 |

|

7 |

| #

Up |

|

39 |

|

37 |

|

25 |

|

23 |

|

22 |

| #

Down |

|

27 |

|

29 |

|

20 |

|

14 |

|

15 |

| Average

% |

|

0.2 |

|

0.1 |

|

0.7 |

|

0.4 |

|

1.3 |

| 4-Year Presidential Election Cycle Performance

by % |

| Post-Election |

|

-1.4 |

|

-1.8 |

|

-3.9 |

|

-1.9 |

|

-2.0 |

| Mid-Term |

|

1.0 |

|

0.7 |

|

1.0 |

|

1.3 |

|

1.9 |

| Pre-Election |

|

1.2 |

|

1.1 |

|

2.8 |

|

1.5 |

|

2.5 |

| Election |

|

-0.1 |

|

0.1 |

|

2.8 |

|

0.3 |

|

2.5 |

| Best & Worst February by % |

| Best |

1986 |

8.8 |

1986 |

7.1 |

2000 |

19.2 |

1986 |

7.2 |

2000 |

16.4 |

| Worst |

2009 |

-11.7 |

2009 |

-11.0 |

2001 |

-22.4 |

2009 |

-10.7 |

2009 |

-12.3 |

| February Weeks by % |

| Best |

2/1/08 |

4.4 |

2/6/09 |

5.2 |

2/4/00 |

9.2 |

2/6/09 |

5.3 |

2/1/91 |

6.6 |

| Worst |

2/20/09 |

-6.2 |

2/20/09 |

-6.9 |

2/9/01 |

-7.1 |

2/20/09 |

-6.9 |

2/20/09 |

-8.3 |

| February Days by % |

| Best |

2/24/09 |

3.3 |

2/24/09 |

4.0 |

2/11/99 |

4.2 |

2/24/09 |

4.1 |

2/24/09 |

4.5 |

| Worst |

2/10/09 |

-4.6 |

2/10/09 |

-4.9 |

2/16/01 |

-5.0 |

2/10/09 |

-4.8 |

2/10/09 |

-4.7 |

| First Trading Day of Expiration Week: 1990-2015 |

| #Up-#Down |

|

16-10 |

|

19-7 |

|

15-11 |

|

19-7 |

|

17-9 |

| Streak |

|

U1 |

|

U2 |

|

U2 |

|

U2 |

|

U2 |

| Avg

% |

|

0.2 |

|

0.2 |

|

0.05 |

|

0.2 |

|

0.1 |

| Options Expiration Day: 1990-2015 |

| #Up-#Down |

|

13-13 |

|

11-15 |

|

9-17 |

|

11-15 |

|

11-15 |

| Streak |

|

U1 |

|

U1 |

|

U1 |

|

U1 |

|

U2 |

| Avg

% |

|

-0.1 |

|

-0.2 |

|

-0.4 |

|

-0.2 |

|

-0.2 |

| Options Expiration Week: 1990-2015 |

| #Up-#Down |

|

15-11 |

|

14-12 |

|

14-12 |

|

14-12 |

|

17-9 |

| Streak |

|

U1 |

|

U1 |

|

U2 |

|

U6 |

|

U6 |

| Avg

% |

|

0.3 |

|

0.03 |

|

-0.1 |

|

0.05 |

|

0.2 |

| Week After Options Expiration: 1990-2015 |

| #Up-#Down |

|

10-16 |

|

11-15 |

|

14-12 |

|

11-15 |

|

13-13 |

| Streak |

|

D1 |

|

D1 |

|

U2 |

|

D1 |

|

U2 |

| Avg

% |

|

-0.5 |

|

-0.4 |

|

-0.4 |

|

-0.4 |

|

-0.3 |

| February 2016 Bullish Days: Data 1995-2015 |

| |

1,

11, 16 |

1,

8, 10, 11, 16 |

1,

8, 11, 12, 23 |

1,

8, 10, 11, 16 |

1, 4, 8, 10-12 |

| |

|

|

|

|

17, 23, 25, 26 |

| February 2016 Bearish Days: Data 1995-2015 |

| |

18,

24 |

17 |

19,

29 |

None |

3, 18, 19, 22, 29 |

| |

|

|

|

|

|

|

February 2016 Strategy Calendar

|

|

By:

Christopher Mistal

|

January 26, 2016

|

|

|

|

|

The Incredible January Barometer: No Other Month Can Match January’s Predicative Prowess

|

|

By:

Jeffrey A. Hirsch

|

January 21, 2016

|

|

|

|

I’d like to share some comments and observations form my astute colleagues. Hirsch Holdings and Stock Trader’s Almanac Director of Research Christopher Mistal is currently on holiday in Brazil. He sent me a communiqué earlier today, suggesting that the whole global market rout seems overblown.

He noted that Brazil may see GDP fall 3.5% this year, but it appears to all be commodity price driven. The consumer and middle class seems happy – still building a great deal, buying cars, clothes and traveling. Recession is not apparent in Brazil at the moment. We have to imagine the same is true in China and other parts of the world.

