|

Market at a Glance - 10/27/2022

|

|

By:

Christopher Mistal

|

October 27, 2022

|

|

|

|

10/27/2022: Dow 32033.28 | S&P 3807.30 | NASDAQ 10792.67 | Russell 2K 1806.32 | NYSE 14569.90 | Value Line Arith 8356.46

Seasonal: Bullish. November is the 1st month of the “Best Six/Eight Months,” and the 1st month of the best three consecutive months November through January. Midterm November is also the 1st month of the best six consecutive month period and the Sweet Spot of the four-year cycle. #2 DJIA, S&P 500 and NASDAQ month of the year. NASDAQ’s best month in midterm years, averaging 3.5%.

Fundamental: Mixed? After declining in two consecutive quarters, GDP rebounded in Q3 to a better than expected 2.6% annualized pace. Unemployment data remains reasonably firm with an official unemployment rate of 3.5%, but labor participation is still below pre-pandemic levels. Inflation remains persistently high even as signs continue to point towards easing sometime in the future. Corporate earnings expectations are slipping, and the stubbornly strong dollar remains a drag on multi-national companies.

Technical: New Bull Market? DJIA, S&P 500 and NASDAQ all closed below their respective June lows in late September or in October. October has logged the most bear market bottoms or major turning points. Russell 2000 did not close below its June low. Major indexes have bounced off their recent lows and appear to be looking forward to the end of the Fed’s rate tightening cycle. DJIA has reclaimed it 50-day moving average. S&P 500 and NASDAQ have not. MACD indicators remain bullish. Further gains will be needed to truly confirm a new bull market.

Monetary: 3.00 – 3.25%. In less than a week, the Fed is widely expected to push its rate range higher by another 0.75% to 3.75% – 4.00%. They will also likely re-affirm their tough-on-inflation stance as official metrics have failed to make a meaningful move lower yet. However, based upon their forecasts last updated in September they are also likely to signal a slower pace of hikes going forward. Should this happen, the market is likely to respond favorably.

Sentiment: Neutral. According to

Investor’s Intelligence Advisors Sentiment survey Bullish advisors stand at 36.9%. Correction advisors are at 24.6% while Bearish advisors numbered 38.5% as of their October 26 release. This reading marked the sixth straight week that bears outnumbered bulls. Over the last three weeks, the number of bulls has been climbing slowly as bears and correction advisors declined. Historically, periods when bears outnumbered bulls have been relatively low risk periods for accumulation.

|

November Outlook: Welcome to the Sweet Spot

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

October 27, 2022

|

|

|

|

The jury is still out on whether October has killed another bear market. But with the Dow up 11.5% so far in October 2022, it is on pace to record its best October performance ever going back to 1901. While many analysts, technicians and pundits continue their deliberations we lean toward the case that we have entered a new bull market – at least for the near term. Sure, we have concerns and recognize the many headwinds the market faces, but perhaps this is the beginning of that proverbial “Wall of Worry” nascent bull markets climb.

All year long our seasonal and cycle analysis combined with all the indicators we track got us out early and kept us out through the bulk of the bear market until earlier this month when we issued our Best Six Months Seasonal MACD Buy Signal on October 4. At the time we were concerned that the MACD trigger came a bit early on those first two strong days of October, but the market backed and filled over the next couple of weeks providing ample opportunities to establish the new long positions we put out.

What concerns us most is that the Fed will remain too aggressive too long like they were too accommodative and easy for too long. And then there is inflation. If inflation doesn’t begin to show signs of meaningfully retreating here in the U.S. soon that will force the Fed to get tighter and continue the rate hike cycle longer and it will hit Main Street, the economy, and Wall Street harder.

The last few CPI inflation readings topped expectations and disappointed the market. However, CPI has decelerated over the past three readings from a peak at 9.0% to 8.5%, 8.2% and 8.2%. Still painfully high for everyone but starting to ease. And the effects of the higher rates are only just beginning to have an impact on inflation.

