|

Market at a Glance 5/28/2015

|

|

By:

Christopher Mistal

|

May 28, 2015

|

|

|

|

5/27/2015: Dow 18162.99 | S&P 2123.48 | NASDAQ 5106.59 | Russell 2K 1254.36 | NYSE 11143.35 | Value Line Arith 4864.53

Psychological: Confused. There is plenty of bullish sentiment and not a lot of bears.

Investor’s Intelligence latest survey reported bull advisors at 48.5% and bearish advisors at 14.9%. S&P 500 is above 2120 and flirting with new all-time highs, but bond yields have fallen since mid-May signaling some flight to safety is happening. Low trading volumes and volatility suggest that traders and investors are uncertain if recent market strength is for real or just another fake out.

Fundamental: Tepid. Recent economic data is pointing to the strong possibility that 2015 Q1 GDP will be negative and the outlook for growth is suggesting another year around 2% GDP for the U.S. Weak growth however has not translated into major trouble for the job market yet. It is likely to impact corporate earnings which are now forecast to be flat to negative in Q2.

Technical: Range bound. Although the DJIA, S&P 500 and NASDAQ have been able to extend the top end of their respective trading ranges with modest new all-time highs, a meaningful and lasting breakout has yet to materialize. Stochastic, MACD and relative strength indicators all reached overbought levels in mid-May and have since eased to essentially neutral. A brisk market pullback, to the 200-day moving averages or lower, would actually be welcome as it would likely clear the path higher. Current 200-day moving averages are around DJIA 17560, S&P 500 2040 and NASDAQ 4740.

Monetary: 0-0.25%. There was no FOMC meeting in May, so we will all have to wait until June 17 for the next clue as to when rates may begin to normalize. Based upon recent data and Fed minutes from their April meeting, any rate increase is likely to be later rather than sooner. A modest bump in inflation (likely due to energy’s bounce) is not likely to trigger a rate increase. The Fed is likely waiting for several consecutive months of across the board positive economic data. Not the mixed readings we continue to see. For now, all that have access can continue to enjoy virtually free money.

Seasonal: Bearish. June is the last month of NASDAQ’s “Best Eight Months.” NASDAQ’s Seasonal MACD Sell signal can occur as soon as June 1. In pre-election years since 1950, June ranks no better than mid-pack. Recent pre-election year Junes in 2011 and 2007 were troublesome for the market as DJIA, S&P 500, NASDAQ and Russell 2000 all declined.

|

June Outlook: Caution Ahead – End of NASDAQ’s Best 8 Months

|

|

By:

By Jeffrey A. Hirsch & Christopher Mistal

|

May 28, 2015

|

|

|

|

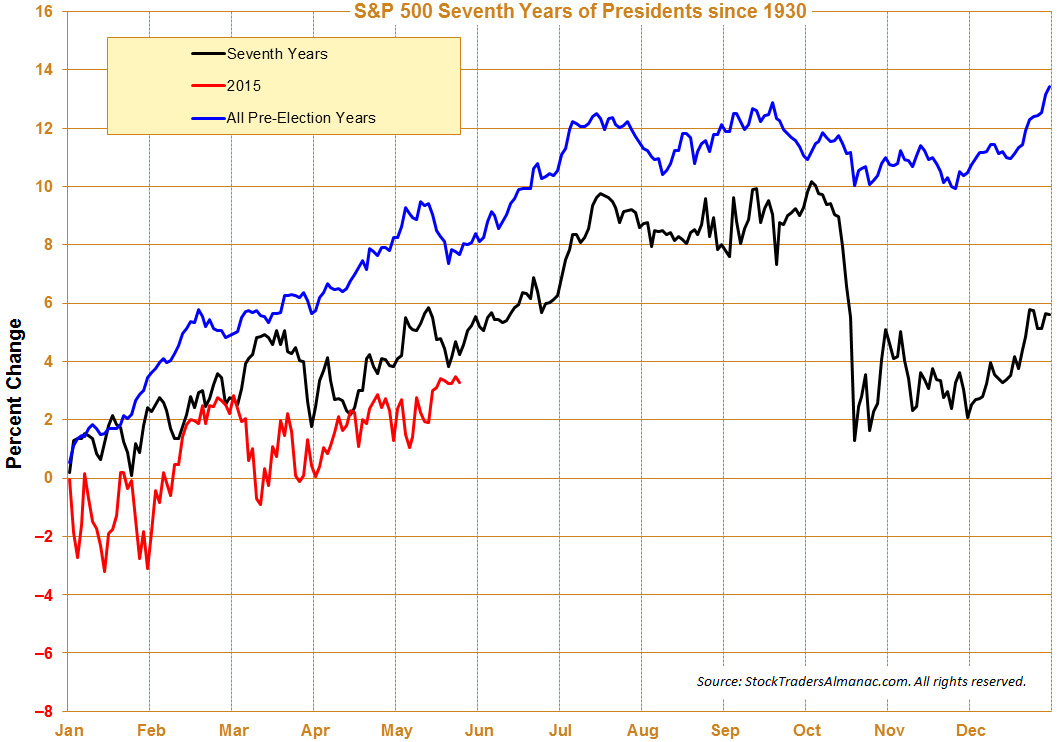

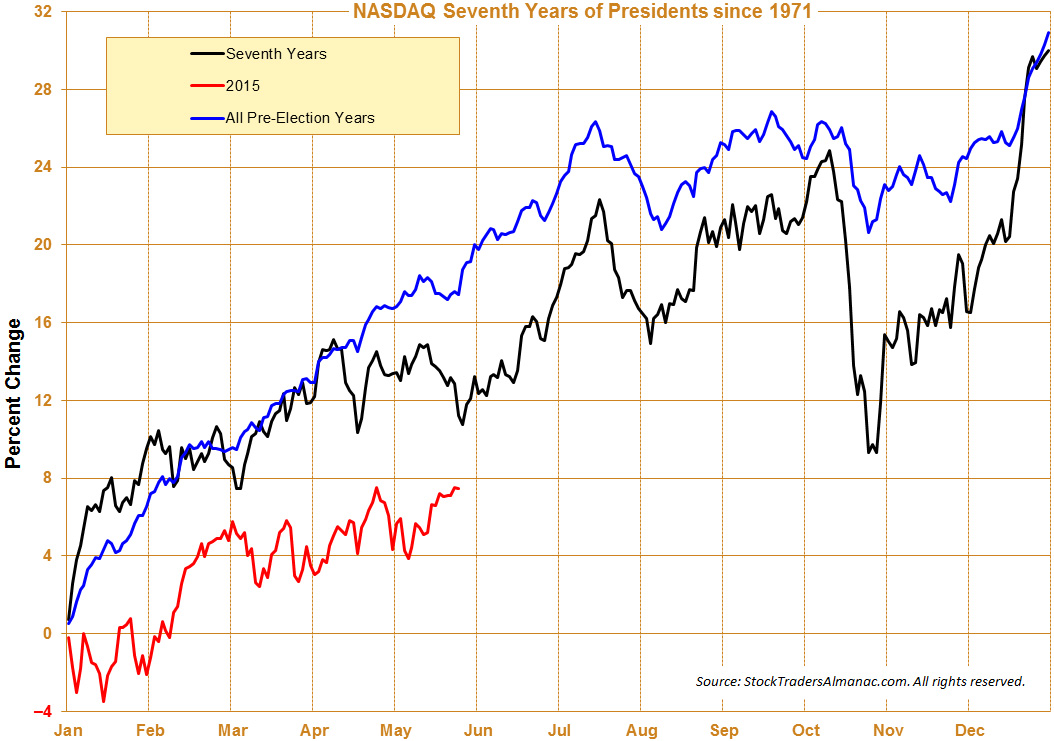

Stocks have not sold off in May this year and that of course has brought out the naysayers who are still not convinced of the validity, efficacy and value of market seasonality, cycles and recurring patterns. While the market is having a rather impressive May, stocks have made little headway this spring. As you can see in the graphs NASDAQ is the leader up 1% from its March high. S&P comes in a weak second, up 0.2% from the early March high. DJIA is off almost 1% and the Russell 2000 is lagging, down more than 1%. It’s not surprising that the NAS is leading heading into June, which is the last of NASDAQ’s Best 8 Months.

May’s gains have many thinking this means that “Sell in May” or the Worst Six Months as we call it are not to be feared. Not so fast. Yesterday on the blog we showed that S&P 500 gains

less than 1% June-October on average following gains in pre-election year Mays since 1950. That is certainly a mouthful, but the point is just because May is up, it does not mean that the Worst Six Months will be great. In the modern, post-WWII era from 1950 to present, the odds are nearly 50/50 that June through October will produce an average gain of just 0.87% this year. (See the blog for more details.)