This appears to be a big rotation. The commodity party is over, but prices are not all going to zero like the market seems to think. But technology and services are likely to be where the future and next secular bull market is at. Manufacturing in China is now only 30-40% of their economy. If it declines 3% how big is the overall impact, 1%? That doesn’t seem like the end of the world.

Our good friend Joseph Childrey is Founder & Chief Investment Officer at

Probabilities Fund Management, LLC. He runs several funds and strategies based in part on the Almanac and we consult and provide research to them. Joe put out a brief note today:

“I wanted to reach out due the recent market volatility and make sure that you and your clients understand that we have been through similar markets before, particularly the first quarter of 2008. We are proactive, not reactive and we continue to stick with our systematic approach.”

Their flagship fund Probabilities Fund (PROTX) gained 5.27% in 2008 – after the drawdown in the first quarter of 2008 of over 20%. Joe trades in much the same way that we trade and invest here at Almanac Investor and Almanac Trader based on historical trends and patterns for frequency and magnitude as laid out in the Almanac and other sources that illustrate evidence of these trends and patterns that we believe are repeatable. We do not wing it and capitulate based on feelings or emotions.

Our flagship indicator, the January Barometer created by Yale Hirsch in 1972, simply states that as the S&P goes in January so goes the year. It came into effect in 1934 after the Twentieth Amendment moved the date that new Congresses convene to the first week of January and Presidential inaugurations to January 20.

The long-term record has been stupendous, an 87.9% accuracy rate, with only eight major errors in 66 years. Major errors occurred in the secular bear market years of 1966, 1968, 1982, 2001, 2003, 2009, 2010 and 2014. Including the eight flat years (less than +/- 5%) yields a 75.8 % accuracy ratio.

As the opening of the New Year, January is host to many important events, indicators and recurring market patterns. U.S. Presidents are inaugurated and present State of the Union Addresses. New Congresses convene. Financial analysts release annual forecasts. Residents of earth return to work and school en mass after holiday celebrations. On January’s second trading day, the results of the official Santa Claus Rally are known and on the fifth trading day the First Five Days early warning system sounds off, but it is the whole-month gain or loss of the S&P 500 that triggers our January Barometer.

And yet for some reason, every February (or sooner if January starts off poorly) our January Barometer gets raked over the coals and every attempt at disparaging this faithful indicator comes up lame. It never ceases to amaze us how our intelligent and insightful colleagues, that we have the utmost professional respect for and many of whom we consider friends, completely and utterly miss the point and fallaciously argue the shortcomings of the January Barometer. Here is why the January Barometer is relevant and important.

1933 “Lame Duck” Amendment—Why JB Works

All detractors refuse to accept the fact the January Barometer exists for one reason and for one reason only: the Twentieth “Lame Duck” Amendment to the Constitution. Passage of the Twentieth Amendment in 1933 created the January Barometer. Since then it has essentially been “As January goes, so goes the year.” January’s direction has correctly forecasted the major trend for the market in most of the subsequent years.

Prior to 1934, newly elected Senators and Representatives did not take office until December of the following year, 13 months later (except when new Presidents were inaugurated). Defeated Congressmen stayed in Congress for all of the following session. They were known as “lame ducks.”

Since 1934, Congress convenes in the first week of January and includes those members newly elected the previous November. Inauguration Day was also moved up from March 4 to January 20. January’s prognostic power is attributed to the host of important events transpiring during the month: new Congresses convene; the President gives the State of the Union message, presents the annual budget and sets national goals and priorities.

These events clearly affect our economy and Wall Street and much of the world. Add to that January’s increased cash inflows, portfolio adjustments and market strategizing and it becomes apparent how prophetic January can be. Switch these events to any other month and chances are the January Barometer would become a memory.

JB vs. All

Over the years there has been much debate regarding the efficacy of our January Barometer. Skeptics never relent and we don’t rest on our laurels. Disbelievers in the January Barometer continue to point to the fact that we include January’s S&P 500 change in the full-year results and that detracts from the January Barometer’s predicative power for the rest of the year. Others attempt to discredit the January Barometer by going further back in time: to 1925 or 1897 or some other arbitrary year.

After the Lame Duck Amendment was ratified in 1934 it took a few years for the Democrat’s heavy congressional margins to even out and for the impact of this tectonic governing shift to take effect. In 1935, 1936 and 1937, the Democrats already had the most lopsided Congressional margins in history, so when these Congresses convened it was anticlimactic. Hence our January Barometer starts in 1938.

In light of all this debate and skepticism we have compared the January Barometer results along with the full year results, the following eleven months results, and the subsequent twelve months results to all other “Monthly Barometers” using the Dow Jones Industrials, the S&P 500 and the NASDAQ Composite.

