|

April 2020 Trading & Investment Strategy

|

|

By:

|

March 26, 2020

|

|

|

|

|

Market-at-a-Glance - 3/26/2020

|

|

By:

Christopher Mistal

|

March 26, 2020

|

|

|

|

3/26/2020: Dow 22552.17 | S&P 2630.07 | NASDAQ 7797.54 | Russell 2K 1180.32 | NYSE 10536.28 | Value Line Arith 4700.09

Fundamental: Uncertain. That may be just be the best and perhaps most honest assessment that could be given at this time. Weekly initial jobless claims exploded to nearly 3.3 million and likely would have been even higher if states did not run into processing capacity limitations. Millions of businesses are shut or operating well below desired levels. The virus is still spreading rapidly around the globe. If containment or some semblance of control can be achieved quickly, then, maybe the recovery could also come quickly.

Technical: Bear bounce? Historically key levels such as 50- and 200-day moving averages were quickly violated and even the 20% decline threshold that is typically associated with a bear market has been exceeded. Technical indicators, like MACD quickly reached oversold levels and when selling dried up earlier this week a bounce has ensued. Historically, lows are typically tested and the current lows have not yet been.

Monetary: 0 – 0.25%. March’s scheduled Fed meeting was no longer needed as they sprung to action well before. The result as of today is the return of ZIRP (zero interest rate policy). Rates have been cut to effectively zero and open-ended purchases of Treasuries and mortgage-backed securities are underway. The Fed has also restarted many of the programs it first used in the financial crisis and appears to be looking to create some new ones as well. The Fed appears to be “all in” but they insist there is still more that could be done, if needed. Hopefully, more will not be needed.

Seasonal: Bullish. April is DJIA’s best performing month since 1950, second best for S&P and fourth best for NASDAQ (since 1971). However, April also marks the end of our “Best Six Months” for DJIA and the S&P 500. Our Seasonal MACD Sell signal can occur as early as April 1 but could easily be delayed should the market continue to recover through April and beyond.

Psychological: Bearish. According to

Investor’s Intelligence Advisors Sentiment survey Bullish advisors are at 30.1%. Correction advisors are at 28.2% and Bearish advisors are 41.7%. This is the highest number of bears since October 2011. Historically, bears outnumbering bulls has coincided with better opportunities to accumulate long positions. However, the exact timing has not been perfect.

|

April Outlook: Beware the Bear Market Bounce

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

March 26, 2020

|

|

|

|

Today’s rally caps the biggest three-day surge since October 6-8, 1931. That may sound encouraging, but remember 1931 was the worst year for DJIA on record, down 52.7%. DJIA is up 21.3% since Monday’s low. This surge comes on the heels of the fastest and most furious decline in stock market history. DJIA dropped 37.1% from its 2/12/2020 all-time high in 40 calendar days. It fell 35.9% in 31 days from the top of the

waterfall decline on 2/21/2020 and 31.4% in 19 days from the 6.6% three-day rally March 2-4, 2020.

While we are all rooting for the market to find support here so much damage has been done. A great deal of uncertainty remains for the economy and health crisis. This looks like a bear market bounce.

Federal Reserve and Federal Government action has been more encouraging. The Fed has made it clear that it will supply unlimited liquidity to the financial system. Congress is fast tracking this $2 trillion emergency stimulus package, which the President has vowed to sign – and more is likely. There are also some encouraging therapeutic solutions, but nothing of substance yet. And the lockdown of much of the country has yet to stem the spread of COVID-19 in the U.S.

History suggests that we are in for some tough sledding in the market this year with quite a bit of chop. When the January Barometer came in with a negative reading our outlook for 2020 began to diminish as every down January since 1950 has been followed by a new or continuing bear market, a 10% correction or a flat year. Then another warning sign flashed when DJIA closed below its December closing low on February 26, 2020 as the impact of this novel coronavirus began to take its toll on Wall Street.

In the

March Outlook we presented this graph of the composite seasonal pattern for the 22 years since 1950 when both the

January Barometer as measured by the S&P 500 were down and the Dow closed below its previous December closing low in the first quarter. Below that is a graph of DJIA, S&P 500 and NASDAQ Composite for 2020 year-to-date as of the close on March 25. Comparing 2020 market action to these 22 years, suggests a choppy year ahead with the potential for several tests of the recent low.

