|

February 2017 Trading & Investment Strategy

|

|

By:

|

January 31, 2017

|

|

|

|

|

Market at a Glance - 1/31/2017

|

|

By:

Christopher Mistal

|

January 31, 2017

|

|

|

|

1/30/2016: Dow 19971.13 | S&P 2280.90 | NASDAQ 5613.71 | Russell 2K 1352.33 | NYSE 11205.24 | Value Line Arith 5327.42

Psychological: Jitters. Weekly CBOE Put/Call ratio has been hanging out between 0.60 and 0.70 since the second half of December. This would suggest sentiment is not too hot or too cold.

Investors Intelligence Advisors Sentiment survey paints another picture with most recent readings (last week’s report) of 58.2% bulls, 17.5% bears and 24.3% correction. Perhaps everyone is waiting to see what the new administration will do next. Thus far, actions taken already by the new administration have stirred many emotions, but appear to have had minimal to no impact on actual economic activity; at least for now.

Fundamental: Mixed. After a soybean driven 3.5% growth spurt in Q3 of 2016, GDP slipped back to a meager 1.9% in the Q4. For all of 2016, GDP was just 1.6%, down from 2.6% in 2015. Based upon these numbers, growth is headed in the wrong direction. However, employment and consumer spending appear to be remaining reasonably firm. The unemployment rate was 4.7% in December and spending increased 0.5% in December. Corporate earnings have also been mixed. Big banks broadly beat, but energy companies continue to struggle.

Technical: Consolidating. After breaking out to new all-time highs, DJIA, S&P 500 and NASDAQ appear to be pausing to digest and reflect on recent gains again. Stochastic, relative strength and MACD indicators are all drifting lower. Last’s week’s breakout appears to have failed. DJIA and S&P 500 have spent nearly 3 months (well) above their respective 50-day moving averages. NASDAQ has spent about two months. If weakness persists, respective 50-moving averages will likely be in play and are key support levels. These levels are: DJIA 19670, S&P 500 2250 and NASDAQ 5463.

Monetary: 0.50-0.75%. A FOMC meeting is taking place now and ends on February 1. Based upon the CME Group’s FedWatch Tool, odds are essentially zero for an interest rate change this meeting. Then they will not meet again until mid-March. Within historical context, interest rates are still highly accommodative and are not likely to be a drag on the economy or the market.

Seasonal: Tepid. Even though our January indicators went 3-for-3, giving 2017 the January Trifecta, February is still the weak link in the “Best Months.” Frequently poorly performing February is even worse in post-election years, ranking #11 DJIA and #12 for S&P 500, NASDAQ, Russell 1000 and 2000 with average losses across the board ranging from –1.4% to –3.9%.

|

February Outlook: First Up January in Four Years Portends Shallow Break

|

|

By:

Jeffrey Hirsch & Christopher Mistal

|

January 31, 2017

|

|

|

|

After finally breaking above Dow 20,000 for three days the market has retreated in supposed response to a string of executive orders signed by President Trump. The implementation of the temporary immigration ban on a few select countries created some waves and news, but net-net the S&P 500 is down a mere 0.8% since its January 25th high.

This was nowhere near enough of a selloff to derail the first positive January Barometer and January Indicator Trifecta in 4 years. The last time this transpired in post-election year 2013 the S&P 500 posted a full-year gain of 29.6%, including a February-December gain of 23.4%

Devised by Yale Hirsch in 1972, the January Barometer has registered eight major errors since 1950 for an 87.9% accuracy ratio. This indicator adheres to propensity that as the S&P 500 goes in January, so goes the year. Of the eight major errors Vietnam affected 1966 and 1968. 1982 saw the start of a major bull market in August. Two January rate cuts and 9/11 affected 2001.The market in January 2003 was held down by the anticipation of military action in Iraq. The second worst bear market since 1900 ended in March of 2009 and Federal Reserve intervention influenced 2010 and 2014. Including the eight flat years yields a .758 batting average.

Our January Indicator Trifecta combines the Santa Claus Rally, the First Five Days Early Warning System and the full-month January Barometer. The predicative power of the three is considerably greater than any of them alone; we have been rather impressed by its forecasting prowess. This is the 28th time since 1949 that all three January Indicators have been positive. As we detailed in the “

Proving Grounds” last week this is rather constructive. The following one-year seasonal pattern charts show some bang up performance in post-election years with a positive January Indicator Trifecta.

Despite the recent barrage of executive orders out of the White House and the uproar in the media, the market has help up rather well. So at this point, we are therefore not making any adjustments to our

2017 Outlook and Forecast. Looking past all the noise and rhetoric, what has happened so far in Washington has not yet had a meaningful impact on the economy.