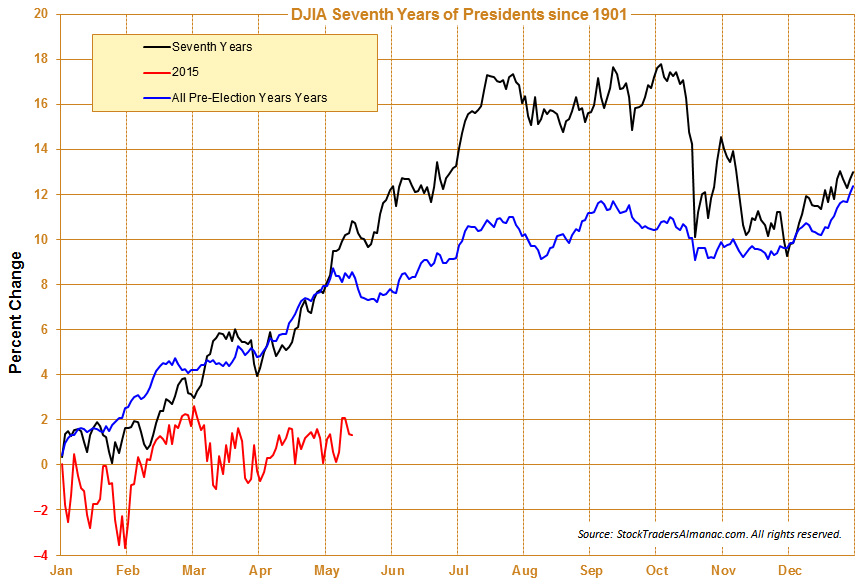

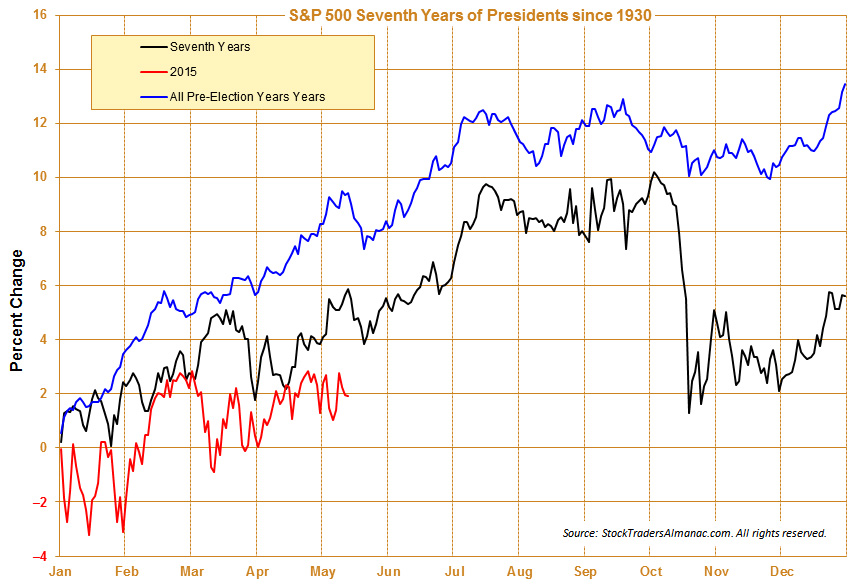

Even with May’s DJIA gain of about 1.8% at yesterday’s close it is still lagging the typical pre-election year as well as the typically weaker 7th year of presidential terms – the second pre-election year of a two-term president. As many of you have chimed in on this phenomenon and appear to be tracking this with us we have updated the graph. As has been the case for the year so far, DJIA remains behind the historical average pre-election year pattern. Market-leading

NASDAQ lags even further behind.

This lagging performance supports our other analysis that the market is getting more prone to a correction some time during the Worst Six Months. Whether we pullback in June or later in the typical August-October dry patch remains to be seen. We may leak higher, but further upside is becoming less likely and harder to come by. The Greek sovereign debt saga and the big headwind from Fed’s highly-anticipated first rate hike since June 2006, plus mixed economic data and seasonal forces are like to catalyze a market pullback. We do not expect anything sinister, but the long-averted 10% correction, give or take a few percentage points is quite likely.

As we enter June keep a few things in mind. While June improves in pre-election years the last two, 2007 and 2011, were down across the board. However, the first trading has been rather strong. Gains have been scant for the rest of the month until the last few days when NASDAQ and Russell 2000 perk up and begin to outperform as we hit the end of their Best 8 Months. Be mindful of the week after Triple- Witching, the week of the June 22-26. It has been nasty with Dow losses in 22 of the last 25 years with average losses of 1.1%.

When we issue our Best 8 Months Seasonal MACD Sell Signal, which can occur June 1 or later, we will sell or tighten stops on any remaining related positions and adjust our defense. Stick to the game plan over the weaker summer months as the market looks toppy. It’s just fine to sit in some cash while we await the next fatter pitch. Continue to limit new longs and weed out underperformers. Consider some of the downside protection and short ideas in the ETF Portfolios.

Pulse of the Market

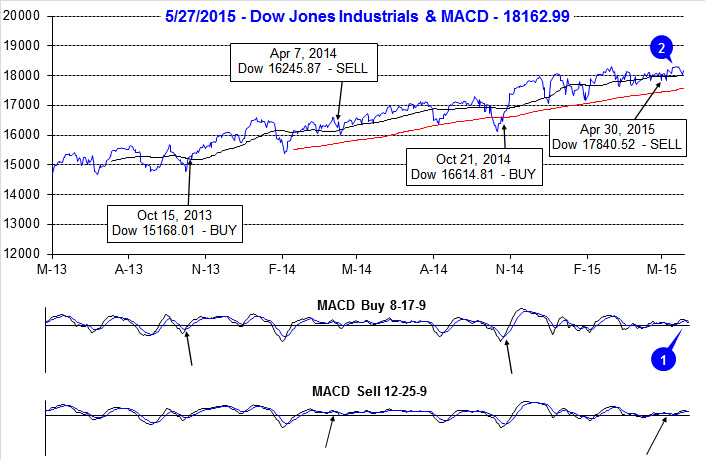

Since issuing our Seasonal MACD Sell signal for DJIA and S&P 500 on the close on April 30, the market has made a meager attempt at breaking out of its trading range. DJIA’s modest bounce higher did result in new all-time highs, just a few handfuls of points higher than its March highs (2). The bounce was accompanied by an improvement in both the faster and slower moving MACD indicators, but now that momentum has faded, both MACD indicators are now negative again (1).

After advancing two weeks in a row, DJIA came under pressure the week before Memorial Day. Selling the day before the three-day weekend was then followed by even heavier selling on Tuesday, triggering the third Down Friday/Down Monday (DF/DM) warning of 2015 (3). DJIA did bounce and recover some of the decline on Wednesday, but weakness has returned. Recent DF/DM occurrences have been followed by relatively mild declines of 2-4% magnitude. This week’s DF/DM coming so soon after new all-times highs could deviate from this pattern. For starters, the Fed is no longer aggressively supporting the market and second, past DF/DM’s near tops proved to be a major inflection point that eventually lead to a meaningful decline sometime during the following 90 calendars days.

S&P 500 has been the best index over the past eight weeks with just two weekly losses (4) compared to three for DJIA and four for NASDAQ (5). DJIA, S&P 500 and NASDAQ are trying to get back in sync like they were earlier in the year however; the Russell 2000, Transport and Utility indices are all still struggling. Absent broad participation, the most recent breakout attempt will most likely end up failing.

Further signs of a divergent and confused overall market can be seen in the number of NYSE Weekly Advancers and Decliners (6). Last week’s gains by S&P 500 and NASDAQ were accomplished with a greater number of declining stocks than advancing. Those gains are suspect. Further compounding concerns is the meager number of New NYSE Highs (7) and the sudden jump in New NYSE Lows. A healthy market advance would have major indices moving higher, together, more Weekly Advancers than Decliners and a more robust number of New Highs.