![[Dec Low Down Jan Seasonal Chart]](/UploadedImage/AIN_0420_20200326_2020_v_Down_JB_Dec_Low.jpg)

The depth of this waterfall decline may be too deep for the market to rebound quickly. This bear market also put this year’s Best Six Months (November-April) at risk of being negative. The record of down Best Six Months is not encouraging and it reminds us of a salient quote from the Almanac from an old market sage, “If the market does not rally, as it should during bullish seasonal periods, it is a sign that other forces are stronger and that when the seasonal period ends those forces will really have their say.”— Edson Gould (Stock market analyst, Findings & Forecasts, 1902-1987)

The table below of Down Best Six Month for DJIA since 1950 also suggests caution and patience is in order. Subsequent Worst Six Months (May-October) have averaged losses with only two decent years 1982 and 2009. The market bottom in August 1982 marked the end of the 1966-1982 secular bear market and came of the early 1980s double dip recession. Following the first back-to-back down Best Six Months since 1973-1974, the market hit a secular bear market low in March 2009. Market action in the rest of these years was rather grim.

![[Down Best Six Months Table]](/UploadedImage/AIN_0420_20200326_Down_BSM.jpg)

Stop losses in our Stock and Sector ETF Portfolios got us out of all but a few positions before the bottom fell out of the market, mitigating our losses significantly. This is a generational crisis that will forever change our lives. But the market has been through these trials and tribulations before – so have the Stock Trader’s Almanac and our brand of seasonal and cyclical trading and investing strategies. Soon enough market conditions will be such that will have new investment and trading ideas for you. Continue to stick to the system, heed stop losses and remain rational.

Pulse of the Market

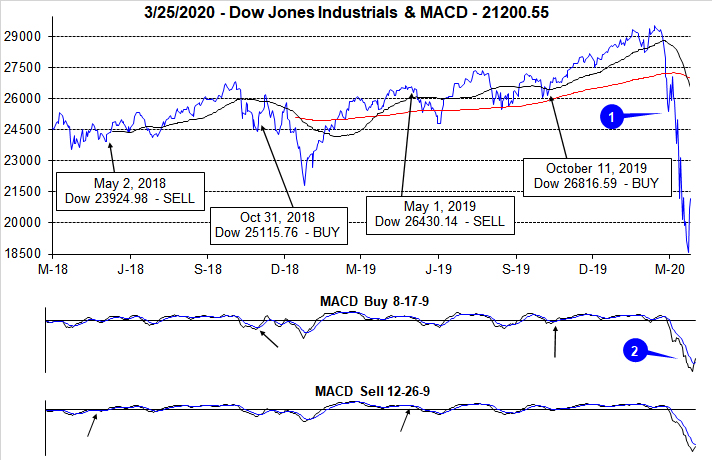

DJIA’s 37.1% decline (1) from its closing high on February 12 through its closing low thus far on March 23 took just twenty-seven trading sessions. Market crashes in 1929 and 1987 are the closest comparable declines although there are observable similarities to numerous other waterfall declines. The once reliable death cross indicator, when the 50-day moving average falls below the 200-day moving average, would not have provided much relief in the current sell off as the indicator triggered on March 23, at the current low.

DJIA’s abrupt reversal and violent decline has both the faster and slower moving MACD indicators deep in negative territory well below the zero line (2). If the chart of MACD looks different, it is. We had to change the scaling of the MACD charts to account for the sharp decline. Currently, the faster moving MACD turned positive on Wednesday’s close and the slower moving MACD indicator could turn positive today. A reprieve from all the selling of late is welcome however it is still too early to assert that the final lows of this bear market have been reached.

Fridays continue to be challenging with DJIA recording just two positive Fridays out of twelve so far this year (3). For the last six weeks, selling on Friday was better than holding over the weekend five times. Monday now holds the record for worst and third worst daily DJIA losses by points. With five Down Friday/Down Mondays (DF/DMs) in less than three months, 2020 is on a pace to have the most of any year going back to 1995 (page 76 of Stock Trader’s Almanac 2020).

Last week, DJIA, S&P 500 (4) and NASDAQ (5) all recorded their biggest weekly percentage declines since October 2008. Four weeks prior, the last week of February also suffered double-digit declines. Currently, the market is on course to recover some of last week’s losses, but any gains this week may not last as uncertainty remains high.

Market breadth measured by NYSE Weekly Advancers and NYSE Weekly Decliners (6) has reached extremes of historic proportions twice in the last three weeks. At the end of February, Weekly Decliners outnumbered Weekly Advancers by nearly 27-to-1 and last week the ratio was over 35-to-1. The only week to log a more lop-sided number was October 10, 2008 when the ratio spiked to just over 41-to-1. Back in 2008, the market did rebound in the following week, but the bear market bottom was not reached until March 2009.

Weekly New Highs have evaporated while Weekly New Lows have exploded to the highest number (7) since October 10, 2008. Last week’s levels will likely not be reached or exceed again in this bear market and can really only improve from there.