Pulse of the Market

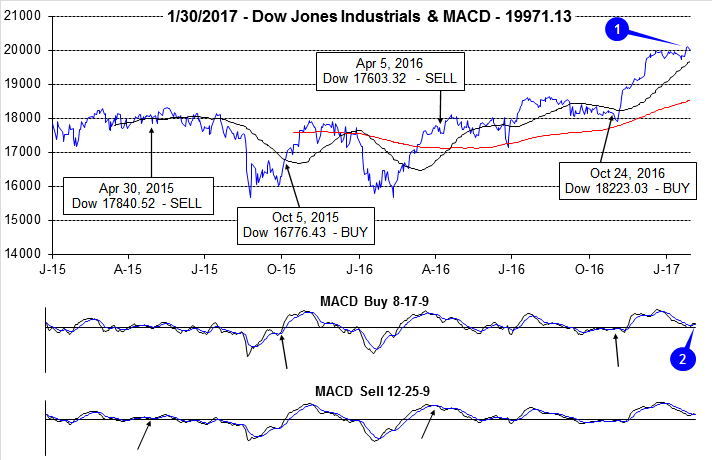

After repeated attempts throughout December and January, DJIA finally punched through and closed above 20,000 on January 25, 2017 (1). This purely psychological level has little technical meaning, but nice big round numbers do make nice headlines and apparently nice targets for profit taking. DJIA spent just three trading days above 20,000 and has come under pressure this week.

DJIA’s thrust above 20,000 was sufficient to turn its faster moving MACD indicator positive (2), but this signal is already beginning to fade. The slower moving MACD indicator turned positive last Friday and was quickly reversed by yesterday’s losses. The post-election rally appears to be taking another breather.

Following seven straight weeks of gains, DJIA (3) has slipped in three of the last five weeks. Mid-month declines were mild at less than 0.4% per week during week endings January 13 and 20. In the middle of this mild weekly losing streak, DJIA logged its first Down Friday/Down Monday (DF/DM) of 2017 (4). A second DF/DM was completed yesterday. Historically, DF/DM occurrences have been followed by further declines sometime within the next 90 calendar days. Losses sometimes occurred immediately while other times, DJIA bounced before retreating. A DF/DM to close out January, ahead of frequently challenging February, (the worst month in post-election years) warrants close monitoring.

S&P 500 (5) appears to be unable to catch a break. It gets pulled down when DJIA is weak and only captures a portion of NASDAQ’s strength (6). It did close at new all-time highs last week with the assistance of technology shares, but on a year-to-date basis is still lagging NASDAQ. At yesterday’s close, S&P 500 was up 1.9% year-to-date compared to NASDAQ’s 4.3%.

NYSE Weekly Advancers and Decliners (7) continue to behave largely as expected. Weekly advancers are robust when the major indices advance and tepid when they decline. However, last week’s Advancers were somewhat light considering the new all-time highs reached. Fewer stocks participating in the rally is a sign that the rally could be stalling. This certainly appears to be the case thus far this week.

NYSE Weekly New Highs (8) appear to have peaked in the first half of December. This is also a somewhat of a concern as it appears to support Weekly Advance/Decline numbers in confirming that new all-time highs are being made by fewer and fewer stocks. NYSE Weekly New Lows have remained subdued which does alleviate some of the concern, but not of all of it. If New Lows were to begin to expand meaningfully, the pause could become a more detrimental pullback.

Weekly CBOE Put/Call (9) has crept higher since mid-December. Weekly readings in the 0.60 to 0.70 range have been largely neutral. This is neither excessively bullish nor excessively bearish which offers little insight into the markets next move alone. Based upon all readings and weak February seasonal factors, a mild pullback appears most likely in the immediate future.

Click for larger graphic…

|

February Almanac, Vital Stats & Strategy Calendar: “Best Months” Weak Link

|

|

By:

Christopher Mistal & Jeffrey A. Hirsch

|

January 26, 2017

|

|

|

|

Usually the weak link in the Best Six months, February tends to follow the current trend, though big January gains often correct or consolidate during the month of Valentines and Presidents as Wall Street evaluates and adjusts market outlooks based on January’s performance. Since 1950, January S&P 500 gains of 2% or more corrected or consolidated in February 62.1% of the time. In the 20 years that the S&P 500 gained 4% or more in January, 65.0% of the time the S&P declined or finished flat (less than 1% gain) in February.

Since 1950, February is up slightly more than half the time and, depending on the index, up marginally on average. However, small cap stocks, benefiting from “January Effect” carry over; tend to outpace large cap stocks in February. The Russell 2000 index of small cap stocks turns in an average gain of 1.2% in February since 1979—just the seventh best month for that benchmark.

February’s post-election year performance since 1950 is miserable, ranking dead last for S&P 500, NASDAQ, Russell 1000 and Russell 2000. Average losses have been sizable: -1.8%, -3.9%, -1.9%, and -2.0% respectively. February is eleventh for DJIA with an average loss of 1.4%. February 2001 and 2009 were exceptionally brutal.

After January’s typically strong finish, February has opened well for large cap stocks. The first trading day is bullish and it has traded higher in 16 of the past 21 years with an average S&P 500 gain of 0.5Strength then tends to fade after that until the stronger eighth, ninth and eleventh trading days. Expiration week has a spotty longer-term record, but this year the week begins early and may benefit from the bullish ninth and eleventh days falling within it. However, no index completely escapes typical end-of-month weakness.