We would not be surprised for the Fed to provide some pivot or pause language at their next FOMC meeting on November 2. After they announce another 75-basis point increase it is increasing likely they will telegraph smaller hikes at the next two meetings and then a pause. With everyone expecting inflation to remain stubbornly high the November 10 CPI is poised to surprise The Street with a continuation of the trend lower, which would positively impact the market. Of course, by that time the midterm elections will be over, and that uncertainty gone.

Anecdotally, Jeff was at an event last night at the New York Stock Exchange for Bob Pisani’s Shut Up and Keep Talking book launch. (It looks like a fun read, and it was great to chat with so many smart Wall Street folks.) But what struck him was this overwhelming bearish sentiment, almost nonchalant that no way is the bottom in and that we have not seen the despondent selling and despair associated with bear market lows. That’s when his contrary antennae start to purr. And besides, NASDAQ, the FAANG stocks and big tech have gotten creamed already this year.

On top of the seasonal and 4-year cycle bullishness we are encouraged by today’s positive GDP number, improving market internals, some developing technical support as well as a decent earnings season despite some big tech misses and disappointments. Perhaps it’s high time for some new market leadership and a new acronym to replace the FAANGs.

We are also encouraged by the Russell 2000. Technically all the other major U.S. indices took out their June lows. But the R2K held above it. Back in November 2021 the Russell 2000 was the first to top out then the first to reach bear market status and now during a historically weak spot for the small cap index, in October, it illustrated strength and looks like it found support around 1640 and has been rallying since. The Dow’s recent leadership is also encouraging.

For this rally to have real legs and materialize into a true cyclical bull market, we will need to see some combination of a change in trend in inflation, interest rates and/or the U.S. dollar. For now, the Best Six Months are upon us, and it looks like October has killed another midterm bear market, so we stick to the system, honor the buy limits and stops and keep a close eye on the indicators, the Fed and how the market reacts. We would not be surprised by another selloff either before yearend or early next year, though this time we expect a higher low.

Best Six-Month Period of All-Time Starts Now

We will leave you with this amazing statistic. We have been clamoring all year about the Sweet Spot of the 4-Year Cycle and how the midterm year is a bottom picker’s paradise and recently how the Best Six Months that begin in the midterm year are the best of the 4 years. We took it one step further.

We ran all the rolling six-month periods back to 1945 for DJIA and S&P 500 broken out into each of the 4 years of the cycle. As we suspected the data shows that the six-month period beginning in November of the midterm year has produced the best performance of them all. It is also worth noting that the Sweet Spot of the 4-year cycle from Q4 midterm year to Q2 pre-election contains all the top six-month periods.

Pulse of the Market

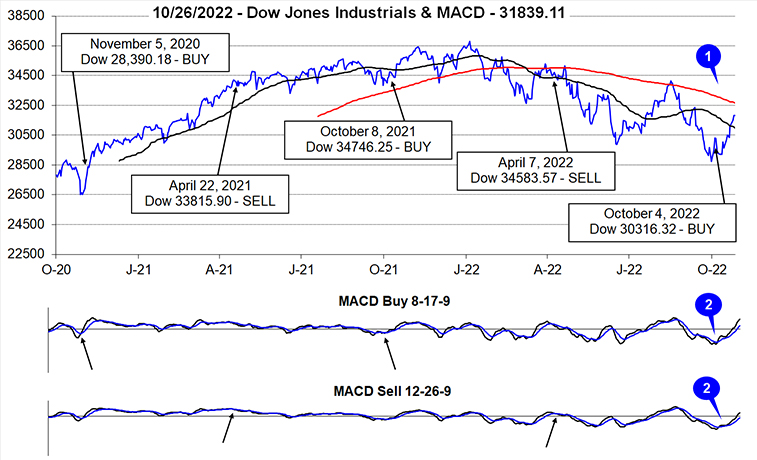

DJIA has lived up to its historical midterm October reputation thus far with only two full trading days remaining. Volatility has persisted throughout the month with historically sizable daily swings, but the cumulative result has been well above average gains by DJIA. As of the close on October 27, DJIA was up 11.5% for the month compared to its historical average gain of 2.6% in midterm Octobers since 1950. The current rally has lifted DJIA back above its 50-day moving average (1), but it will need to overcome resistance at its 200-day moving average for the rally to continue.