Yet another reading that reached a level last seen in the depths of the financial crisis of 2007-2009, was the Weekly CBOE Put/Call ratio (8) last week at 1.03. In November 2008 it reached 1.04. Back then, the market did bounce and move higher into early January of 2009, but that bounce failed to hold.

Click for larger graphic…

|

Humanity Rallies to Battle Coronavirus

|

|

By:

Jeffrey A. Hirsch

|

March 19, 2020

|

|

|

|

Welcome to the new digital world. Life has surely become more challenging as we all hunker down to stem the spread of the novel coronavirus. Many folks are now out of work or were forced to close their business during this social distancing decree. Some of us are fortunate enough to be able to continue working or running our business from home. We at

Hirsch Holdings and at StockTradersAlmanac.com are here and open for business, so feel free to call or email if you have questions, comments or requests.

Only four positions remain in our Almanac Investor Stock and Sector Rotation ETF Portfolios. Most have been stopped out. Our stop loss methodology and rules had many positions closed out well before this latest leg down, preserving gains and mitigating losses.

Two stocks from our October basket remain. Regeneron (REGN) is working on treatments for coronavirus and has been a standout stock. Chinese express delivery concern ZTO Express (ZTO) has held up relatively well. CVR (Celegene) (BMY-R) is a contingent value right from the Bristol Meyers Squibb acquisition. SPDR Gold (GLD) is our remaining Sector ETF position, which is benefiting from a flight to safety in this volatile market. Our Tactical Seasonal Switching ETF Portfolio is down 20.4% from our October 14, 2019 entry point following our October 11 Seasonal MACD Buy Signal. It has been helped by the QQQs.

At this time it’s important to help others where and when we can. Kids will need more support in general and guidance to stay on task with their new distance learning systems (thankfully many are already familiar with these tools). We also need to check in with our seniors while we stay away. Our founder, inspiration and creator of the Stock Trader’s Almanac, Yale Hirsch is 96 and in a nearby nursing home. We had our first FaceTime visit on Wednesday. He looks healthy and in good spirits.

Yes, this time

is different, but what history tells us about

waterfall declines still provides a valuable perspective. Volatility is likely to remain high for the near future, but we all know this market will rebound and get back to new highs at some point. The question of course is how much it will rebound and when.

This may be the fastest and most furious decline in stock market history, but in reality we have experienced similar declines, just not quite as rapidly – and not straight off a new all-time high. It’s impossible to know if we have hit bottom yet. By definition and nature bear market bottoms are only visible with a bit more hindsight. So speculating on the timing of a rebound, rally and recovery is not prudent. When we have a clearer picture on a bottom being in, we will be able to project what the next bull market may look like.

So let’s examine how this bear market stacks up with the history of declines of this nature and depth. The S&P 500’s 29.2% decline from the February 19 all-time high to the March 18 close is just under the

average bear market decline of 33.1% since 1948 in the post WWII era. And it’s just about equal to the average bear market decline of 30.6% for DJIA listed in the

2020 Stock Trader’s Almanac on page 131 that uses the

Ned Davis Research bull and bear market definitions going back to the year 1900. So the decline so far is average.

The velocity of the decline of near 30% over 28 calendar days is only matched by the 1929 and 1987 crashes. It took the market 25 years to reclaim the 1929 high through the depression and WWII. It took two years to reclaim the August 1987 high. Monetary and fiscal policies, as well as market systems, have come a long way since 1929 and 1987 and those crashes were outliers. This time could be an outlier as well, but the global response has been massive and we have learned a great deal since the outbreak became public in January.

Massive fiscal and monetary interventions are in place and more is at the ready. The healthcare industry is being ramped up while local governments and communities shelter in place to stem the spread of the virus. Most importantly some existing medical solutions appear to have potential and the government is throwing all the support it can behind these potential therapeutic solutions.

While this coronavirus situation is not like anything we have experienced before, the planet has survived a host of plagues and wars and humankind has thrived for quite some time despite it all. Our species has the ability to build on the ingenuity and wisdom of previous generation in an exponential manner. If we can go to the Moon and Mars and beat fascism we can beat this virus and come out of it stronger.

All that being said we suspect we are closer to the low than another major leg down and that we will end up with a V-shaped bottom and recovery. But the damage has been done and as we reported on

January 31 when the January Barometer came in negative our outlook has diminished this year. After the Dow’s December Low was breached our March Outlook showed the disconcerting returns in years with a negative January Barometer when DJIA closed below its December closing low in Q1.

At this point Congress has already approved and President Trump has signed into law well over $100 billion in emergency funding with more likely to come. This is in addition to the approximately $50 billion that became available when President Trump declared a national emergency to combat coronavirus and changed requirements to speed up testing and care.