Presidents’ Day is the lone holiday that exhibits weakness the day before and after. (Stock Trader’s Almanac 2017, page 88). The Friday before this mid-winter three-day break is exceptionally treacherous and average declines persist for three trading days after the holiday going back to 1980.

| February (1950-2016) |

| |

DJI |

SP500 |

NASDAQ |

Russell

1K |

Russell 2K |

| Rank |

|

8 |

|

9 |

|

9 |

|

9 |

|

7 |

| #

Up |

|

40 |

|

37 |

|

25 |

|

23 |

|

22 |

| #

Down |

|

27 |

|

30 |

|

21 |

|

15 |

|

16 |

| Average

% |

|

0.2 |

|

0.1 |

|

0.7 |

|

0.4 |

|

1.2 |

| 4-Year Presidential Election Cycle Performance

by % |

| Post-Election |

|

-1.4 |

|

-1.8 |

|

-3.9 |

|

-1.9 |

|

-2.0 |

| Mid-Term |

|

1.0 |

|

0.7 |

|

1.0 |

|

1.3 |

|

1.9 |

| Pre-Election |

|

1.2 |

|

1.1 |

|

2.8 |

|

1.5 |

|

2.5 |

| Election |

|

-0.1 |

|

0.1 |

|

2.5 |

|

0.3 |

|

2.2 |

| Best & Worst February by % |

| Best |

1986 |

8.8 |

1986 |

7.1 |

2000 |

19.2 |

1986 |

7.2 |

2000 |

16.4 |

| Worst |

2009 |

-11.7 |

2009 |

-11.0 |

2001 |

-22.4 |

2009 |

-10.7 |

2009 |

-12.3 |

| February Weeks by % |

| Best |

2/1/08 |

4.4 |

2/6/09 |

5.2 |

2/4/00 |

9.2 |

2/6/09 |

5.3 |

2/1/91 |

6.6 |

| Worst |

2/20/09 |

-6.2 |

2/20/09 |

-6.9 |

2/9/01 |

-7.1 |

2/20/09 |

-6.9 |

2/20/09 |

-8.3 |

| February Days by % |

| Best |

2/24/09 |

3.3 |

2/24/09 |

4.0 |

2/11/99 |

4.2 |

2/24/09 |

4.1 |

2/24/09 |

4.5 |

| Worst |

2/10/09 |

-4.6 |

2/10/09 |

-4.9 |

2/16/01 |

-5.0 |

2/10/09 |

-4.8 |

2/10/09 |

-4.7 |

| First Trading Day of Expiration Week: 1990-2016 |

| #Up-#Down |

|

17-10 |

|

20-7 |

|

16-11 |

|

20-7 |

|

18-9 |

| Streak |

|

U2 |

|

U3 |

|

U3 |

|

U3 |

|

U3 |

| Avg

% |

|

0.3 |

|

0.2 |

|

0.1 |

|

0.2 |

|

0.2 |

| Options Expiration Day: 1990-2016 |

| #Up-#Down |

|

13-14 |

|

11-16 |

|

10-17 |

|

11-16 |

|

12-15 |

| Streak |

|

D1 |

|

D1 |

|

U2 |

|

D1 |

|

U3 |

| Avg

% |

|

-0.1 |

|

-0.2 |

|

-0.4 |

|

-0.2 |

|

-0.1 |

| Options Expiration Week: 1990-2016 |

| #Up-#Down |

|

16-11 |

|

15-12 |

|

15-12 |

|

15-12 |

|

18-9 |

| Streak |

|

U2 |

|

U2 |

|

U3 |

|

U7 |

|

U7 |

| Avg

% |

|

0.3 |

|

0.1 |

|

0.1 |

|

0.2 |

|

0.3 |

| Week After Options Expiration: 1990-2016 |

| #Up-#Down |

|

11-16 |

|

12-15 |

|

15-12 |

|

12-15 |

|

14-13 |

| Streak |

|

U1 |

|

U1 |

|

U3 |

|

U1 |

|

U3 |

| Avg

% |

|

-0.5 |

|

-0.3 |

|

-0.3 |

|

-0.3 |

|

-0.2 |

| February 2017 Bullish Days: Data 1996-2016 |

| |

1,

13, 15 |

1,

10, 13, 15 |

1,

13, 14, 22 |

1,

10, 13, 15 |

1, 6, 8, 10, 13, 14 |

| |

|

|

|

|

16, 22, 24, 27 |

| February 2017 Bearish Days: Data 1996-2016 |

| |

17,

23, 28 |

16,

28 |

3,

28 |

28 |

3, 9, 17, 28 |

| |

|

|

|

|

|

|

February 2017 Strategy Calendar

|

|

By:

Christopher Mistal

|

January 26, 2017

|

|

|

|

|

Proving Grounds: Positive January Indicator Trifecta Hails Upside

|

|

By:

Jeffrey Hirsch

|

January 24, 2017

|

|

|

|

A rather interesting and insightful inquiry was posed on our Twitter feed by devout follower @WayneYJacksonII and we address here today in the Almanac Investor “Proving Grounds.” Mr. Jackson posed the question after I discussed the January Indicator Trifecta on CNBC Squawk Box two weeks ago. He asked, “Has your team run statistics if we should sell in April if all 3 green lights appear, and hold till '18?”