Here’s what we found going back to 1938. There were only 9 major errors. In addition to the eight major errors detailed on page 16 of the Stock Trader’s Almanac 2016: in 1946 the market dropped sharply after the Employment Act was passed by Congress, overriding Truman’s veto, and Congress authorized $12 billion for the Marshall Plan.

Including these 9 major errors, the accuracy ratio is 88.5% for the 78-year period. Including the 9 flat year errors (less than +/– 5%) the ratio is 76.9% — still effective. For the benefit of the skeptics, the accuracy ratio calculated on the performance of the following 11 months is still solid. Including all errors — major and flat years — the ratio is still a respectable 69.2%.

Now for the even better news: In the 48 up Januarys there were only 3 major errors for a 93.8% accuracy ratio. These years went on to post 16.1% average full-year gains and 11.7% February-to-December gains.

Now let’s compare the January Barometer to all other “Monthly Barometers.” For the accompanying table we went back to 1938 for the S&P 500 and the Dow — the year in which the January Barometer came to life — and back to 1971 for NASDAQ when that index took its current form.

The accuracy ratios listed are based on whether or not the given month’s move — up or down — was followed by a move in the same direction for the whole period. For example, in the 78 years of data for the S&P 500 for the January Barometer, 60 years moved in the same direction for 76.9% accuracy.

The Calendar Year ratio is based on the month’s percent change and the whole year’s percent change; i.e., we compare December 2014’s percent change to the change for 2014 as a whole. By contrast the 11-month ratio compares the month’s move to the move of the following eleven months. February’s change is compared to the change from March to January. The 12-month change compares the month’s change to the following twelve months. February’s change is compared to the change from March to the next February.

Though the January Barometer is based on the S&P 500 we thought it would clear the air to look at the other two major averages as well. You can see for yourself in the table that no other month comes close to January in forecasting prowess over the longer term.

There are a few interesting anomalies to point out though. On a calendar year basis the Dow in January is slightly better than the S&P. 2011 is a perfect example of how the DJIA just edges out for the year while the S&P does not. For NASDAQ April, September and November stick out as well on a calendar year basis, but these months are well into the year, and the point is to know how the year might pan out following January, not April, September or November. And no other month has any basis for being a barometer. January is loaded with reasons.

Being the first month of the year it is the time when people readjust their portfolios, rethink their outlook for the coming year and try to make a fresh start. There is also an increase in cash that flows into the market in January, making market direction even more important. Then there is all the information Wall Street has to digest: The State of the Union Address, FOMC meetings, 4th quarter GDP, earnings and the plethora of other economic and market data.

Myths Dispelled

In recent years new myths and/or areas of confusion have come to light. One of the biggest errors is the notion that the January Barometer is a stand-alone indicator that can be used to base all of your investment decisions for the coming year on. This is simply not true and we have never claimed that the January Barometer should or could be used in this manner. The January Barometer is intended to be used in conjunction with all available data deemed relevant to either confirm or call into question your assessment of the market. No single indicator is 100% accurate so no single indicator should ever be considered in a vacuum. The January Barometer is not an exception to this.

Another myth is that the January Barometer is completely useless. Those that believe this like to point out that simply expecting the market to be higher by the end of the year is just as accurate as the January Barometer. Statistically, they are just about right. In the 78-year history examined in this article, there were only 23 full-year declines. So yes, the S&P 500 has posted annual gains 70.5% of the time since 1938. What is missing from this argument is the fact that when January was positive, the full year was also positive 87.5% of the time and when January was down the year was down 60.0% of the time. These are not the near perfect outcomes that true statisticians prefer, but once again, see the previous paragraph.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held a position in PROTX.

|

Seasonal Sector Trades: Seasonal Support for a Tradable Crude Oil Bottom

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

January 19, 2016

|

|

|

|

CBOE Weekly Equity Only Put/Call spiked to 0.93 last week. That’s the highest since June 2011. It hit 0.93 the week ending June 17, 2011. Put/Call also hit 0.90 November 13, 205. Both of these last two readings above 0.90 preceded some nice weekly gains. However, the market continued lower after both respites.

In 2011 the market suffered a summer/ fall selloff of 19.4% on the S&P 500 for what we declared in the Stock Trader’s Almanac as a “Ned Davis Research” bear market (A 13% DJIA decline after 145 calendar days) posting the last major bottom October 3, 2011. At Friday’s close the DJIA was down 12.7% after 241 calendar days. So we are getting close to a low, at least for the short term.