The Fed has shown it will pump virtually unlimited amounts of liquidity into the system. We have learned a lot over the years and society is pulling together to do everything in its power. Medical fundamentals are improving. The full force of United States Federal Government is being deployed. Barring an absolute worst case medical scenario where the whole country is infected a fairly brisk recovery is likely once the virus has been contained.

So stay safe and stay informed. Follow healthcare and government guidelines. Keep others calm and when this is over we will guide you back in the markets with our historical perspective, sound fundamental and technical analysis and our evidence-based tactical seasonal strategies.

|

April Almanac: Can Top Month Curtail Market Rout?

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

March 19, 2020

|

|

|

|

The first trading day of April and the second quarter, has enjoyed notable strength over the past 25 years, advancing 18 times with an average gain of 0.40% in all 25 years for S&P 500. However, four of the seven declines have occurred in the last seven years. Other declines were in 2001, 2002 and 2005. DJIA’s record on April’s first trading day matches the S&P 500, 18 advances in 25 years. NASDAQ recent performance is slightly weaker than DJIA and S&P 500, but the day is still bullish for technology stocks in general with more advances than declines during the same period.

April marks the end of the “Best Six Months” for DJIA and the S&P 500. The window for the seasonal MACD sell signal opens on April 1st. The unprecedented speed of the current market selloff and current bear market would appear to have made this year’s signal insignificant. This could be the case, but it is far too early to say if the worst of the bear market is over. Double-digit DJIA losses during the “Best Six Months” have only occurred three times (ending in April in 1970, 1974 and 2009) since 1950. In 1970 & 2009 the “Worst Six Months” were positive while in 1974 DJIA slide another 20.5%.

April 1999 was the first month to gain 1000 DJIA points. However, from 2000 to 2005, “Tax” month was hit, declining in four of six years. Since 2006, April has been up fourteen years in a row with an average gain of 2.3% to reclaim its position as the best DJIA month since 1950. April is second best for S&P and fourth best for NASDAQ (since 1971).

The first half of April used to outperform the second half, but since 1994 that has no longer been the case. The effect of April 15 Tax Deadline appears to be diminished with numerous bullish days present on either side of the day. Traders and investors are clearly focused on first quarter earnings and guidance during April. This year, guidance will likely be the greatest focus as first and second quarter earnings are likely to be disappointing as a result of the coronavirus pandemic.

Historically bullish election-year influences (the second-best year of the four-year presidential election cycle) have the exact opposite effect on April. Average gains since 1952 are approximately half of the average gain of all years since 1950 for DJIA and S&P 500. Largely due to a 15.6% loss in 2000, NASDAQ’s typical strength in all Aprils since 1971 is transformed into an average loss in election years.

Options expiration week frequently impacts the market positively in April and DJIA has the best track record since 1991, with an average gain of 1.38% for the week with just five declines in 29 years. The first trading day of expiration week has a slightly better record than expiration day and the week as a whole is generally marked by respectable gains across the board. The week after has a softer long term-record, but still has a bullish leaning record.

Good Friday (Passover and Easter) lands a week before April’s option expiration week this year. Historically the longer-term track record of Good Friday (page 100 of STA 2020) is bullish with notable average gains by DJIA, S&P 500, NASDAQ and Russell 2000 on the trading day before. NASDAQ has advanced 18 of the last 19 days before Good Friday. Monday, the day after Easter has exactly the opposite record and is in the running for the worst day after of any holiday. Since 2004 the day after has improved.