In recent years we have been rather impressed by the forecasting prowess of this

January Indicator Trifecta, which combines the Santa Claus Rally, the First Five Days Early Warning System and the full-month January Barometer. The predicative power of the three is considerably greater than any of them alone. So in honor of the savvy of this question and the efficacy of the Trifecta, our Best Six Months Switching Strategy and the Four-Year Presidential Election Cycle, we present the amalgamation of all three trends.

My initial response was that 2017 is a post-election year and it’s usually advisable to heed our “Worst 6 Months” strategy after we issue our Best Six Months MACD Seasonal Sell Signal to sell losers and underperforming positions, hold big winners and take defensive positions appropriately. Upon further review I felt that response was a bit glib and professed internally to run the data and share our findings with subscribers first.

In the following two tables we have laid out all the years since 1949, which was the first full post-election year following the end of WWII in 1945. The first table is all years broken out by year of the four year cycle. The second table shows just the years that the Trifecta was positive for all three also broken out by year of the cycle so we can compare the impact of a positive Trifecta.

Post-election years benefit most followed by Midterm years and Elections years. Pre-Election years have such a bullish bias a positive Trifecta has little impact. Notable years that were negative after a positive Trifecta were: 1966 Vietnam escalation, 1987 Crash, and 2011 US government budget and political battles.

So the answer to the query, should we sell in April/May 2017 if all three January Trifecta indicators are positive, is it does not seem as urgent. But we would stick with the program. While a positive Trifecta shows big gains for the Best Six Months, Worst Six Months, the following eleven months as well as the full year, there is a still a

greater risk with a newly elected republican presidency. So while a positive Trifecta bodes well for the year, we will take precaution as we approach the Worst Six Months and get our Sell Signal and take off risk, while holding big winners and assess defensive positions prudently.

|

Stock Portfolio Updates: Free Lunch Delivers a Modest Gain

|

|

By:

Christopher Mistal

|

January 19, 2017

|

|

|

|

Just past the halfway point in January, the market has essentially gone nowhere in the New Year. We got off to a solid start with positive readings from our Santa Claus Rally and First Five Days indicators, but aside from NASDAQ, other major indices, DJIA, S&P 500 and Russell 2000 are flat or slightly down. Looking at the following charts, it’s apparent that the market has slipped into a holding pattern that extends back to about mid-December. DJIA cannot seem to break through 20,000; S&P 500 is struggling with 2280 and Russell 2000 has gone from knocking on 1400 to near its 50-day moving average today. NASDAQ was encouraging up to a few days ago when it also appears to have stalled out.

![[DJIA Daily Bar Chart]](/UploadedImage/AIN_0217_20170119_DJIA.jpg)

![[S&P 500 Daily Bar Chart]](/UploadedImage/AIN_0217_20170119_SP500.jpg)

![[NASDAQ Daily Bar Chart]](/UploadedImage/AIN_0217_20170119_NASDAQ.jpg)

![[Russell 2000 Daily Bar Chart]](/UploadedImage/AIN_0217_20170119_R2k.jpg)

Even though new Presidential Administrations only come along once every eight years (the trend since 1992), the market’s recent behavior is not all that different from when a major Fed meeting is scheduled. Trades are made in advance to position portfolios for the most likely outcome. This appears to be precisely what is happening, only in slow(er) motion. The market sprinted higher following Election Day results in anticipation of numerous, potential earnings boosting actions by a new Republican President and a Republican controlled Congress. De-regulation, tax cuts, increased infrastructure spending and defense spending, the repeal (replace) of Obamacare—basically a major course change in D.C. is expected. Everyone is positioned for the myriad potential benefits, now we all wait to see what will actually unfold.

In less than 24 hours Donald Trump will take office and we will finally begin to see if the right trades were made or not. Unfortunately, we will not be delivered a single statement at a specified date and time like a Fed meeting. It will take time for the new administration and Congress to work through its long list of want-to-do. The longer it takes the more volatile trading is likely to become.

Portfolio & Free Lunch Updates

Over the six weeks since last update, S&P 500 was up 1.4% while Russell 2000 was down 0.4% as of yesterday’s close. The

Almanac Investor Stock Portfolio’s blend of cash and long positions resulted in a 0.06% overall loss over the same time period. Our Small-Cap portfolio, aided by a modest overall gain from the

Free Lunch basket of stocks (shaded in grey in table below) performed best, up 0.9%. Our Large Caps were off 0.7% while Mid-Caps shed 2.5%. Mid-cap Free Lunch stocks were the main drag.

Overall, this year’s Free Lunch was a moderate success, especially when applying our tight 5% trailing stop loss. Entering the Free Lunch positions within a range of +/-2% of their respective closing prices did work well as the majority of the basket was added on the first day of trading. A 5% trailing stop however is open for debate as many positions, especially small-cap, were quickly stopped out after addition. Some, like OHRP, did just continue to fall apart while others like BIOS only dipped and then rallied higher.

Overall the entire Free Lunch basket is averaging a 5.4% gain since the close on December 16 through yesterday’s close using a simple buy and hold approach. Following our suggested trading rules resulted in an average gain of 2.8% and only Hanesbrands (HBI) remains active. Either approach has outperformed the NYSE, AMEX and NASDAQ over the same time period. With the exception of HBI, Free Lunch has come to an end.