A potential buying opportunity appears to unfolding in some corporate bonds. Mainly Moody’s AAA bonds (8) as the recent squirt higher by stocks has sent their yield back above 4%. At 4.07%, this is the highest reading since last September and likely has some Fed rate hike fear already build into it.

Click for larger graphic…

|

June Almanac: Last Two Pre-Election Year Junes have been Losers

|

|

By:

By Jeffrey A. Hirsch & Christopher Mistal

|

May 26, 2015

|

|

|

|

June has shone brighter on NASDAQ stocks over the last 44 years as a rule, ranking sixth with a 0.8% average gain, up 25 of 44 years. This contributes to NASDAQ’s “Best Eight Months” which ends in June. June ranks near the bottom on the Dow Jones Industrials just above September since 1950 with an average loss of 0.3%. S&P 500 performs poorly as well, ranking tenth, but essentially flat (–0.002% average). Small caps also tend to fare well in June. Russell 2000 has averaged 0.6% in the month since 1979.

In pre-election years since 1950, June ranks no better than mid-pack. June is the #8 DJIA month in pre-election years averaging a 1.0% gain with a record of nine advances in sixteen years. For S&P 500, June is #5 with an average gain of 1.4% (10-6 record). Pre-election year June ranks #6 for NASDAQ and #7 for Russell 2000 with average gains of 2.3% and 1.4% respectively. Recent pre-election year Junes in 2011 and 2007 were troublesome for the market as DJIA, S&P 500, NASDAQ and Russell 2000 all declined.

The second Triple Witching Week of the year brings on some volatile trading with losses frequently exceeding gains. On Monday of Triple-Witching Week the Dow has been down ten of the last eighteen years. Triple-Witching Friday is better, up nine of the last twelve years, but weaker over the past 22 years, up thirteen, down nine with an average loss of 0.2%. Full-week performance is choppy as well, littered with greater than 1% moves in both directions. The weeks after Triple-Witching Day are horrendous. This week has experienced Dow losses in 22 of the last 25 years with average losses of 1.1%. NASDAQ and Russell 2000 have fared better during the week after, up four years in a row and five of the last six.

June’s first trading day is the Dow’s best day of the month, up 20 of the last 27 years. Gains are sparse throughout the remainder of the month until the last three days when NASDAQ and Russell 2000 stocks begin to exhibit strength. The last day of the second quarter is a bit of a paradox as the Dow has been down 17 of the last 24 while NASDAQ and Russell 2000 have nearly the opposite record, although, since 2003 technology and small-caps indices have been dragged down by their large-cap brethren.