| April (1950-2019) |

| |

DJI |

SP500 |

NASDAQ |

Russell

1K |

Russell 2K |

| Rank |

|

1 |

|

2 |

|

4 |

|

2 |

|

4 |

| #

Up |

|

48 |

|

50 |

|

32 |

|

29 |

|

26 |

| #

Down |

|

22 |

|

20 |

|

17 |

|

12 |

|

15 |

| Average

% |

|

1.9 |

|

1.5 |

|

1.4 |

|

1.6 |

|

1.5 |

| 4-Year Presidential Election Cycle Performance

by % |

| Post-Election |

|

1.9 |

|

1.5 |

|

2.4 |

|

2.4 |

|

2.1 |

| Mid-Term |

|

0.7 |

|

0.2 |

|

-0.1 |

|

-0.1 |

|

0.7 |

| Pre-Election |

|

3.9 |

|

3.5 |

|

3.6 |

|

2.9 |

|

2.9 |

| Election |

|

0.9 |

|

0.6 |

|

-0.4 |

|

0.9 |

|

0.2 |

| Best & Worst April by % |

| Best |

1978 |

10.6 |

2009 |

9.4 |

2001 |

15.0 |

2009 |

10.0 |

2009 |

15.3 |

| Worst |

1970 |

-6.3 |

1970 |

-9.0 |

2000 |

-15.6 |

2002 |

-5.8 |

2000 |

-6.1 |

| April Weeks by % |

| Best |

4/11/75 |

5.7 |

4/20/00 |

5.8 |

4/12/01 |

14.0 |

4/20/00 |

5.9 |

4/3/09 |

6.3 |

| Worst |

4/14/00 |

-7.3 |

4/14/00 |

-10.5 |

4/14/00 |

-25.3 |

4/14/00 |

-11.2 |

4/14/00 |

-16.4 |

| April Days by % |

| Best |

4/5/01 |

4.2 |

4/5/01 |

4.4 |

4/5/01 |

8.9 |

4/5/01 |

4.6 |

4/9/09 |

5.9 |

| Worst |

4/14/00 |

-5.7 |

4/14/00 |

-5.8 |

4/14/00 |

-9.7 |

4/14/00 |

-6.0 |

4/14/00 |

-7.3 |

| First Trading Day of Expiration Week: 1990-2019 |

| #Up-#Down |

|

19-11 |

|

17-13 |

|

16-14 |

|

16-14 |

|

13-17 |

| Streak |

|

D1 |

|

D1 |

|

D1 |

|

D1 |

|

D1 |

| Avg

% |

|

0.32 |

|

0.26 |

|

0.22 |

|

0.25 |

|

0.05 |

| Options Expiration Day: 1990-2019 |

| #Up-#Down |

|

18-12 |

|

17-13 |

|

13-17 |

|

17-13 |

|

16-14 |

| Streak |

|

U1 |

|

U1 |

|

U1 |

|

U1 |

|

D3 |

| Avg

% |

|

0.11 |

|

0.04 |

|

-0.21 |

|

0.04 |

|

0.09 |

| Options Expiration Week: 1990-2019 |

| #Up-#Down |

|

24-6 |

|

20-10 |

|

19-11 |

|

20-10 |

|

21-9 |

| Streak |

|

U4 |

|

D1 |

|

U4 |

|

D1 |

|

D1 |

| Avg

% |

|

1.26 |

|

1.01 |

|

1.04 |

|

1.01 |

|

0.94 |

| Week After Options Expiration: 1990-2019 |

| #Up-#Down |

|

18-12 |

|

19-11 |

|

19-11 |

|

19-11 |

|

19-11 |

| Streak |

|

D2 |

|

U1 |

|

U1 |

|

U1 |

|

U1 |

| Avg

% |

|

0.17 |

|

0.32 |

|

0.67 |

|

0.33 |

|

0.78 |

| April 2020 Bullish Days: Data 1999-2019 |

| |

1,

2, 6, 15-17 |

1,

2, 6, 8, 17 |

1-3,

8, 13 |

1,

2, 6, 8, 17 |

2, 13, 16, 17 |

| |

21,

22, 27-29 |

20,

22, 29 |

17,

22, 29 |

20,

22, 29 |

22, 28 |

| April 2020 Bearish Days: Data 1999-2019 |

| |

30 |

30 |

7,

14 |

30 |

None |

| |

|

|

|

|

|

|

April 2020 Strategy Calendar

|

|

By:

Christopher Mistal

|

March 19, 2020

|

|

|

|

|

Coronavirus Ends Bull Market, New Bear Market Underway

|

|

By:

Christopher Mistal

|

March 12, 2020

|

|

|

|

After another disastrous day for the market, the second longest bull market since 1949 appears to have come to an end. DJIA’s worst single-day decline since 1987 today (–10.0%) expanded its decline to –28.3% from its February 12 closing high. From their closing highs on February 19, S&P 500 is currently down 26.7% and NASDAQ is off 26.6%. Small caps, measured by the Russell 2000 are down 35.5% from its all-time closing high set on August 31, 2018. The commonly used 20% decline definition of a bear market has been satisfied.

Not unlike many of the bear markets of the past, the current bear has manifested itself on sharply rising expectations of an economic recession due to the ever-widening impacts of the coronavirus. Whether or not a recession does follow is still an unknown. Central banks and governments could still take aggressive measures to head off or at a minimum possibly reduce the economic toll from the virus. Science could also arrive at a solution sooner than expected. Uncertainty is off the charts and the market is responding as such.

There are optimistic and pessimistic scenarios of all degrees. History suggests that someplace in the middle will be the actual outcome. With history as a guide we present a familiar table with S&P 500 bull and bear markets going back to 1948 with NBER recessions. Prior to now there have been eleven S&P 500 bear markets with an average duration of 407 calendar days and an average peak to trough decline of 33.1%. Three bear markets ended with declines of less than 25%. The shortest duration bear was 101 calendar days in 1987. Four bear markets did not have a corresponding recession.