Per last month’s update, Corelogic Inc (CLGX) was closed out of the portfolio using its average price of $36.60 on December 9. This resulted in a loss of 7% on the position. As of today CLGX is lower and its technical indicators are negative confirming the likelihood of further weakness. Sucampo Pharma (SCMP) was also stopped out on January 17 when it closed below $12.20. SCMP has enjoyed positive press recently as analysts have bumped up 2017 estimates, but it has not been enough to overcome the potential drag of $260 million in recently sold convertible senior notes that are due in 2021.

Many of the remaining positions from our

September Stock Basket have given back some of their gains. This is not much of a surprise as many of these positions were up 20%, 30% even 40% since last October/November.

Arista Networks (ANET) is down for a different reason, they have been forced to use their U.S. supply chain instead of their Asian chain by the U.S. Customs and Border Protection. The workaround that was in place for patents ANET was ruled to be in violation of was revoked. The net result of this was a reduction in 2017 gross margin and earnings estimates. Earnings estimate fell by 4.4% while shares dropped 12% the day the news broke. Based upon these numbers, the selloff appears overblown. With ANET shares gaining ground since, others may have come to a similar conclusion.

ANET is on HOLD. Its stop loss remains unchanged from last update at $83.19.

Please refer to the updated portfolio table below for Current Advice about each specific position. Please note that many stop losses have been updated.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in ANET, BUSE, CCS, HLTH, IESC, MHO, PFBC, SBRA and SCMP.

|

Mid-Month Update: Mild January Break Underway

|

|

By:

Christopher Mistal

|

January 17, 2017

|

|

|

|

This Friday, Donald Trump will be inaugurated as the 45th President of the United States and a new administration will be in place. The market’s rally since Election Day has been one of this best in records going back to 1952 at various points along the way and remains near the top today even after some mild losses. The pace of gains has slowed as an increasing number of traders and investors ponder whether or not the rally can continue. Based upon the following seasonal pattern charts, the rally has a reasonably good chance of lasting, but gains are likely to be limited to around 6-8% at yearend for DJIA and S&P 500 and around 10% for NASDAQ.

![[DJIA Seasonal Pattern Chart]](/UploadedImage/AIN_0217_20170117_PE_DJIA.jpg)

![[S&P 500 Seasonal Pattern Chart]](/UploadedImage/AIN_0217_20170117_PE_SP500.jpg)

![[NASDAQ Seasonal Pattern Chart]](/UploadedImage/AIN_0217_20170117_PE_NASDAQ.jpg)

In the above charts, four different seasonal patterns are plotted alongside 2017 year-to-date as of today’s close. The baseline is “All Years” and includes every year of data. DJIA data begins in 1901, S&P 500 in 1930 and NASDAQ is since 1971. 2017 is a post-election year and a comparison to “All Post-Election Years” is included. This year will also be the first year of a new administration which is represented by “1st Year of New Administration.” Lastly, “7th Years of Decades” is included. 7th Years of Decades have a rather nasty history and are the second worst performing year for DJIA going back to 1881 (page 129 of Stock Trader’s Almanac 2017). Zero years have the worst record however; we don’t place much emphasis on the decennial cycle currently as the four-year presidential cycle exhibits more influence.

Allowing for the fact that all “1st Years of New Administrations” are also Post-Election Years, all four seasonal patterns are quite similar. The first two months of 2009 (a Post-Election Year and a 1st Year of New Administration) are responsible for much the difference in the first three months and 1937 and 1987 are responsible for the plunge in “7th Years of Decades.”

Shifting the focus back to the near-term, the anticipated January Break appears to be materializing. This

emerging trend has seen the S&P 500 decline in 18 of the last 21 Januarys with an average retreat of 3.6% from its closing high in the first seven trading days of January to its closing low sometime during the last seven trading days of the month.

Optimism fueled by the prospects of less regulation, rising interest rates and a stronger U.S. dollar looks to be fading. Bank earnings have been mostly better than expected thus far this earnings season, but valuations, the length of the current bull market and recently increased forward earnings expectations are all being questioned. The incoming administration’s apparent lack of focus could also be contributing to a resetting of expectations. A mild pullback could be exactly what the market needs and the ETF Portfolio is ready with positions in ProShares UltraShort S&P 500 (SDS) and ProShares UltraPro Short S&P 500 (SPXU). As a reminder, this is a short-duration trade that we will look to exit sometime this week or early next week at the latest.

![[DJIA Daily Bar Chart]](/UploadedImage/AIN_0217_20170117_DJIA.jpg)

![[S&P 500 Daily Bar Chart]](/UploadedImage/AIN_0217_20170117_SP500.jpg)

![[NASDAQ Daily Bar Chart]](/UploadedImage/AIN_0217_20170117_NASDAQ.jpg)

Technology shares, measured by NASDAQ above, lagged somewhat in the early stages of the rally that started after Election Day eventually caught up and broke out to new all-time highs and the streak has continued in the New Year. However, DJIA and S&P 500 have stalled out. DJIA cannot seem to build sufficient momentum to break through 20,000 and S&P 500 cannot seem to break through and close above 2280. A mild pullback to just above respective 50-day moving averages (solid magenta line) would likely temper excessive bullish sentiment and reset stretched technical indicators. Combined with still respectable fundamentals and seasonal factors, the path higher would once again be open.