Back-to-back daily gains exceeding 2.5% on the first and second trading days of the month were sufficient to turn the faster and slower moving MACD indicators (2) positive when the market closed on October 4. With confirming MACD Buy indications from S&P 500 and NASDAQ we issued our annual Seasonal MACD Buy signal via email on that day. From their respective closes on October 4 through October 27 close, DJIA was up 5.7%, S&P 500 was up 0.4% while NASDAQ was down 3.4%. Collectively the trio is up an average of 0.9%.

DJIA’s most recent Down Friday/Down Monday (DF/DM) in early October (3) was the fourteenth of this year. That occurrence came at the end of a weekly losing streak where DJIA, S&P 500 (4) and NASDAQ (5) were all down in six out of seven weeks. A similar situation occurred back in June just prior to that month’s lows and an above average summer rally ensued. October’s DF/DM may have marked a significant turning point in sentiment and was possibly an early sign pointing to the end of the bear market.

NYSE Weekly Advancers and Weekly Decliners (6) have been consistent with the market’s overall moves. Weekly Decliners easily outnumbered Weekly Advancers during down weeks while the opposite was true in advancing weeks. Participation in last week’s (week ending October 21) advance was reasonably broad, but the ratio of Advancers to Decliners was less than 2 to 1. This hints that skepticism remains elevated, and buyers are being selective. Should the rally continue to gain momentum it would not be surprising to see it accelerate further as “fear of missing out” kicks in.

Weekly New Highs (7) have climbed back above 100 for the first time since August. New Weekly Lows have also been cut in half since the last week of September. This is also encouraging, but much more progress is still needed. Ideally a continuing trend of increasing New Weekly Highs and steadily declining New Weekly Lows is what fuels sustained rallies.

Treasury yields (8) continued to climber higher during the last four weeks. The 90-day Treasury rate has climbed to its highest level since October 2007. At the opposite end of the yield curve, the 30-year Treasury has climbed above 4% for the first time since July 2011. The brisk rise in rates this year is influencing the economy, most notably in the housing market where mortgage rates have risen to over 7%. However, most of the impact of higher rates does appear to be priced into the market already.

|

November Almanac: DJIA & S&P 500 Second Best Month in Midterm Years

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

October 20, 2022

|

|

|

|

November maintains its status among the top performing months as fourth-quarter cash inflows from institutions drive November to lead the best consecutive three-month span November-January. However, the month has taken hits during bear markets and November 2000, down –22.9% (undecided election and a nascent bear), was NASDAQ’s second worst month on record—only October 1987 was worse.

November begins the “Best Six Months” for the DJIA and S&P 500, and the “Best Eight Months” for NASDAQ. Small caps come into favor during November, but don’t really take off until the last two weeks of the year. November is the number-two DJIA, S&P 500 (since 1950), and NASDAQ (since 1971) month. November is best for Russell 1000 (since 1979) and Russell 2000 (since 1979). Average performance in all year ranges from 1.7% from DJIA and S&P 500 to a solid 2.3% by Russell 2000.

In midterm years, November’s market prowess is relatively unchanged. DJIA has advanced in 14 of the last 18 midterm years since 1950 with an average gain of 2.5%. S&P 500 has also been up in 14 of the past 18 midterm years, gaining on average 2.6%. Small caps perform well with Russell 2000 climbing in 7 of the past 10 midterm years, averaging 3.3%. The only real blemish in the November midterm-year record is 1974 (DJIA –7.0%, the final DJIA bear market bottom was in December).

![[Midterm Year November Performance Table]](/UploadedImage/AIN_1122_20221020_Midterm_November_mini_table.jpg)

Options expiration often coincides with the week before Thanksgiving. DJIA posted ten straight gains 1993-2002 and has been up 19 of the last 29 weeks before Thanksgiving but has been down the last five. The Monday of expiration week has been streaky, but the net result since 1994 is 17 DJIA gains in 28 years with 12 advances occurring in the last 18 years. Options expiration day has a bullish bias, up 14 of the last 20. The week after expiration has been a mixed bag recently. DJIA has been up six of the last ten after being down five of six from 2006 to 2011.