| June (1950-2014) |

| |

DJI |

SP500 |

NASDAQ |

Russell

1K |

Russell 2K |

| Rank |

|

11 |

|

10 |

|

7 |

|

10 |

|

8 |

| #

Up |

|

30 |

|

34 |

|

25 |

|

21 |

|

22 |

| #

Down |

|

35 |

|

31 |

|

19 |

|

15 |

|

14 |

| Average

% |

|

-0.3 |

|

-0.002 |

|

0.8 |

|

0.2 |

|

0.6 |

| 4-Year Presidential Election Cycle Performance

by % |

| Post-Election |

|

-1.2 |

|

-0.7 |

|

0.5 |

|

0.1 |

|

0.9 |

| Mid-Term |

|

-1.7 |

|

-1.9 |

|

-1.6 |

|

-1.4 |

|

-1.6 |

| Pre-Election |

|

1.0 |

|

1.4 |

|

2.3 |

|

1.4 |

|

1.4 |

| Election |

|

0.9 |

|

1.4 |

|

1.9 |

|

0.8 |

|

1.6 |

| Best & Worst June by % |

| Best |

1955 |

6.2 |

1955 |

8.2 |

2000 |

16.6 |

1999 |

5.1 |

2000 |

8.6 |

| Worst |

2008 |

-10.2 |

2008 |

-8.6 |

2002 |

-9.4 |

2008 |

-8.5 |

2010 |

-7.9 |

| June Weeks by % |

| Best |

6/7/74 |

6.4 |

6/2/00 |

7.2 |

6/2/00 |

19.0 |

6/2/00 |

8.0 |

6/2/00 |

12.2 |

| Worst |

6/30/50 |

-6.8 |

6/30/50 |

-7.6 |

6/15/01 |

-8.4 |

6/15/01 |

-4.2 |

6/9/06 |

-4.9 |

| June Days by % |

| Best |

6/28/62 |

3.8 |

6/28/62 |

3.4 |

6/2/00 |

6.4 |

6/10/10 |

3.0 |

6/2/00 |

4.2 |

| Worst |

6/26/50 |

-4.7 |

6/26/50 |

-5.4 |

6/29/10 |

-3.9 |

6/4/10 |

-3.5 |

6/4/10 |

-5.0 |

| First Trading Day of Expiration Week: 1990-2014 |

| #Up-#Down |

|

14-11 |

|

15-10 |

|

11-14 |

|

13-12 |

|

11-14 |

| Streak |

|

U2 |

|

U2 |

|

U2 |

|

U2 |

|

U2 |

| Avg

% |

|

-0.04 |

|

-0.1 |

|

-0.3 |

|

-0.1 |

|

-0.4 |

| Options Expiration Day: 1990-2014 |

| #Up-#Down |

|

16-9 |

|

17-8 |

|

14-11 |

|

16-9 |

|

16-9 |

| Streak |

|

U5 |

|

U6 |

|

U1 |

|

U6 |

|

U6 |

| Avg

% |

|

-0.2 |

|

-0.1 |

|

0.01 |

|

-0.1 |

|

0.04 |

| Options Expiration Week: 1990-2014 |

| #Up-#Down |

|

15-10 |

|

14-11 |

|

11-14 |

|

12-13 |

|

12-13 |

| Streak |

|

U1 |

|

U1 |

|

U1 |

|

U1 |

|

U1 |

| Avg

% |

|

-0.04 |

|

0.01 |

|

-0.3 |

|

-0.1 |

|

-0.2 |

| Week After Options Expiration: 1990-2014 |

| #Up-#Down |

|

3-22 |

|

7-18 |

|

12-13 |

|

8-17 |

|

11-14 |

| Streak |

|

D1 |

|

D1 |

|

U4 |

|

D1 |

|

U4 |

| Avg

% |

|

-1.1 |

|

-0.7 |

|

-0.2 |

|

-0.7 |

|

-0.5 |

| June 2015 Bullish Days: Data 1994-2014 |

| |

1,

5, 12, 15 |

1,

2, 12, 15, 29 |

2,

12, 15, 17, 26 |

2,

12, 15, 29 |

4, 12, 15, 26 |

| |

|

|

29,

30 |

|

29, 30 |

| June 2015 Bearish Days: Data 1994-2014 |

| |

9,

19, 23, 24, 30 |

23,

24, 25, 30 |

22,

23, 24 |

5,

9, 23, 24, 25 |

8, 9, 22, 23, 24 |

| |

|

|

|

|

|

|

June 2015 Strategy Calendar

|

|

By:

Christopher Mistal

|

May 26, 2015

|

|

|

|

|

Long live Sell in May

|

|

By:

By Jeffrey A. Hirsch

|

May 21, 2015

|

|

|

|

One of the first tactical and strategic maneuvers Yale Hirsch made upon completion of the first Stock Trader’s Almanac in the summer of 1967 was to hire a salesman to go door-to-door on Wall Street to all the brokerage firms and wire houses to introduce them to this tour de force. So while Jimi Hendrix shrouded the airwaves and the Monterey Pop Festival with Purple Haze and the Beatles rocked the music landscape with groundbreaking concept albums and took the world on a Magical Mystery Tour of love, peace and controversy, Yale’s Almanac salesman pounded the pavement of lower Manhattan during the Summer of Love, turning the investment world on to the efficacy and validity of market patterns, seasonality and cycles and Yale’s brilliant creation, The Stock Trader’s Almanac. The rest, especially in our case, is history.

Decades later in 1999 Joe Childrey, at the time a branch manager for A.G. Edwards in La Jolla, California was heading out on a long-planned African safari vacation. Departing from his office and having left his reading material at home, he grabbed the Stock Trader’s Almanac that had been sitting on his desk and conference table annually for years – a gift from his boss, the late Ben Edwards, a wise man Joe respected very much. While Joe had perused it and shared it with clients, he had never really delved deep into the Almanac.

Gains in 2008

Traveling for two weeks with nothing to read but the Almanac, Joe came back a changed man and a converted market pattern devotee. Upon his return he began to trade his own account using the Best Six Months/Worst Six Months Switching Strategy with a solid degree of success. In 2007 Joe went out on his own and founded Probabilities Fund, LP. This private investment partnership went live on January 1, 2008 and outperformed the S&P in 2008. While the S&P 500 lost 37.0%, including dividends, during the worst bear market in a generation in 2008, the partnership gained 5.3% net of management fees and other expenses, including the effect of the hedge fund performance fee.

After five more years of continued success Joe was compelled to make the strategy available to more people, especially registered investment advisors and their clients and individual investors. In 2013 the strategy became available to retail investors in a public format under the Investment Company Act of 1940, following the same strategy used to manage the hedge fund. Probabilities Fund Management LLC also began to run the strategy on a variety of variable insurance trusts and other programs as well as for individual clients.

Rules-Based, Data-Driven

Probabilities Fund Management LLC utilizes a rules based, systematic approach to attempt to capitalize on repeating cyclical, seasonal, political and other long-term historical patterns in the S&P 500 Index. They seek to identify periods when the S&P 500 is estimated to have the highest and lowest probabilities of capital appreciation to identify market entry and exit points. This dynamic methodology utilizes strategic rules and tactical signals.

Strategic rules create a calendar blueprint from historical trends and patterns that define the daily biases, either, bullish, bearish or neutral. Daily biases are updated annually as each new year incorporates the previous years’ trends and patterns. These strategic rules include:

• Presidential election cycles

• Historical “Best Six Months”

• Historical “Worst Six Months”

• Monthly market patterns

• Quarterly market patterns

• Institutional fund flow patterns

Tactical signals are generated from technical or political event driven decisions used to dial up or down the exposure and predetermined entries and exits. Tactical signals include:

• Technical Momentum Indicators

• Pre-Fed Announcement Drift

• Congress in or out of session

• International markets relative to domestic markets

• Special Congressional Sessions

In 2015, I joined the Probabilities Fund Management LLC team as a consultant to the firm and an Investment Committee Member. I will be working them to refine, hone and improve upon the rules and signals where possible and assist in developing a new Tactical Sector Rotation Strategy for mutual funds, ETFs and separately managed accounts based on much of the seasonal sector work we do.