Based upon a positive Santa Claus Rally and First Five Days, we would anticipate S&P 500 finishing January with a gain thus making the January Barometer positive and completing a bullish January Trifecta. From there, we will need to see how effective the Trump administration is. For now our

Base Case scenario for 2017 remains the most likely with a 65% chance.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in SDS and SPXU.

|

ETF Trades: Winter Weather Drives Natural Gas Prices

|

|

By:

Christopher Mistal

|

January 12, 2017

|

|

|

|

This year will be the 20th year that the stock market is closed to honor Dr. King and his contributions to the world and civil rights. Martin Luther King, Jr. Day has only been observed since 1998 and market behavior around this holiday has not been added to the Stock Trader’s Almanac yet. So I wanted to share with you the history of market performance around this holiday.

Overall the market has been more positive, on average, on the Friday before MLK day and weaker the Tuesday after. Though trading is rather mixed with a relatively even split of ups and downs on the day before and the day after. This mixed and choppy performance is possibly due to the fact that MLK day can either land in options expiration week or the week after. Both weeks have been rather volatile and weak since 1999.

January Trade Idea

Based upon the NYSE ARCA Natural Gas Index (XNG) there is a seasonal tendency for natural gas companies to enjoy gains from the end of February through the beginning of June. Detailed in the Stock Trader’s Almanac 2017 on page 94, this trade has returned 10.8%, 11.1%, and 3.8% on average over the past 15, 10, and 5 years respectively.

One of the factors for this seasonal price gain is consumption driven by demand for heating homes and businesses in the cold weather northern areas in the United States. In particular, when December and January are colder than normal, we see depletions in inventories through late March and occasionally into early April. This has a tendency to cause price spikes lasting through mid-April.

A relatively mild start to winter this year has kept natural gas prices in check right around $3.30/mmBtu as of today. Inventories are modestly lower now than a year ago and are slightly below the 5-year average for this time of year. Unseasonably warm weather in the Northeast now is not likely to last through the remainder of January and February.

First Trust Natural Gas (FCG) is an excellent choice to gain exposure to the company side of the natural gas sector. FCG could be bought on dips below $26.00. Once purchased, use a stop loss of $23.40 and take profits at the auto sell, $31.69. Top five holdings by weighting as of yesterday’s close are: Anadarko Petroleum, Devon Energy, Concho Resources, Cimarex Energy and Noble Energy. The net expense ratio is reasonable at 0.6% and the fund has approximately $245 million in assets.

United States Natural Gas (UNG) is suggested to trade the commodity’s seasonality as its assets consist of natural gas futures contracts and is highly liquid with assets of over $500 million and average daily trading volume in excess of 15 million shares per day on average over the past three months. Its expense ratio is 1.27%. UNG could be bought on dips below $8.10. If purchased, set an initial stop loss at $7.29.

ETF Portfolio Updates

Since last update in mid-December, the market and the ETF Portfolio have essentially traded sideways. NASDAQ and technology related sectors have made the most progress and this is reflected in modest gains by IYW, XLK and QQQ. However, the mixed, choppy performance did allow the addition of Global X Copper Miners (COPX) when it dipped below its buy limit for the first time on December 15. As of yesterday’s close, COPX was up 5.8% and enjoyed additional gains today.

Per Tuesday’s Alert, ProShares UltraPro Short S&P 500 (SPXU) and ProShares UltraShort S&P 500 (SDS) were added to the portfolio using that day’s closing prices. Better pricing was available on Wednesday and the market showed initial signs of mid-January weakness today. SPXU and SDS are currently on Hold. Option expiration week, next week, and the week after options expiration has been volatile and weak recently. Should this trend continue this year, SPXU and SDS could provide a nice quick gain.

As a reminder, three favorable sector seasonalities usually come to an end in January; High-Tech, Computer Tech and Pharmaceutical. High-Tech and Computer Tech resume favorable seasonalities again in March and April respectively. With this in mind, corresponding positions in IYW and XLK are on Hold. Due to the increasingly blurry line between Healthcare, Biotech and Pharmaceutical sectors, no one specific ETF was selected to trade just Pharmaceutical strength last September. Instead we elected to purchase XLV which has a longer favorable period and is on Hold. XLV has been under pressure, but somehow I don’t think the new administration will be any more successful at controlling rising healthcare costs than any of the previous.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in FXB, IWM, IYT, QQQ, SPY, SDS, SPXU, VNQ, XLB, XLP, XLV and XLY.

|

Seasonal Sector Trades: Trading Mid-January S&P 500 Weakness

|

|

By:

Christopher Mistal & Jeffrey A. Hirsch

|

January 10, 2017

|

|

|

|

Despite New Year bullishness from our early January indicators and our expectation for full-month January Barometer gains that will support our modestly bullish 2017 Forecast, a mid-January break in equities is looking increasingly likely. Since 1996 this January break has been more pronounced and more consistent. This trade, last featured in the Commodity Trader’s Almanac 2013, is beginning to set up nicely right now.