![[Recent 21-Year November Seasonal Pattern Chart]](/UploadedImage/AIN_1122_20221020_November_2022_Seasonal.jpg)

Being a bullish month November has seven bullish days based upon S&P 500, with four occurring on the first four trading days of the month. Although historically a bullish month, November does have weak points. NASDAQ and Russell 2000 exhibit the greatest strength at the beginning and end of November. Russell 2000 is notably bearish on the 12th trading day of the month; the small-cap benchmark has risen just ten times in the last 38 years (since 1984). The Russell 2000’s average decline is 0.35% on the day. Recent weakness around Thanksgiving has shifted DJIA and S&P 500 strength to mirror that of NASDAQ and Russell 2000 with the majority of bullish days at the beginning and end of the month. The best way to trade Thanksgiving is to go long into weakness the week before the holiday and exit into strength just before or after.

|

November 2022 Strategy Calendar

|

|

By:

Christopher Mistal

|

October 20, 2022

|

|

|

|

|

Market Outlook Update: More Bears End in October Than Any Other Month

|

|

By:

Jeffrey A. Hirsch

|

October 13, 2022

|

|

|

|

Since our Best Six Months Seasonal MACD Buy Signal on October 4, stocks declined for six straight days coming into today’s reversal. While this is disconcerting, it is important to remember that our Best Months + MACD Timing system and strategy are not designed to pick exact bottoms and tops. Frankly, we don’t know of any market timing system that can do that consistently.

But what it is designed to do, and has done over the past seven decades, is to capture the bulk of the market’s rallies and avoid the bulk of the market’s downturns. It’s not perfect, but this year it began to get us out of harm’s way in early April. Nevertheless, it is important to remember to invest and trade within your own individual risk/return profile, to be diversified and nimble during these volatile times.

Whether today’s snapback rally marks the bear market’s low or we find bottom over the next few weeks, Octoberphobia has surely delivered. The fact that October has delivered its usual hazards and wild swings is encouraging. The seasonal patterns and 4-year cycle patterns we have been tracking and reporting on will likely continue to play out according to historical trends. This would culminate in a bear market low sometime near the end of October.

Wherever the ultimate low ends up, by our analysis the end of the bear market is nigh. The market has been down substantially this year, while we have been mostly in cash and on the sidelines. October has been the best month to buy stocks. It is a notorious bear-killer. I will leave you will leave with these two points: More bears have ended in October than any other month and the Best Six Months starting in November of Midterm years are up 18-0 since 1950.

Not all indices have bottomed on the same day for all bear markets, but the lion’s share, or bear’s share I should say, bottomed in October. Of the 23 bear markets since WWII 8 have bottomed in October for DJIA and 7 for S&P 500, 6 for NASDAQ, significantly more than any other month. Over all three indices, 7 were in midterm Octobers: 1946, 1960, 1966, 1974, 1990, 1998 & 2002.

DJIA October bottoms: 1946, 1957, 1960, 1966, 1987, 1990, 2002 & 2011. S&P October bottoms: 1957, 1960, 1966, 1974, 1990, 2002 & 2011. NASDAQ October bottoms: 1974, 1987, 1990, 1998, 2002 & 2011. The month with the next largest amount of bear market lows is March with 4 for S&P 500 – mostly recently in 2009 and 2020, previously in 1978 & 1980.

Since 1950 the Best Six Months has its best performance from November of the Midterm year to April of the Pre-Election year, by a factor of three. And none of the other years of the 4-year cycle had zero losses.

December and February have been the weak spots with January and April leading the charge. From the October close to the April close BSM beginning in Midterm years gains 15.2% on average, up 18 down 0. Post-Election BSM: Average 3.1%, 11-8. Pre-Election BSM 4.6, 13-5. Election BSM: 5.3%, 14-4. Adding in the MACD timing indicator only improves the results slightly.