![[S&P 500 Bull, Bear, Correction, Recession Table]](/UploadedImage/AIN_0420_20200312_SP500_bulls_bears_recessions_table.jpg)

Yes, this time is different, but not completely so. Uncertainty, fear and panic have gripped the nation and the market in the past. Painful lessons were learned then and new ones are likely to be taught now. Excesses in the past were resolved and are likely to resolve again. Stop losses in the Almanac Investor Sector Rotation ETF and Stock Portfolios have been triggered and market exposure has been reduced. Our Tactical Seasonal Switching Strategy is underwater now, but we will continue to hold these positions as a rebound or bounce remains likely. Past bear markets did have positive days, weeks and even months before they ended.

Stock Portfolio Update

In the time since last update through yesterday’s close the Almanac Investor Stock Portfolio declined 6.2% compared to an 18.9% decline by S&P 500 and a whopping 25.2% decline from the Russell 2000. Our Small-Cap portfolio which consisted mostly of Free Lunch stocks at the start of the year was cleaned out last update and was entirely in cash for the last four weeks. Mid-Caps declined 8.5% on average over the last four weeks. A sizable cash position helped buffer the decline. Large-Caps were the worst performing portion of the portfolio, off 12.7%. Losses were mitigated in the Large-Cap portfolio by defensive holdings that have remained since June 2018 as well as some strength from Regeneron (REGN) and ZTO Express (ZTO).

In the Mid-Cap portfolio, three positions were stopped out. South Jersey Industries (SJI), American Eagle (AEO) and Steelcase (SCS). All three positions were stopped out near the end of February. Algonquin Power (AQN) and One Gas (OGS) were stopped out today. In the next update AQN and OGS will be closed out. The last remaining position in the Mid-Cap portfolio, Pattern Energy (PEGI) is being acquired for $26.75 per share and the transaction is expected to close shortly.

A total of fourteen positions have been stopped out of the Large-Cap portfolio. Seven positions were closed out for a gain while seven were closed out at a loss. Aramark (ARMK) was the biggest loser, down 22% as it rapidly sank below its stop loss and failed to muster a meaningful rebound. On a less negative note, Qorvo (QRVO) was closed out for a 22.5% gain. Today, ABT, CHD, MDLZ, BRO, EXPD, NI, D, T and VZ were all stopped out. These positions will be closed out in the next update.

Remaining positions in the portfolio are currently on Hold. Please see table below suggested stop losses.

|

Perspectives on Waterfall Declines

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

March 10, 2020

|

|

|

|

Volatile market action over the several weeks warrants some much needed perspective into the history of these types of waterfall declines. Fortunately, we have this research on hand and have been examining the nature of deep, fast selloffs like we have experience here in early 2020 as well as the nature of the inevitable and often sharp recoveries.

First of all yes, this time is different – and yet it’s not. The headline causes of each of these historic waterfall declines are all different and yet investor, trader and money manager behavior remains rather similar. Fear has once again exposed the market’s overvaluation and weaknesses. This time it’s the fear of the coronavirus pandemic and price war in the oil market that spills over into the rest of the financial.

Like the previous occurrences of waterfall declines in the table and graphs below the market reacted to fear and sold off fast and hard. It’s too early to tell if this waterfall decline is over or how fast and far the recovery will be. As we continue to analyze the current situation a thorough review of the history of waterfall declines and their subsequent recoveries should provide some much needed perspective.

Most bear market bottoms since 1950 were preceded by precipitous declines. These plunges, or waterfall declines, ranging from 12-28% and 2-4 months in duration, were responsible for creating the feelings of outright fear, desperation and helplessness that so characterize investor sentiment at bear market bottoms. Remarkable however, is the fact that it only took 3-8 months for the rebound from those bottoms to reach the levels where the final declines began.

This phenomenon was first documented in December 1974 by our illustrious founder and resident sage, Yale Hirsch. In the January 1975 issue of this newsletter’s predecessor dated December 11, 1974, this discovery enabled Yale to accurately forecast a 38.5% rise in the Dow from December 1974 closing low of 577.60 to 800. The headline read “Dow 800 By April 1975” – one of Yale’s many bold, prescient and amazingly accurate forecasts.

Also astounding is how this pattern has recurred at practically every bear market bottom since. For this current study we have gone back a little further than Yale’s original work and examined every bear market since 1950. Two bear bottoms did not qualify as they did not meet our waterfall decline criteria and two were slightly off. The waterfall declines in August 2015 and December 2018 were not bear market bottoms. The rest fit the bill to a tee.