The stock market has demonstrated a tendency to retreat after the first of the New Year, especially when there has been a strong fourth quarter gain. Once the New Year begins we often see a profit taking correction. Investors tend to sell stocks to lock in profits in order to defer taxes from capital gains after the New Year begins. Even though the best time to be long the overall equity markets lasts from October through late April, this January break can certainly give short-term, nimble traders a nice return. With stocks struggling to move higher this week this trade is setting up a little later this year.

The table below of the “big” S&P 500 contract shows the typical January break. Since 1996 shorting the March contract on or about the second trading day of the New Year and holding for twelve trading has produced gains 12 of the last 21 years for a success rate of 57.1% and a cumulative gain of $81,538 (based upon trading a single contract excluding fees and taxes).

The results in the above table are based upon specific entry and exit dates with no further analysis being applied. This trade potentially could have been successful in 18 of the last 21 January’s with the application of technical indicators. The average decline from the high in the first seven trading days in January to the low in the last seven trading days in January has been 3.6% since 1996 using the same “big” S&P 500 contract.

Also consider that since the New York Stock Exchange began observing the Martin Luther King, Jr. holiday on the third Monday in January in 1998 that the stock market has exhibited strength in the days before the market is closed on that third Monday and weakness after. This also coincides with the pattern of weakness during January’s expiration week. S&P 500 has been down 13 of the last 18 years during the week, while suffering some heavy losses on expiration Friday in 10 of the last 18 years.

In the chart of the S&P 500 below you can see that the blue chip average is pushing up against monthly pivot point resistance around 2280 (red dashed line) and that the Sell-side MACD and the Fast Stochastic have rolled over. A pullback to somewhere between the monthly pivot point level of 2234.60 (blue dashed line) and the 50-day moving average around 2210 is quite possible. There are two leveraged ETFs we are going to suggest to capitalize on this potential break using a tight stop in the event the break fails to materialize.

On today’s close we will add the ProShares UltraShort S&P 500 (SDS), which is two-times the inverse of the daily move of the S&P 500 to the Almanac Investor ETF Portfolio, employing a 3.0% trailing stop based upon daily closing price. We will take profits if we get a 5-7% gain. We will also add ProShares UltraPro Short S&P 500 (SPXU), which is three-times the inverse of the daily move of the S&P 500, employing a 4.0% trailing stop (also based upon daily close) and taking profits if we get a 7-9% gain.

DISCLOSURE NOTE: Officers of the Hirsch Organization do not currently own any SDS or SPXU.

|

Positive First Five Days: Early Gains Hold

|

|

By:

Jeffrey Hirsch & Christopher Mistal

|

January 09, 2017

|

|

|

|

Even though today turned out to be a mixed day for the market (DJIA and S&P 500 down, NASDAQ up), S&P 500 is still positive year-to-date and thus our First Five Day (FFD) early warning system is also positive. Combined with last week’s positive Santa Claus Rally (SCR), our January Trifecta is now two for two. The January Trifecta would be satisfied with a positive reading from our January Barometer (JB) at month’s end.

When all three indicators, SCR, FFD and JB, are positive this has been the most bullish scenario for the next eleven months and the full year. In 28 previous Trifecta occurrences since 1950, S&P 500 advanced 89.3% of the time during the subsequent eleven months and 92.9% of the time for the full year. However, a January Indicator Trifecta does not guarantee the year will be bear free. The three losing “Last 11 Mon” years, shaded in grey, experienced short duration bear markets (2011, S&P 500 –19.4% peak to trough).

A positive SCR and FFD are encouraging and further clarity will be gained when the January Barometer (page 16, STA 2017) reports at month’s end. A positive January Barometer would further boost prospects for full-year 2017. The December Low Indicator (2017 STA, page 44) should also be watched with the line in the sand at DJIA’s December Closing Low of 19170.42 on 12/2/16.

|

Free Lunch Update: Basket Beating Broader Market

|

|

By:

Christopher Mistal

|

January 05, 2017

|

|

|

|

In recent years it has become rather common for the market to be down on the last day of the year and then down again on the first trading day of the New Year. The market was indeed down on the last day of 2016, but rebounded solidly on the first day (and second day) of 2017. However, today the market struggled which could be a sign that the market is slipping back into its recent, disappointing January pattern.

In the above chart, January’s performance for the recent 21-year period has been plotted. Of the five major indices only NASDAQ finishes the month with an average gain. After early gains, first two or three trading days, DJIA, S&P 500, NASDAQ and Russell 1000 tend to weaken and slip until the sixteenth trading day. The only reprieve has been a brief mid-month (eleventh trading day) bounce.

However, past Post-Election Year Januarys have a substantially different pattern. Early gains are present, but the retreat afterwards comes to an end by the fifth, sixth or seventh trading day depending on index. From that low point the trend is sideways to higher by the end of the month with positive across the board average gains. If the major indices can shake of today’s minor setback and break out to new all-time highs, January 2017 will likely follow the much more bullish Post-Election Year January pattern.

Free Lunch Update

As a reminder, our “Free Lunch” (page 112 of Stock Trader’s Almanac 2017) strategy is a short-term trade that takes advantage of several yearend and New Year phenomena. Our research has shown that NYSE stocks making new 52-week week lows in mid-December, primarily due to yearend tax-loss selling, tend to outperform the NYSE through mid-February. These stocks are selected ahead of the Santa Claus Rally (page 114 STA17) and approximately near the start of the January Effect (page 110 STA17).