Probabilities Fund Management LLC’s strategy is geared to compliment any well-thought-out diversified portfolio. It may serve as a diversifier for traditional and alternative portfolios. With a low correlation to the S&P 500 Index it can act as a separate asset class, providing non-correlated alpha.

|

Stock Portfolio Updates: Tighten Some Stops and Cut Underperforming Positions

|

|

By:

Christopher Mistal

|

May 19, 2015

|

|

|

|

One of the six basic tenets of Dow Theory states that market averages must confirm each other. When major indices diverge, it is a potential warning sign. DJIA and S&P 500 have broken out to new all-time highs once again this year, mostly on tepid economic data and the rather low bar set for first quarter earnings. NASDAQ and Russell 2000 recently reached new all-time highs, but are not yet participating in the breakout by DJIA and S&P 500. This lack of support from techs and small-caps is worrisome. When the Transports (DJTA) and Utility (DJUA) indices are added to the mix, the broader picture is even more concerning.

![[DJ Indices Chart]](/UploadedImage/AIN_0615_20150519_DJIA_compare.jpg)

In the above chart, DJIA, DJTA and DJUA have been plotted since last October’s market bottom. All three major indices moved in relative unison from mid-October through the end of last year. In January, DJIA and DJTA both struggled while DJUA average soared on to new highs on hopes of zero interest rate policy lasting even longer. DJIA and DJTA rebounded in February while DJUA crumbled and since the end of February DJUA has gone nowhere, the DJTA has drifted lower as energy moved higher while DJIA moved sideways and finally on to new highs.

Although timing is rarely perfect, the duration of time that DJTA and DJUA has languished is becoming significant. This week’s new highs by DJIA and S&P 500 are not likely to last long without the support of tech, small caps, utilities and/or the transports.

Stock Portfolio Updates

Over the past five and a half weeks since last update, through the market’s close on May 18, S&P 500 climbed 2.3%. However, Russell 2000 was down 0.4% over the same time period. Collectively the three Almanac Investor Stock Portfolios advanced 1.0% while 57% of the portfolio is in cash. Our Large-Cap portfolio performed best, nearly matching the S&P 500 by gaining 2.2%. The Mid-Cap portfolio was second best up with a 1.7% gain. Our Small-Cap stocks did outperform the Russell 2000 by climbing 0.6%.

Repligen (RGEN), tied for longest holding in the portfolio, was responsible for the bulk of the Small-Cap portfolio’s gain. RGEN is now up a whopping 375.3% since presentation, adjusted for the automatic sale of half the original position when it first doubled. RGEN’s near 36% jump since last update was due to a first quarter earnings homerun. Revenues, earning and margins were all solid, but the icing on the earnings cake came when management raised its guidance for full-year revenues, earnings and margins. Share performance says it all as this upbeat earnings report was obviously well-received.

Insteel Industries (IIIN), Park-Ohio Holdings (PKOH) and Rocky Mountain Chocolate Factory (RMCF) had a tough past five weeks. All suffered declines. PKOH was the worst swinging from a gain of 6.4% last month to being stopped out and sold for a 5% loss on April 30 when it closed below its stop loss. IIIN’s was down last month and weakness persists. RMCF was a trade based upon declining cocoa price at the start of March. Cocoa has since bottomed and is at a multi-month high. As part of our “Worst Six Months” strategy of selling weak or under-performing stocks, Sell IIIN and RMCF. IIIN will be closed out of the portfolio using today’s closing price. RMCF is up nearly 3% as I write this sentence and can be sold into any strength at or above $13.40.

Our Mid-Cap portfolio’s four holding are looking solid. JetBlue (JBLU) just missed doubling on May 13 and is currently showing a gain of 76.3% on the two-thirds position that remains. The laggard of the group is Group 1 Automotive (GPI) up just 33.4% since February 2014. All stocks in the Mid-Cap portfolio are on Hold.

In the Large-Cap portfolio, all but two stocks are on firm ground. Polaris Industries (PII) seemed to be poised for a rebound last month, but the rebound did not materialize. A late-April “death cross” (50-day moving average crossing below the 200-day moving average) is the final blow to this position. Sell PII. For tracking purposes, PII will be closed out of the portfolio using today’s closing price. Avis Budget Group (CAR) is the second struggling position. Its current bounce is looking like it will be short-lived and will make a great exit. Sell CAR. This position will also be closed out using today’s closing price.

The “Best Six Months” for DJIA and S&P 500 have officially ended. NASDAQ and Russell 2000 seasonal strength can last until June. All other positions, not specifically mentioned above, are on Hold. See table below for updated Stop Losses.

Disclosure Note: At press time, officers of the Hirsch Organization, or the accounts they control, held a position in UNH.

|

Mid-Month Update: Market Still Trying to Breakout

|

|

By:

Christopher Mistal

|

May 14, 2015

|

|

|

|

Once again this pre-election year, the market is making a run at new all-time highs. Today, DJIA threatened its March 2 closing high of 18288.63 while S&P 500 closed a few points above its April 24 high of 2117.69. But for all the attempts this year, no breakout has stuck. At yesterday’s close DJIA was up just 1.3% year-to-date and S&P 500 was a little better at 1.9%. This performance is well below the average pre-election year performance. Typically, by mid-May of a pre-election year, DJIA and S&P 500 would be showing gains of approximately 9%.

Some of this year’s laggard performance is likely due to the above-average performance of post-election-year 2013 and midterm-year 2014. Sluggish Q1 growth, perhaps due to harsh winter weather, has weighed on corporate earnings causing valuations to drift away from neutral toward a bit rich. “Sell in May” seasonality is also a headwind as many traders and investors are reluctant to put new money to work at the start of a seasonally weak period, especially with the market struggling to breakout. Considering the time the market has been stuck in a range, the direction of the move out is likely to be course of the market for summer and early fall.