Stick to our buy limits and honor the stop losses. By this time next year, the Fed will likely be done hiking rates, inflation will likely be coming down and the market is likely to be considerably higher.

|

October Stock Basket & Stock Portfolio Update: Handful of New Ideas

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

October 13, 2022

|

|

|

|

We present this basket to take advantage of the “Best Months” of the year (November through April/June) for stocks. We will look to add these 11 stocks, in the table below, near current levels or on minor dips. Many of the positions did jump today and could just as quickly retreat or consolidate tomorrow. We will allocate a hypothetical $2000 from the cash position in the Stock Portfolio to each position. For each stock we have provided the ticker, name, sector, general business description, PE, price-to-sales ratio, market value and a suggested buy limit and stop loss.

These 11 stocks all have reasonably solid valuations, plus revenue and earnings growth. Most also exhibit positive price and volume action as well as other constructive technical and chart pattern indications. The group of 11 is heavily connected to the energy sector. For this basket we elected to focus on revenue growth and stocks that have outperformed the S&P 500 over the last six months. Stocks selected today are a mix of small caps ranging from $50 million to $1 billion in market cap, mid-caps in the $1 to 5 billion range, and a single large cap pick over $5 billion.

To arrive at this list, we first sifted through the entire universe of U.S. traded stocks for those with a market cap of at least $50 million and average daily volume of 20,000 shares or more on average over the past twenty trading sessions. Then we winnowed the list down to only those stocks with relatively low price-to-sales and price-to-earnings ratios with a few exceptions. A special nod was given to stocks with a below average number of analysts following them. Revenue growth and outperformance relative to the S&P 500 over the past six months were also key considerations.

We then dug into numerous individual company charts and historical earnings reports before settling on these final 11 stocks. Our underlying theme was to find reasonably priced stocks that appear to be quietly growing sales while flying somewhat under the radar with only a limited number on The Street paying close attention to them. As market cap goes higher, this becomes increasingly challenging, and a history of earnings surprises and trend of future estimates becomes even more important.

At the end of the screening process, we were left with an outsized number of companies in the energy sector. We did not search specifically for top-performing stocks within any specific sector, this just happens to be what remained after our process. Once earnings season gets rolling in earnest, we anticipate another, possibly larger basket of stocks. Late-October and November has historically been a good time to buy small-cap and technology stocks.

Stock Portfolio Updates

Over the last five weeks since last update through yesterday’s close, S&P 500 retreated 10.7% while Russell 2000 fell 8.6%. Over the same time period the entire stock portfolio slipped 1.8% lower, excluding dividends and any fees. The portfolio’s cash balance has climbed to nearly 94% of the total hypothetical value. As it has done for much of this year, this cash has mitigated the impacts of broad market declines.

When the major indexes took out June’s lows, damage was widespread with four of the seven remaining positions closing before their respective stop losses. Atlantic Union Bankshares (AUB), Black Hills (BKH), Southern Company (SO), and Canadian Pacific Railway (CP) have all been closed out of the portfolio. Of these four only CP recorded a minor loss.

Of the three remaining positions, AT&T (T) is the single position in the red. T did bounce higher today with the broader market which is encouraging. T also paid it quarterly dividend earlier this month. We will continue to hold T in anticipation of an eventual turn around.

Even after recent weakness, Amdocs (DOX) and MGP Ingredients (MGPI) are still positive year-to-date. DOX and MGPI are on Hold.

Positions in the above stock basket will be added to the portfolio table in the next update.

|

ETF Trades: October Seasonal Sector ETF Long Basket

|

|

By:

Christopher Mistal

|

October 06, 2022

|

|

|

|

Each year while preparing the annual Almanac, we revisit and re-analyze our sector seasonalities (STA 2022 pages 94, 96 and 98) in depth in order to adjust for any new or developing trends. There have been a few minor revisions made to our Sector Seasonalities table in recent years, but for the most part, sector seasonality has been reasonably on track with many sectors producing the bulk of their annual gains during their traditionally favorable periods. Years of sector research allows us to specify whether the seasonality starts or finishes in the beginning third (B), middle third (M) or last third (E) of the month based upon the number of trading days in the month.