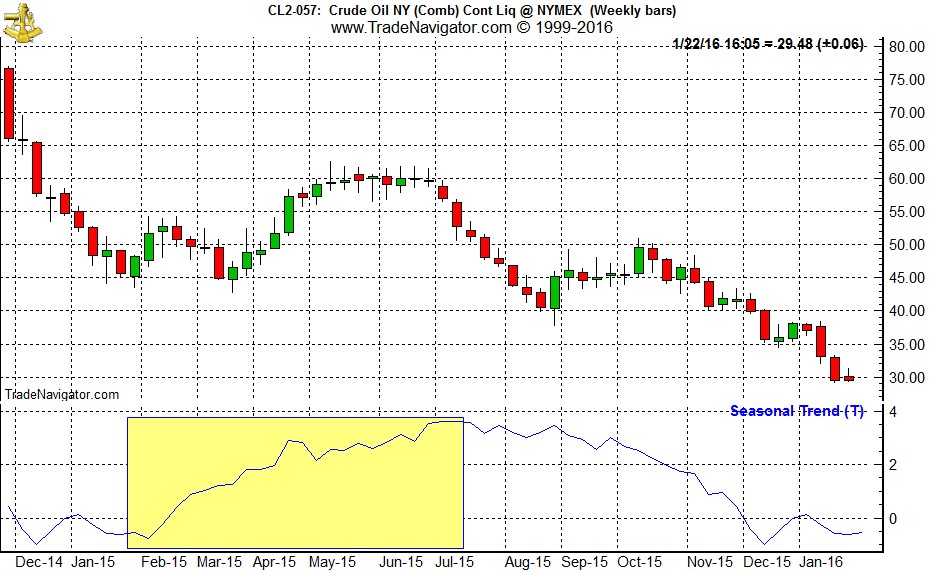

Crude oil also has some rather negative sentiment at the moment, but has not reached extreme levels as far as the COT report goes. Large and small speculators remain net long though the trend has been lower since 2014 and lower still since last fall. Commercial hedgers remain negative though trending higher. In 2008/2009 at the last major crude oil low both spec groups went negative and commercials turned positive. Last January the COT report was at similar levels as it is now, suggesting a tradable rally, which coincides with the seasonal low.

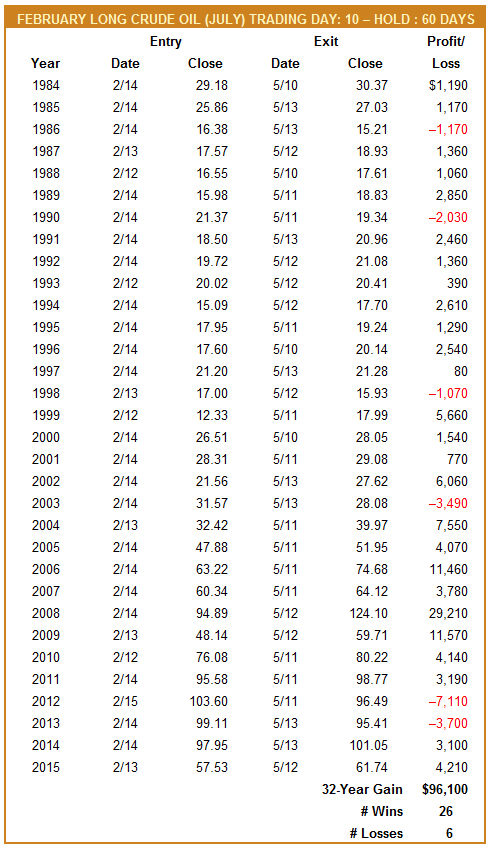

Crude oil has a tendency to bottom in mid-February and then rally through July (highlighted in yellow in second chart below) with the bulk of the seasonal move ending in late April or early May. It is that early February low that can give traders an edge by buying ahead of a seasonally strong period. Going long crude oil’s July contract on or about February 13 and holding for approximately 60 days has been a profitable trade 26 times in 32 years, including last year in 2015, for an 81.3% win ratio with a cumulative profit of $96,100 (based upon a single futures contract excluding commissions and taxes).

Crude oil’s seasonal tendency to move higher in this time period is partly due to continuing demand for heating oil and diesel fuel in the northern states and partly due to the shutdown of refinery operations in order to switch production facilities from producing heating oil to reformulated unleaded gasoline in anticipation of heavy demand for the upcoming summer driving season. This has refiners buying crude oil in order to ramp up production for gasoline. In recent years, crude has been finding a bottom earlier. Last year, crude double bottomed in late January and mid-March rallying from about $50 to just over $60 per barrel in May/June before rolling over last summer.

United States Oil (USO) is the largest and most liquid of the futures-backed ETFs. It trades in excess of 30 million shares daily and has net assets exceeding $2 billion. USO is once again off nearly 60% from its 52-week high reached last year in May. Its stochastic, relative strength and MACD indicators are deeply into oversold territory. USO can be purchased below $9.00. It will be added to the Almanac Investor ETF Portfolio at today’s closing price.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held a position in USO.

|

Mid-January Update: Market on Shaky Ground – January Barometer to the Rescue

|

|

By:

Jeffrey A. Hirsch

|

January 14, 2016

|

|

|

|

The Russell 2000 entered bear market territory yesterday and the DJIA, S&P 500 and NASDAQ Composite all reached the 10% correction level. But today we have the first really good market day of the year. Most encouraging was that the morning rally held and tacked on more throughout the day, and only gave back a little on the close. Not the most convincing turnaround, but it’s a start, potentially creating a series of higher lows off the August and September lows last year.