Exceptions to the Rule

The final drop to the 1982 bottom was not as severe as the others and ended the 16-year secular bear market that had ruled the market since 1966. Unemployment peaked at its post-WWII high of 10.8% and the snapback rally reclaimed the level of the final decline in eight days. The 1987 Crash, caused by a technical glitch at the New York Stock Exchange, created a 34.2% freefall in 17 days which took nearly 2 years to reclaim.

1957’s nascent decline may have been exacerbated by the passage of the Civil Rights Act of 1957 and the related racial standoff in Arkansas. The rebound here took ten months, somewhat longer than the others. AT&T’s breakup in January 1984 likely awoke the bear. The sideways action from February to the July 1984 bottom made this waterfall decline and rebound the exception. As mentioned above August 2015 and December 2018 were not bear market bottoms. All of the remaining 15 bear-market-bottom final waterfall declines were triggered by an exogenous event or major financial/economic calamity.

Cuba, USSR, Vietnam & Watergate

Cold war machinations spooked the market in 1960 when the USSR shot down a U.S. U-2 spy plane in Soviet territory in May and Castro seized U.S. oil refineries in June-July, which led to Cuban embargo, which largely remains in effect over 60 years later. JFK’s 1962 crack down on the steel industry in April sent Wall Street reeling. When the U.S. escalated military action in the Vietnam theater in 1966 by firing into Cambodia, bombing Hanoi and pumping up troop levels near half a million, the market blew up as well.

More trouble in Vietnam and swelling protests here in the States, culminating in the Kent State and Jackson State shootings, forced a bottom in May 1970. Nixon’s halt on the convertibility of gold and the implementation of wage and price controls tipped the scales in 1971 and helped push the market lower. Nixon’s resignation on August 9, 1974 set off the final plunge of the 1973-74 bear. An increase in Social Security taxes and minimum wage hike in late 1977 helped facilitate the last gasp of the 1976-78 bear.

With inflation sky-high in January 1980, President Carter imposed economic sanctions on the USSR in retaliation for the Soviet invasion of Afghanistan. The February 1980 attempt by the Hunt brothers to corner the silver market sent the stock market over the edge and then President Carter forced the U.S. boycott of the Moscow Summer Olympics in April.

Iraq, Long Term Capital, 9/11, Subprime Crisis & Debt Ceiling Debacle

With the junk bond debacle, the S&L crisis and the breakup of the Soviet Union in full swing, Iraq’s August 1990 invasion of Kuwait knocked the market into a tailspin. Over the backdrop of the Clinton-Lewinsky affair and President Clinton’s impeachment, a global financial crisis in the summer of 1998 forced the Russian ruble to collapse and noted hedge fund Long Term Capital to fail; creating the shortest bear market on record.

With the market on shaky ground in the summer of 2001, the terrorist attacks on September 11 closed the market for four days. When it reopened the following Monday, the Dow suffered its worst weekly loss since 1940. In 2002 corporate malfeasance, trouble in Afghanistan and Iraq War drums had stocks on the ropes. WorldCom failed in July and President Bush addressed the U.N. on the “grave and gathering danger” in Iraq in September.

In 2008 the subprime mortgage fiasco had completely morphed into a global financial crisis, the likes of which we have not experienced for decades and fear of depression loomed. Lehman was allowed to go belly up on September 15 after the government took over Fannie Mae and Freddie Mac and orchestrated the rescue of several large financial institutions and subsequent bailout of others.

Finally, on October 1, the U.S. Senate passed the $700 billion bailout bill. The Dow proceeded to plunge, falling for the first eight trading days of October in a row, suffering its worst weekly loss ever. DJIA initially hit bottom on November 20 at 7552.29 and rallied to close out 2008 but suffered a second waterfall decline before finally reaching bottom on March 9, 2009 at 6547.05.

In 2011 the European Union was mired in a sovereign debt crisis while here in the states, Congress was deadlocked and initially unable to come to terms over raising the U.S. debt limit. The U.S. lost its AAA credit rating, consumer and investor confidence fell and DJIA dropped 16.3% in 2.5 months from July to October.

History Is Our Only Guide

It is still too early to tell if the bottom is in yet. But from all the analysis we have done it appears that the bulk of the damage has been done. Yes we all remain concerned about this virus, yet health and government officials have become increasingly vigilant and the numbers are improving.