Valuation at a Premium

According to

S&P Capital IQ, first quarter 2015 earnings have beaten the low bar that existed at the end of March. Q1 estimates are now showing EPS growth of 2.9% compared to the expected 3% decline from a few months above. However, due to a large expected decline in energy sector earnings, Q2 2014 earnings estimates are now predicting a 4% decline. Based upon a S&P 500 close of 2100, S&P Capital IQ calculates the S&P 500 (at 21.1x) is currently trading at a whopping 33% premium to the median of 15.9x earnings since 1936 using the S&P 500’s P/E on trailing GAAP EPS. This may not be the highest premium on record, but it certainly yet another reason to hold off on new buying. Equities are no longer cheap.

Bullish Sentiment Eases

Following early month market weakness,

Investor’s Intelligence Advisory sentiment survey did show a decline in % bullish advisors from 52.5% to 47.5%, but % bearish advisors are still tiny at just 15.8%. This leaves the difference between the two at a still worrisome 31.7%. Sentiment suggests now is not a great opportunity for establishing new long positions.

The combination of deteriorating seasonality, still frothy sentiment and a rather tepid Q2 earnings outlook is not positive for the market. The unofficial start of summer, Memorial Day weekend, is just a week away. Trimming long exposure and moving to the sidelines (or to a more defensive posture) remains the best course of action now and the market is providing ample opportunity to exit near all-time highs.

|

Early Four-Year Cycle Gains Borrow From Future

|

|

By:

Christopher Mistal

|

May 12, 2015

|

|

|

|

In the time since issuing our

Seasonal MACD Sell Signal on April 30, the market has struggled to make any meaningful headway. S&P 500 and DJIA made a brief run at new all-time highs, but came up short as they ran into projected monthly resistance (red dashed line in charts below). NASDAQ also bounced, but has had an even tougher time, now down over 100 points since its all-time closing high on April 24. The range the market has been stuck in for the better part of this year only continues to compress.

Although DJIA, S&P 500 and NASDAQ have repeatedly fallen below their respective 50-day moving averages, they have all remained firmly above their 200-day moving averages. A decisive move by two or more of the indices below their 200-day moving average would likely be viewed negatively by the bulls and celebrated by the few bears that currently exist.

Stochastic, relative strength and MACD indicators (excluding DJIA as its MACD buy and sell indicators are meagerly positive) are neutral or negative. This earnings season has failed to move the market. All eyes must be on the Fed, awaiting further clues as to when they will finally begin to normalize (raise) interest rates. After an unprecedented run of near zero interest rates, there are bound to be a least a few disruptions. Many are anticipated, but inevitably there will be a few surprises as well, more likely negative than positive. Don’t expect the market to respond well to negative surprises.

Borrowed Returns

The four-year-presidential election cycle, is perhaps one of the most well-known historical cyclical patterns, which has stood the test of time. Going back to 1833, there have been 45 complete 4-year cycles, excluding the current one. Over these 180 years, DJIA preformed best in pre-election years with an average gain of 10.4%, second best in election years gaining an average 5.8% and worst in post-election years gaining just 1.9%.

Since the end of the Great Recession bear market in 2009, DJIA has been up six years straight with sizable above average gains in post-election years 2009 and 2013. DJIA also racked up above average gains in each of the two most recent midterm years, seemingly defying the four-year pattern. Before jumping to any hasty conclusions, let’s take a closer look at history.

Including the cycle that began in 2009, there have been nine cycles in history in which both the post-election and midterm years outperformed their respective averages (shaded light brown in table above). The cycle beginning in 1997 came at the tail end of the dot-com boom and was followed by a bust and the reassertion of the 4-year cycle. Back in 1985, the last secular bull market was just gaining steam, but got ahead of itself in 1987. Truman (1949) enjoyed four straight years of gains at the start of the post-World War II secular bull market. FDR’s first term also brought four straight years of gains, but this was following the Great Depression. Harding (1921) was also well received during his first two years in office but following his death in pre-election year 1923, DJIA struggled. McKinley, Cleveland and Grant also enjoyed solid gains during their post and midterm-year elections, but ultimately DJIA either cooled off or declined in the subsequent pre-election or election year.

The four-year presidential election cycle has been disrupted by economic boom and gloom, but inevitably it has managed to reassert itself. Following the solid gains of the most recent post-election and midterm years, some weakness or underperformance this pre-election year is not without precedent. The streak of no losing DJIA pre-election years since 1939 is likely to continue, it just maybe with below average returns.

|

Seasonal Sector Trades: Silver’s Slide Usually Lasts until Late June

|

|

By:

By Christopher Mistal & Jeffrey A. Hirsch

|

May 07, 2015

|

|

|

|

Silver has a strong tendency to peak or continue lower in May, bottoming in mid to late June. Traders can look to sell silver on or about May 14 and maintain a short position until on or about June 25. In the past 42 years this trade has seen declines 28 times for a success rate of 66.7%. Prior to last year, this trade had been successful for eight years in a row. Even last year’s trade was potentially profitable as silver did decline until early June. In the second chart below, the 43-year historic average seasonal price tendency of silver as well as the decline typically seen from the high in February until the low is posted in late June into early July. This May silver short trade captures the tail end of silver’s weak seasonal period (shaded yellow).