This has been the worst start to a New Year on record, triggering bearish warning signs on several of our New Year seasonal indicators. There have been few places to hide, barely any respite and little solace. With our “Santa Claus Rally” (SCR) and “First Five Days Early Warning System” (FFD) in the red and the DJIA’s December closing low violated, a positive reading from our full-month January Barometer would go a long way in improving the prospects for the year.

If today’s oversold rally can hold and the S&P 500 can move up more than 8% by the close of the month our January Barometer will be positive and an indication that this current selloff is of similar ilk to the August-September correction last year. However, a negative January Barometer is not the death knell for the market. It sure suggests rough sledding and likely lower prices if history is any guide. A deeper examination of the historical record illustrates that despite the market’s current troubles – and even if the JB is negative – there will likely be a silver lining.

Of the past 10 times that the SCR and FFD were both negative, the December low was NOT violated only once in 1985 as you can see in the accompanying annotated table. 1985 is also one of the three years in the table that registered a positive January Barometer. All three were pure bull market years with solid gains. 1985 and 1991 were both up 26.3% and 1993 was up 7.1%.

The January Barometer was up in 2005 and the bull market raged on, but the year was flat with a paltry 3% gain. The other six years in the table are a mishmash, but only three are a total washout. 1969, 2000 and 2008 all registered losses for the next eleven months, the full year and beyond, delivering bear markets that spanned more than one year. The other three years, 1956, 1978 and 1982 all contained bear and bull markets and managed 11-month and full-year gains; modest in 1956 and 1978, but smashing in 1982 with the start of the last secular bull.

Whatever happens this January and this year, the beginning of the next secular bull and our

“Super Boom” forecast is getting closer on the horizon.

However, this does not mean that we get off scot-free this year. There is no doubt about it, the market is on shaky ground and the odds of further downside are increasing. On top of the China-slowdown fears, the oil meltdown and global violence and turmoil, President Obama’s rhetoric in his final State of the Union Address did little to quell investors’ concerns; in fact they may have fanned the flames. About the only positive, from a contrary perspective that is, is increased pessimistic sentiment and bearish market calls up and down Wall Street.

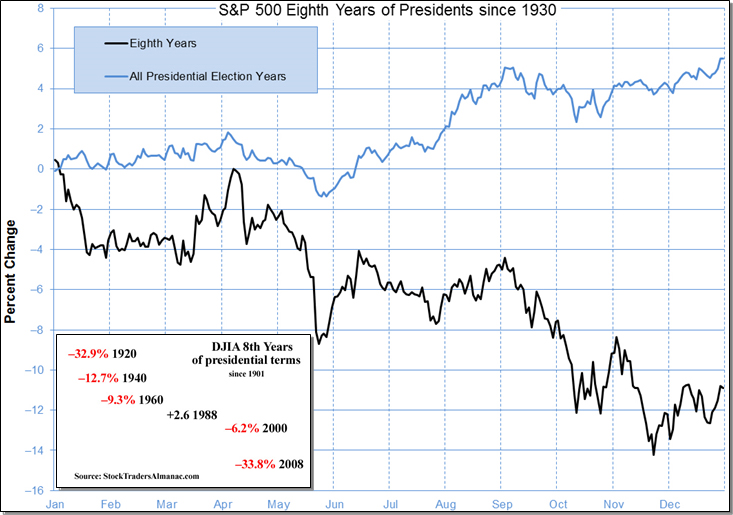

Way back in early June 2015, when I put the Stock Trader’s Almanac 2016 to bed and sent it off to the publisher, I warned that my outlook for 2016 was less than sanguine and that there was a low probability for substantial gains in 2016. Election years used to be the second best year of the four-year cycle, but the recent history of back-to-back-to-back two-term presidents (Obama, GW Bush & Clinton), plus several others in the 20th Century has impacted the 4th year of the cycle dramatically. Since 1941 the DJIA has been the worst of the 4-year election cycle.

While election years have been considerable weaker in recent history, eighth years of presidential terms represent the worst of election years since 1920. In eighth years DJIA and S&P 500 have suffered average declines of –13.9% and –10.9% respectively. Out of these six full years, only 1988 was positive. As a result, eighth years have vastly differed from the typical election-year pattern.

Prior to President Obama, there have been six previous presidents that served an eighth year in office since 1901; Presidents Wilson (1920), Roosevelt (1940), Eisenhower (1960), Reagan (1988), Clinton (2000) and G.W. Bush (2008). President McKinley was elected to a second term, but was assassinated in his fifth year in office. Nixon was also elected to a second term, but resigned in the face of the Watergate scandal in his sixth year in office. Eighth years are also presidential election years. In the following chart the one-year seasonal pattern for eighth years is compared to all presidential election years.