The soon-to-be available 2023 Almanac table follows. Both long and short trade opportunities are researched and the most statistically viable appear below. Because indexes are not directly tradable, highly correlated exchange-traded funds (ETFs) are chosen to execute trades. Performance over the last 5-, 10- and 25-year time periods is included. We prefer to focus on the 25-year average performance as this period has sufficient data to be seasonally significant.

![[Stock Trader’s Almanac 2023 Sector Seasonality Table]](/UploadedImage/AIN_1122_20221006_Sector_Seasonality_Table.jpg)

These entry and exit points will be the basis for our seasonal trades over the coming year. They are guidelines, as we generally look to enter new positions before the start of the favorable period and exit before its end. Occasionally a trade is closed out well in advance of the seasonality’s end. An outsized advance may trigger a trade at the suggested auto-sell price (a price target based upon past historical performance of the specific seasonality plus an additional percentage) or should strength fail to materialize, a stop loss could be reached.

There are thirteen sector seasonalities that enter their favorable periods in October. The following trade ideas are made based upon these seasonalities. Currently, all buy limits (the suggested maximum to pay for a share) are near current market levels as the market appears to be consolidating early October gains that triggered our

Seasonal MACD Buy signal on Tuesday. Market volatility, measured by VIX, remains elevated. This has been taken into consideration when determining the suggested stop losses in an effort to avoid being whipsawed out of a position.

Trades for October Sector Seasonalities

Transports enter their historically favorable season at the beginning of October and it runs until May. iShares DJ Transports (IYT) is attractive near current levels with a buy limit of $210.68. The suggested stop loss is $183.82 and auto sell is $272.54. Top 5 holdings are: Union Pacific, United Parcel Service, CSX, Old Dominion Freight, and Uber. With nearly 70% of U.S GDP coming from consumers, seasonal strength in the consumer sector overlaps nicely with the transportation sector.

![[iShares DJ Transports (IYT) Chart]](/UploadedImage/AIN_1122_20221006_IYT.jpg)

Over the last 25 years, Telecom has generated an average return of 7.6% during its bullish seasonality from the middle of October through around yearend. The top ETF within this sector is iShares DJ US Telecom (IYZ). Use a buy limit of $22.31 and stop loss of $19.47. If above average gains materialize, take profits at the auto sell of $28.81. Top 5 holdings are: Cisco Systems, Verizon, Comcast, AT&T, and T-Mobile. Aggressive competition and slowing growth has hindered the sector, but IYZ does boast a 12-month trailing yield of 2.78% as of August 31.

![[iShares DJ US Telecom (IYZ) Chart]](/UploadedImage/AIN_1122_20221006_IYZ.jpg)

Semiconductors come into favor near October’s end and remain so until the beginning of December. This trade has averaged 14.5% and 13.7% gains over the last 25- and 5-year periods, respectively. iShares Semiconductor (SOXX) is the top selection. Establish new positions with a buy limit of $351.52 and utilize a stop loss of $306.70. Take profits at the auto sell of $482.99. Top 5 holdings are: Texas Instruments, Broadcom, Nvidia, Qualcomm, and Advanced Micro Devices. These are the companies that design and supply the brains for the bulk of our favorite electronic devices: smart watches, smart phones, PCs, tablets, cameras, drones, refrigerators, air conditioners basically you name it. Persistent shortages of some semiconductors have only reinforced how important and significant the sector has become. Prior to going long, the short position in SOXX will be covered (see below in Updates).

![[iShares PHLX Semiconductor (SOXX) Chart]](/UploadedImage/AIN_1122_20221006_SOXX.jpg)

Although consumer spending is spilt into two distinct sectors, Discretionary and Staples, their favorable seasons run concurrently from the beginning of October to the beginning of June in the following year. Over the past 25-years Discretionary has an average gain of 16.5% and Staples 9.6%. SPDR Consumer Discretionary (XLY) and SPDR Consumer Staples (XLP) are the preferred vehicles to execute these trades. XLY can be considered below $148.17. An initial stop loss of $129.28 and an auto-sell at $207.14 are suggested. XLY Top 5 holdings are: Amazon.com, Tesla, Home Depot, McDonald’s, and Lowe’s Companies. XLP could be purchased below $69.20. Our suggested stop loss is $60.37 and use an auto-sell of $91.01. XLP Top 5 holdings are: Procter & Gamble, Pepsi, Coca-Cola, Costco Wholesale, and Walmart.