Our “Best Six Months” strategy has a 70-year track record and has worked over many timeframes and through crises, exogenous events and all types of markets. Our other seasonal and cyclical trading and investing strategies have also stood the test of time. So stick to the system, heed stop losses and remain rational.

|

ETF Portfolio Updates & New Trades in Utilities & Tech

|

|

By:

Christopher Mistal & Jeffrey A. Hirsch

|

March 05, 2020

|

|

|

|

Market volatility, large daily moves in both directions of 2-5% and huge intraday swings have taken a toll on markets and psyches. But step back for a moment and look at this chart. The February 28 low has held through this week’s wild swings. Interestingly, the February 28 lows found support right near one of our old support/resistance levels around 2875 on the S&P 500.

2875 is the level of the old January 2018 high. As you can see in the chart of the weekly bars here 2875 has been a level the S&P 500 has spent quite a bit of time at over the past 2 years. Resistance proved formidable at this level in 2018. After the late-August gap and September consolidation the market fell into a waterfall decline from this level in October 2018.

Then from April 2019 through October 2019 the S&P 500 traversed 2875 several times before leaving it behind in October, until now. It appears this is an important level once again. We will be keeping a close on eye on this level. It would be constructive if the market finds support here now at 2875 on the S&P 500.

ETF Trades

Featured in the Stock Trader’s Almanac 2020, on page 92, Sector Seasonality, there are two sectors that begin their seasonally favorable periods in March: High-Tech and Utilities. High-Tech has recently gotten much cheaper after surging to start of this year while Utilities have held their ground on safe-haven demand and falling interest rates.

Last year Utilities had a solid year, right alongside the broader market. Even though defensive in nature, the sector produced gains last year of over 25%, excluding dividends. Diving Treasury bond yields and an uncertain growth outlook as the coronavirus continues to permeate headlines is likely to support continued gains from the sector.

In the following weekly bar chart of the Utility Sector Index (UTY), seasonal strength (lower pane, shaded in yellow) typically begins following an early or mid-March bottom and usually lasts through early October although the bulk of the move is typically done sometime in late June or early July (blue arrow).

With over $13 billion in assets and ample average daily trading volume, SPDR Utilities (XLU) is a top choice to consider holding during Utilities seasonally favorable period. It has a gross expense ratio of just 0.13% and a relatively attractive yield of 2.78%. Top five holdings include: NextEra Energy, Duke Energy, Dominion Resources, Southern Co and American Electric Power Company.

XLU could be bought on dips below $67.20. This is around halfway between its projected monthly pivot point (blue-dashed line in daily bar chart below) and monthly resistance (red-dashed line). Based upon its 15-year average return of 7.3% (excluding dividends and trading fees) during its favorable period mid-March to the beginning of October, set an auto-sell price at $79.32. If purchased an initial stop loss of $60.48 is suggested.

![[SPDR Utilities (XLU) Daily Bar Chart]](/UploadedImage/AIN_0420_20200305_XLU.jpg)

Technology has had its fair share of struggles recently, but it had also enjoyed the greatest gains before the current market correction commenced. Technology has given back some of those gains, but it is still holding onto approximately half of its advance since our Seasonal MACD Buy in October of last year. Our favorite ETF to trade High-Tech’s seasonal strength from mid-March through the beginning of July is iShares DJ US Tech (IYW). Our existing position was stopped out on February 27 and closed out for a 6.4% gain. IYW can be considered on dips below 228.50. If purchased an initial stop loss at 205.65 is suggested and should above average gains materialize take profits at the auto-sell price of 267.69.

Sector Rotation Update

Early February gains quickly became losses as fear and uncertainty sunk stocks during the last week of the month. As a result of the fastest correction from new all-time highs, numerous positions in the Sector Rotation Portfolio have been stopped out. Technology related positions fared the best as they had generally enjoyed the greatest gains prior to the correction. IYW, SOXX and XLK were stopped out for modest single-digits gains.

Other sectors were not as fortunate. Energy related positions that were re-entered in early February were also quickly stopped out. Materials, Industrials, Financials, Consumer Discretionary and Transports were also stopped out. Losses range from a mild 2.4% by IYT to a tough 11.8% by COPX.

Two bright areas in the portfolio during the current correction are GLD and IBB. GLD is rallying on safe haven demand and falling interest rates. IBB has held up in hope and/or expectations that someone within the sector could be first to market with a viable vaccine.

Other than today’s new trade ideas in Utilities and High Tech, all other remaining positions in the Sector Rotation ETF Portfolio are currently on Hold.

Tactical Switching Strategy Update

After plunging the last week of February, the market has gone into a rollercoaster pattern of up-down, up-down so far this week. On a positive note, the lows traded on the last day of February have held and some progress has been made this week. All of the volatility makes it difficult to see but some recovery has happened even after today’s decline.

All positions in the Tactical Seasonal Switching Strategy Portfolio are on Hold.