Making matters even worse, 2015 registered the first losing pre-election for DJIA since war-torn 1939 when Germany invaded Poland (S&P 500 was down 0.7% in 2015). This is not a great sign. 1939 was the seventh year of FDR’s Presidency, his second pre-election just as 2015 was for Obama. The S&P 500 was down 5% in 1939 and as WWII broke out in Europe the stock market was down double digits the next two years.

With seasonals, cycles, fundamentals and technical all flashing warning signs, caution is clearly in order. At a bare minimum consider sitting on the sidelines for the time being and holding some cash. Once we have our full month January Barometer reading and more economic, technical and fundamental data points at month’s end, we’ll adjust our forecast and outlook for 2016 if need be. So for now, don’t expect big gains this year and sit tight.

|

Stock Portfolio Update: New Year Jitters Hammer Market & Portfolio

|

|

By:

Christopher Mistal

|

January 12, 2016

|

|

|

|

Perhaps this afternoon’s market rally will be the start of something meaningful after the worst start to a New Year on record. The apparent and broadly accepted reason for this year’s slide is a slowdown in China’s growth that triggered a market rout there, has sent crude oil and other manufacturing-based commodities tumbling. This has led to falling global growth estimates and weakness across major commodity suppling nations. This certainly appears to be a sizable portion of the reason for all the weakness.

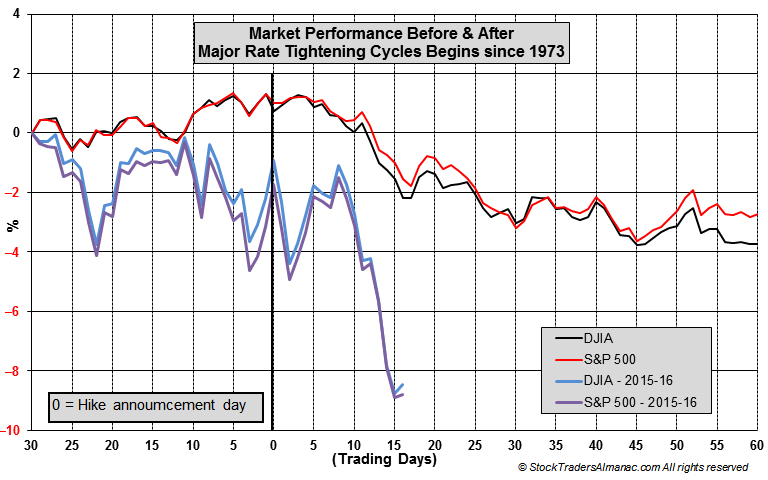

Further compounding the market’s woes is the Fed. Even though their December rate increase and the start of the first tightening cycle since 2004 was the most well-telegraphed move in history, the market may not have been totally prepared for the move. Based upon the previous five major rate tightening cycles since 1973, the market generally moved higher in the 30 days before the start of the tightening cycle and was weak during the 60 trading days immediately following the rate hike announcement.

In the above chart, DJIA and S&P 500 performance during the 30 trading days before and the 16 trading days since the Fed’s December announcement have been plotted against the previous five cycles. This time the market was weak ahead of the announcement and due to China concerns even weaker than average afterwards. If growth concerns ease and the market were to return to the average post-rate-hike decline, it would represent a rally of around 6% from DJIA and S&P 500 closes yesterday, January 11.

Stock Portfolio Updates

Over the past four and a half weeks since last update, S&P 500 has dropped 6.1% and Russell 2000 is off a whopping 9.1% as of yesterday’s close. Small-, Mid- and Large-cap portfolios all suffered declines. Mid-caps were hit the hardest, off 8.9%. Large-caps dropped 7.9% and Small-caps fell 7.6%. Much of the portfolio’s decline was due to the addition of

December’s Free Lunch Stocks. Initially the basket was performing exceptionally well, up 6.3% on average on January 4 close. But, once crude broke down towards $30 per barrel, early gains quickly faded and became losses.

This year’s basket is a near-textbook example of why you need to be nimble, take gains when presented, cut losses early and not get attached to the stocks. Many of the names in the basket were from the energy and materials sectors and were down for good reason late last year.

The entire basket has been added to the Almanac Investor Stock Portfolio, per the original Alert. As of yesterday’s close, just 12 remain and only Eclipse Resources Corp. (ECR) had a gain. Closed positions will not be reconsidered. Those that remain on are Hold for now. Crude oil may hold $30 per barrel and bounce and small-caps also appear poised for some type of bounce as well.

Beyond the Free Lunch stocks, recent broad market weakness resulted in six previous positions being stopped out; two in the Small-cap section of the portfolio (CCS & LGIH), three in Mid-caps (JBLU, LAS & CALM) and one in Large-caps (FNF). Centene Corp. (CNC) was the only non-Free Lunch stock to post a gain over the past four and a half weeks.