![[SPDR Consumer Discretionary (XLY) Chart]](/UploadedImage/AIN_1122_20221006_XLY.jpg)

![[SPDR Consumer Staples (XLP) Chart]](/UploadedImage/AIN_1122_20221006_XLP.jpg)

The line between Broker/Dealer and Banking sectors is somewhat blurry with each sector averaging gains of 15.7% and 19.3% over the last 5 years, respectively. Instead of trading two smaller, somewhat less liquid ETFs, SPDR Financial (XLF) appears to be the better choice. Use a buy limit of $32.41 and a stop loss of $28.28 once a position has been entered. The auto sell is $45.00. Its holdings cover all things financial from insurance companies to stock exchanges. Top 5 holdings are: Berkshire Hathaway, JPMorgan Chase, Bank of America, Wells Fargo, and Charles Schwab. As long as the jobs market remains reasonably firm, profits for these two sectors are likely to hold up.

![[SPDR Financial (XLF) Chart]](/UploadedImage/AIN_1122_20221006_XLF.jpg)

Another area exhibiting a reasonable amount of overlap is the Healthcare and Pharmaceutical sectors, at least as far as many ETFs are concerned. Healthcare has racked up a 7.7% average return over the past five years while Pharmaceutical alone has been 7.1%. SPDR Health Care (XLV) does an excellent job of representing both sectors and comes with the added bonus of holding several well-established biotechnology companies as well. XLV is attractive around current levels with a buy limit of $128.16. The stop loss is $111.82, and the auto sell is $169.94. Top five holdings are: UnitedHealth Group, Johnson & Johnson, Eli Lilly, AbbVie, and Pfizer.

![[SPDR Health Care (XLV) Chart]](/UploadedImage/AIN_1122_20221006_XLV.jpg)

Industrials have a favorable period that runs from the end of October through the middle of May with historical returns averaging 12.7% over the last 25-year period. Buy SPDR Industrials (XLI) with a buy limit of $88.71. Once purchased, set a stop loss of $77.40 and an auto sell of $119.97. Top 5 holdings are: Raytheon Technologies, Union Pacific, United Parcel Service, Honeywell, and Boeing.

Materials have a favorable period that runs from the beginning of October through the beginning of May with historical returns of 15.7% over the last 25-year period. Buy SPDR Materials (XLB) with a buy limit of $72.70. Once purchased, set a stop loss of $63.43 and an auto sell of $100.94. Top 5 holdings are: Linde, Air Products & Chemicals, Sherman-Williams, Corteva, and Freeport-McMoRan.

Computer Tech comes into favor in early October and remains so until the beginning of January. This trade has averaged 14.1% and 11.1% gains over the last 25- and 5-year periods, respectively. SPDR Technology (XLK) is the top selection. Enter this trade with a buy limit of $128.16 and employ a stop loss of $111.91. Take profits at the auto sell of $175.61. Top 5 holdings are: Apple, Microsoft, NVIDIA, Visa, and Mastercard. Apple and Microsoft combined account for 45.79% of total assets as of the October 5 close.

Real Estate has seen returns of 10.9% over the last 25 years from the end of October to the beginning of May. Vanguard REIT (VNQ) is our choice. Use a buy limit of $82.44 and a stop loss of $71.93 once a position has been entered. The auto sell is $109.71. Top 5 holdings are: Vanguard Real Estate II Index fund, American Tower, Prologis, Crown Castle International, and Equinix.

Sector Rotation ETF Portfolio Updates

During September’s slump, SPDR Biotech (XBI) dipped below its buy limit and additional shares were added to the existing position on September 22. XBI’s purchase price has been adjusted for the additional shares added at a lower price. As a reminder, XBI is a long-term holding. XBI can still be considered on dips below its buy limit.

iShares NASDAQ Biotech (IBB) did not trade below its suggested buy limit since last update. As a result of our Seasonal MACD Buy Signal on October 4, IBB’s suggested buy limit, stop loss and auto-sell have been adjusted. IBB can be considered at current levels up to its new buy limit of $123.00.