![[May Short Silver Futures Contract – Trade History]](/UploadedImage/AIN_0615_20150507_SI_History.jpg)

![[Silver Continuous Contract Daily Bar Chart & 1-Yr Seasonal Pattern]](/UploadedImage/AIN_0615_20150507_SI_Seasonal.jpg)

Back on

February 10 we executed a trade on silver’s longer-term seasonal slump (February through June) using

ProShares UltraShort Silver (ZSL). More nimble traders likely performed much better than the 0.5% gain that was realized in the ETF Portfolio. Silver shed nearly $2 per ounce from mid-February through early March before sharply rebounding at the end of March. During silver’s decline then, ZSL went from under $100 per share to over $120 before quickly falling back under $100. It was on the slide down that ZSL was stopped out of the ETF Portfolio.

![[ProShares UltraShort Silver (ZSL) Daily Bar Chart]](/UploadedImage/AIN_0615_20150507_ZSL.jpg)

ZSL generally corresponds to two times the inverse of the daily performance of silver. However, ZSL is not tracking spot silver price, rather it is tracking the U.S. dollar price for delivery in London. Nonetheless, ZSL has a solid history of rising when silver price declines. ZSL could be bought on dips below $100.00. If purchased, an initial stop loss of $92.00 is suggested. If ZSL then rises and closes above $105 switch to a 5% trailing stop loss. Use ZSL’s daily close to update its stop loss. This trade will be tracked in the Almanac Investor ETF Portfolio.

|

ETF Trades: Four New Short Ideas for May

|

|

By:

Christopher Mistal

|

May 05, 2015

|

|

|

|

Last Thursday, we issued our

Seasonal MACD Sell Signal for DJIA and S&P 500. NASDAQ’s Best Eight Months lasts until June. From our October 21, 2014

Seasonal MACD Buy Signal through last Thursday’s sell signal DJIA and S&P 500 both gained 7.4% in 191 calendar days. DJIA gained only 7.5% in all of 2014, this result is additional proof that the market does make the bulk of its gains in the six months from November through April.

Full-time traders may not find this return all that impressive, but the history of steady consist returns with less volatility does add up to an impressive result in a retirement account. It also comes with the added benefit of being able to enjoy the summer without fretting over the markets every twist and turn. Updated tables comparing our Best Months Switching Strategy can be found

here. NASDAQ’s return for its current “Best Eight Months” through yesterday’s close was 13.5%.

May Sector Seasonalities

With the end of the “Best Six Months” come a slew of long sector seasonalities that also end in May: Banking, Cyclical, Healthcare, Materials, Real Estate and Transports. With the exception of Healthcare related positions, corresponding ETFs were closed out of the ETF Portfolio using closing prices from the day when we issued our Seasonal MACD Sell Signal. SPDR Retail (XRT) was also closed out. The average gain on these positions was 5.4% in the portfolio. However, if you heeded the sell advice you likely got a better price during last Friday’s market rally, possibly as much as another percent on all the positions.

Four sectors begin seasonally weak periods in May: Banking, Cyclical, Gold & Silver (stocks) and Materials. Over the past five years Cyclical and Materials have managed to eke out minor gains, on average, however, over the past 15 years, all four sectors have declined on average 6.6 to 8.0% which sets them up as good short trade candidates during the summer and early fall months.

Typically we like to take advantage of sector weakness through the use of inverse or bearish sectors. By doing so, the trade is similar to any other long trade that we choose to execute. One of the drawbacks of inverse ETFs is they frequently employ leverage and only track the daily performance of the underlying benchmark. As holding periods get longer, these types of funds often exhibit performance that differs significantly than expected due to compounding and tracking error. Three out of today’s four new trade ideas are going to be short trades. An “(S)” follows each ETF name in the Portfolio Table to denote it is a short trade. Only in the case of Gold & Silver will we use a leveraged inverse fund as its seasonally weak period is only about six weeks long.

![[SPDR Financial (XLF) Daily Bar Chart]](/UploadedImage/AIN_0615_20150505_XLF.jpg)

SPDR Financial (XLF) could be shorted at $24.80 as it is currently struggling to break through projected monthly resistance (red dashed line). Look for a corresponding MACD Sell signal accompanied by a rollover of its Stochastic and relative strength indicators. Should XLF suddenly breakdown, and not reach $24.80, short it at $23.85 as it will have broken support. Set an initial stop loss at $25.50 and take profits at $20.53.

iShares DJ Transports (IYT) could be shorted on a rally toward resistance near $158.84 or on a break down below $152.02. Stochastic, MACD and relative strength are all currently weak. IYT could easily bounce or just fall apart. Watch crude oil’s price for an early indication of which way it may be. The initial stop loss is $167.80 while profits can be taken at $133.52.

Direxion Daily Jr Gold Miners Bear 3X (JDST) can be bought on dips below $7.25. JDST is volatile due to its 3x leverage and traded as low as $7.04 on April 29 to a high of $8.71 on May 1. Odds are it will flirt with or trade below our buy limit before its next move. Set a stop loss at $6.31 and considering taking profits on any pop above $8.61.

SPDR Materials (XLB) could be shorted on a rally back toward resistance near $51.50 or on a break down through support right around $49.01. After a solid rally from late March till now, it’s Stochastic, MACD and relative strength indicators are beginning to turn as a result of recent weakness. A stop loss at $52.20 is suggested and profits can be taken at $42.78.

ETF Portfolio Updates

Now that the “Best Six Months” for DJIA and S&P 500 have officially come to an end, we are shifting the portfolio toward an overall market neutral stance. Continue to Hold long positions associated with the NASDAQ’s “Best Eight Months” while considering some defensive bond and bearish ETF (HDGE) positions. We will consider a more defensive posture when NASDAQ’s favorable period ends or sooner should the market begin to unravel in earnest.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in UNG, USO, XLU and XLV.