All positions in the portfolio are on Hold. No Santa Claus Rally, a down First Five Days and DJIA’s December closing low has been violated. Of the

January Trifecta indicators, only the January Barometer remains to either confirm or possible reverse all of the negative indicators.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in CALM, CCS, CNC, CVS, DHI, HBI, LGIH, MMSI, NTRS, PLOW, SUN, TMH, TSCO AND VSR.

|

Worst S&P 500 Start Ever, First Five Days Early Warning, January Barometer Crucial This Year

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

January 08, 2016

|

|

|

|

First there was no Santa Claus Rally (SCR), and then December’s Closing Low of 17128.55 was violated on January 6 and now the First Five Days (FFD) early warning indicator has registered its worst reading on record going back to 1930 (S&P 500 –6.0%). The first five days of 2016 were capped by a 1.1% S&P 500 drop despite a solid December employment report that showed the economy added 292,000 jobs last month. The market is definitely on shaky ground and the risk of further downside is growing.

However, ample time remains for the market to rebound and finish January with a gain. A positive January Barometer reading would go a long way to improving full-year prospects. And given the recent tendency for the market to rebound just as sharply as it sells off, the possibility of a positive January is not all that far-fetched.

Of the 28 negative S&P 500 FFDs since 1930, the full year was down 15 times and up 13 times. The worst annual loss was 2008, S&P 500 off 38.5%. The best year is nearly a four-way tie with 1955, 1985, 1991 and 1998 all registering full-year gains of over 26 %.

In presidential election years this indicator has a solid record. In the last 16 presidential election years 14 full years followed the direction of the FFD. Errors occurred in 1956 and 1988 when the FFD was negative and the full year finished positive.

The current combination of a negative SCR, negative FFD and DJIA December Low violation has occurred nine times since 1950 (shaded in grey in table below), excluding this year. January was down in seven of those previous nine. But, the Last 11 Months and Full Year were up in six of those nine years. Losing years were all bear markets and included 1969, 2000 and 2008.

No single indicator is perfect and even the January Trifecta plus the December Low indicator has given a few false negative readings. All the negative readings thus far are a cause for serious concern, but if the market can hold last year’s August low and stage a January rally the outlook for 2016 would improve. The official January Barometer (JB) on the 29th is even more significant this year. A positive reading could signal fears and concerns regarding China and global growth were overblown while a negative JB would add credibility.

|

ETF Trades: Looking for Additional Natural Gas Gains

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

January 07, 2016

|

|

|

|

Famous financier and fund manager George Soros came out today with his outlook that this year is in store for a meltdown and financial crisis like 2008, mostly triggered by a Chinese economic and market collapse. Dr. Doom, Marc Faber, was also awoken from his slumber in the middle of the night in his residence in Thailand to espouse his bearish outlook – the same one he has had since about 2010.

Both gentlemen are giants in the field and brilliant analysts who we respect greatly, but so many folks are now jumping into the bear camp that the complacency that was prevalent in January 2008 is not quite as present here in January 2016. Don’t get us wrong, there are many troubling factors and indications presenting themselves at the moment, but we are not convinced we will experience another generational bear market so soon. A tamer bear market is however, not out of the question.

So we took a look back at our commentaries and market action back in 2008 to compare and contrast it to the market here in 2016. There are similarities and differences. Market sentiment feels a little more bearish now. CBOE Equity only put/call ratio was more fearful in 2008, but there is more bearish advisors here in 2016. As you can see in the chart, S&P 500 was down much more and much faster in 2008 than now.

Caution is definitely in order now, but so is patience. Let’s wait and see what the full-month January Barometer tells us before throwing in the towel.

January Trade Ideas

Based upon the NYSE ARCA Natural Gas Index (XNG) there is a seasonal tendency for natural gas companies to enjoy gains from the end of February through the beginning of June. Detailed in the Stock Trader’s Almanac 2016 on page 94, this trade has returned 15.1%, 11.8%, and 3.4% on average over the past 15, 10, and 5 years respectively. Concurrent with this is a featured trade on page 32 of the Commodity Trader’s Almanac 2013 that is based upon natural gas, itself.

One of the factors for this seasonal price gain is consumption driven by demand for heating homes and businesses in the northern cold weather areas in the United States. In particular, when December and January are colder than normal, we see depletions in inventories through late March and occasionally into early April. This has a tendency to cause price spikes lasting through mid-April.

A relatively mild start to winter this year combined with plunging crude oil prices had sent natural gas back below $2/mmBtu in mid-December. Since then it has enjoyed a nice rally back to just under $2.50/mmBtu. Inventories are healthier now than a year ago and are still slightly above the 5-year average for this time of year, but have declined rather briskly in recent weeks. With more cold weather in the forecast and the most of January and February yet to come, further upside potential for natural gas and possibly natural gas company stocks seems plausible.