Broad weakness in September pushed iShares US Technology (IYW) below its stop loss on September 23. With the arrival of the Sweet Spot of the four-year cycle, a new position in IYW can be considered near current price up to a buy limit of $79.34. If purchased, the suggested stop loss is $69.22, and the auto-sell price is $106.53.

Seasonal weakness in Semiconductors has historically ended in October. Cover the short trade in SOXX. For tracking purposes, SOXX will be covered using its average price on October 7.

Seasonal weakness in oil appears to have been brief this year, but it did arrive. ProShares UltraShort Bloomberg Crude (SCO) was added to the portfolio on September 14, when it traded below $24. Twelve days later SCO traded above its auto-sell price of $30.82 and was sold for a 28.4% gain.

Tactical Seasonal Switching Strategy ETF Portfolio Updates

Per Tuesday’s

Seasonal MACD Buy Alert, new positions in

SPDR DJIA (DIA),

SPDR S&P 500 (SPY),

Invesco QQQ (QQQ), and

iShares Russell 2000 (IWM) have been added to the portfolio using their respective average daily prices on October 5. As of today’s close, these positions are mildly underwater.

DIA, SPY, QQQ, and IWM can all be considered up to their buy limits.

Partial positions in bond ETFs, TLT, AGG and BND are on hold. There poor performance this year is not unexpected as the Fed has been increasing rates and bond prices generally decline as rates go higher. In anticipation of

poor bond ETF performance during this year’s “Worst Months,” we limited the portfolio to partial positions and suggested a preference for cash. Suggested stop losses for TLT, AGG, and BND appear in the table below.

|

Seasonal MACD & Tactical Switching Strategy Portfolio Update

|

|

By:

|

October 04, 2022

|

|

|

|

Faster moving MACD “Buy” indicators applied to DJIA, S&P 500 and NASDAQ are all positive as of today’s close. With all three indices confirming, we are issuing our Seasonal MACD Buy Signal.

Throughout the balance of the year, and even more so during the “Worst Months,” we have maintained a cautious/defensive outlook and approach. New longs were substantially limited, and cash was a preferred holding. While our seasonal research suggested a market turn sometime in late-Q3 or early Q4. This turn may have finally arrived. The Fed has briskly raised its key rate and is closer to the end of a significant tightening cycle. Treasury yields have eased, and the U.S. dollar appears to be softening while signs of growth slowing and inflation easing continue to accumulate. These developing conditions hint at a less aggressive Fed.

Make no mistake headwinds remain numerous, and volatility is likely to persist in the near-term with some back fill of recent gains a possibility. But the market is forward looking, and the worst is either past or will soon pass. Q3 earnings expectations have been sufficiently lowered that it would not be at all that surprising to see a sizable number of “surprise beats” when earnings season commences in earnest around mid-October.

Seasonal factors have been well-aligned throughout the year. Though never a certainty, we will stick with the system and begin establishing new long positions.

Tactical Seasonal Switching Strategy ETF Portfolio Trades

Buy SPDR DJIA (DIA), SPDR S&P 500 (SPY), Invesco QQQ (QQQ), and iShares Russell 2000 (IWM) in the Almanac Investor Tactical Seasonal Switching Strategy Portfolio. These positions will be equally weighted in the portfolio. Buy limits for DIA, SPY, QQQ and IWM are initially today’s closing price plus 1% (closing price times 1.01 = buy limit). For tracking purposes, these ETFs will be added to the portfolio using their respective average prices on Wednesday, October 5. This price will be calculated by summing the high and low prices and dividing by two.

We will continue to hold defensive “Worst Months” positions in iShares 20+ Year Treasury Bond (TLT), iShares Core US Aggregate Bond (AGG) and Vanguard Total Bond Market (BND). We will be adding tight stop losses to these positions in Thursday’s scheduled email Alert.

Sector Rotation ETF & Stock Portfolios

We anticipate releasing our annual Sector Rotation ETF and New Stock baskets in this week’s email Alert, currently scheduled to be released after the close on October 6.