![[Natural Gas Weekly Bars (NG) and 1-Year Seasonal Pattern Since 1990]](/UploadedImage/AIN_0216_20160107_NG_Seasonal.jpg)

First Trust ISE-Revere Natural Gas (FCG) is an excellent choice to gain exposure to the company side of the natural gas sector. FCG could be bought on dips below $3.75. Once purchased, use a stop loss of $3.65 and take profits at the auto sell, $3.75. Top five holdings by weighting as of yesterday’s close are: EXCO Resources, Southwestern Energy, Chesapeake Energy, Rice Energy and Gulfport Energy. The net expense ratio is reasonable at 0.6% and the fund has approximately $135 million in assets.

United States Natural Gas (UNG) is suggested to trade the commodity’s seasonality as its assets consist of natural gas futures contracts and is highly liquid with assets of nearly $500 million and average daily trading volume in excess of 6 million shares per day on average over the past three months. Its expense ratio is 1.14%. UNG could be bought on dips below $8.40. If purchased, set an initial stop loss at $7.90.

ETF Portfolio Updates

Since last update in early December, the market and the ETF Portfolio have weakened substantially. As a result, positions in iShares DJ Transports (IYT) and SPDR Energy (XLE) have been stopped out. Additionally, today’s losses have triggered stop loss sales of SPDR Materials (XLB) and iShares Russell 2000 (IWM). XLB and IWM will be officially closed out of the portfolio in the next update.

As a reminder, three favorable sector seasonalities usually come to an end in January; High-Tech, Computer Tech and Pharmaceutical. High-Tech and Computer Tech resume favorable seasonalities again in March and April respectively. With this in mind and the magnitude of recent declines considered, corresponding positions in IYW and XLK are on Hold. Due to the increasingly blurry line between Healthcare, Biotech and Pharmaceutical sectors, no one specific ETF was selected to trade just Pharmaceutical strength last September. Instead we elected to purchase XLV and IBB, both of which have longer lasting favorable periods and are on Hold.

With the exception of today’s two new trade ideas, all positions in the portfolio are on Hold.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in IBB, IWM, IYT, QQQ, VNQ, XLV and XRT.

|

Santa Claus Rally Official Results & Free Lunch Update: Santa is a No Show

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

January 05, 2016

|

|

|

|

As defined in the Stock Trader’s Almanac, the Santa Claus Rally (SCR) is the propensity for the S&P 500 to rally the last five trading days of December and the first two of January an average of 1.4% since 1950.

The lack of a rally can be a preliminary indicator of tough times to come. This was certainly the case in 2008 and 2000. A 4.0% decline in 2000 foreshadowed the bursting of the tech bubble and a 2.5% loss in 2008 preceded the second worst bear market in history.

Including this year, Santa has failed to pay Wall Street a visit in just 15 years since 1950. Of the previous 14 occasions, January’s First Five Days (FFD) was down 10 times and the January Barometer (JB) was negative 8 times. When all three indicators were negative, the full year was either flat (+/– 5.0%) or negative with the lone exception being 1982, the year the last secular bull market began.

The lack of a positive SCR is cause for concern, but further clarity will be gained when the January’s First Five Days Early Warning System (page 14, STA 2016) gives its reading later this week and when the January Barometer (page 16, STA 2016) reports at month’s end. A positive First Five Days and January Barometer would certainly improve prospects for full-year 2016. The December Low Indicator (2016 STA, page 44) should also be watched with the line in the sand the Dow’s December Closing Low of 17128.55 on 12/18/15.

Free Lunch Update

As a reminder, our “Free Lunch” (page 112 of Stock Trader’s Almanac 2016) strategy is a short-term trade that takes advantage of several yearend and New Year phenomena. Our research has shown that NYSE stocks making new 52-week week lows in mid-December, primarily due to yearend tax-loss selling, tend to outperform the NYSE through mid-February. These stocks are selected ahead of the Santa Claus Rally (page 114 STA16) and approximately near the start of the January Effect (page 110 STA16).

Many of the stocks selected for the “Free Lunch” trade are down for good reason. Declining revenue and shrinking profits are most common amongst these names while others may have run into legal or accounting trouble. Once a name pops, profits should be taken and conversely if a name continues lower it should be cut loose quickly. This year’s basket is heavily dependent on the performance of the energy and materials sectors, more specifically, crude oil’s price. When crude has a good day the basket does well and vice-a-versa.

Overall, this year’s basket is handily outperforming the NYSE Comp with a 6% average gain at yesterday’s close compared to just 0.3% for the index. NYSE listed stocks, the largest portion of the list, are performing best, up 8% on average. All of these stocks have been added to the Almanac Investor Stock Portfolio. Returns listed in the table below are calculated using either the stocks open price on December 21 or the suggested buy limit if the stock opened higher and then dipped below the buy limit.

Despite a negative SCR and a poor start to 2016, this basket appears to still have plenty of life left in it. We will officially continue to hold the basket in the Stock Portfolio.