Many of the stocks selected for the “Free Lunch” trade are down for good reason. Declining revenue and shrinking profits are most common amongst these names while others may have run into legal or accounting trouble. Once a name pops, profits should be taken and conversely if a name continues lower it should be cut loose quickly. This year’s basket has several familiar names from the consumer sector as well as biotech and healthcare.

Overall, this year’s basket is handily outperforming the NYSE Comp with a 9% average gain at yesterday’s close compared to 1.1% for the index. NASDAQ listed stocks, the largest portion of the list, are performing best, up 7.6% on average. The lone AMEX stock, HLTH was up 36.8% at yesterday’s close. Returns listed in the table below are calculated from their closing price on December 16 through their close on January 4.

All of these stocks were added to the Almanac Investor Stock Portfolio using suggested guidelines for buy limits and stop losses. Due to the strict 5% trailing stop loss, updated daily using the position’s closing price, all but HBI, VSTO and AFMD have been stopped out. Closed Free Lunch positions and remaining open positions had an average gain of 4.4% as of yesterday’s close.

This basket appears to have some life left in it. We will officially continue to hold HBI, VSTO and AFMD in the Stock Portfolio with the previously mentioned 5% trailing stop loss.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in ANF, CO, FIT, GES, HBI, VSTO, HLTH, AFMD, AMCN, FOLD, RKDA, ARWR, BIOS, EGAN, FCEL, OHRP, SHLD, TTOO and TVIA.

|

Santa Claus Rally Official Results: Santa Arrives Fashionably Late

|

|

By:

Jeffrey Hirsch & Christopher Mistal

|

January 04, 2017

|

|

|

|

As defined in the Stock Trader’s Almanac, the Santa Claus Rally (SCR) is the propensity for the S&P 500 to rally the last five trading days of December and the first two of January an average of 1.4% since 1950.

The lack of a rally can be a preliminary indicator of tough times to come. This was certainly the case in 2008 and 2000. A 4.0% decline in 2000 foreshadowed the bursting of the tech bubble and a 2.5% loss in 2008 preceded the second worst bear market in history.

Including this year, Santa has paid Wall Street a visit 53 times since 1950. Of the previous 52 occasions, January’s First Five Days (FFD) and the January Barometer (JB) were both up 28 times. When all three indicators were positive, the full year was positive 26 times (92.9% of the time) with an average gain of 17.8% in all years.

A positive SCR is encouraging and further clarity will be gained when January’s First Five Days Early Warning System (page 14, STA 2017) gives its reading next week and when the January Barometer (page 16, STA 2017) reports at month’s end. A positive First Five Days and January Barometer would certainly boost prospects for full-year 2017. The December Low Indicator (2017 STA, page 44) should also be watched with the line in the sand at the Dow’s December Closing Low of 19170.42 on 12/2/16.

|

The Extraordinary “January Barometer”

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

January 03, 2017

|

|

|

|

Devised by Yale Hirsch in 1972, the January Barometer (JB) has registered nine major errors since 1950 for an 86.4% accuracy ratio. This indicator adheres to propensity that as the S&P 500 goes in January, so goes the year. Of the nine major errors Vietnam affected 1966 and 1968. 1982 saw the start of a major bull market in August. Two January rate cuts and 9/11 affected 2001.The market in January 2003 was held down by the anticipation of military action in Iraq. The second worst bear market since 1900 ended in March of 2009 and Federal Reserve intervention influenced 2010 and 2014. Last year, DJIA slipped into an

official Ned Davis bear market in January. Including the eight flat years yields a .742 batting average.

As the opening of the New Year, January is host to many important events, indicators and recurring market patterns. U.S. Presidents are inaugurated and present State of the Union Addresses. New Congresses convene. Financial analysts release annual forecasts. Residents of earth return to work and school en mass after holiday celebrations. On January’s second trading day, the results of the official Santa Claus Rally are known and on the fifth trading day the First Five Days early warning system sounds off, but it is the whole-month gain or loss of the S&P 500 that triggers our January Barometer.

And yet for some reason, every February or sooner if January starts off poorly our January Barometer gets raked over the coals and every attempt at disparaging this faithful indicator comes up lame. It never ceases to amaze us how our intelligent and insightful colleagues, that we have the utmost professional respect for and many of whom we consider friends, completely and utterly miss the point and fallaciously argue the shortcomings of the January Barometer. However, this year we are not waiting until this happens again. Instead, here is why the January Barometer is relevant and important.

1933 “Lame Duck” Amendment—Why JB Works

Many detractors refuse to accept the fact the January Barometer exists for one reason and for one reason only: the Twentieth “Lame Duck” Amendment to the Constitution. Passage of the Twentieth Amendment in 1933 created the January Barometer. Since then it has essentially been “As January goes, so goes the year.” January’s direction has correctly forecasted the major trend for the market in many of the subsequent years.

Prior to 1934, newly elected Senators and Representatives did not take office until December of the following year, 13 months later (except when new Presidents were inaugurated). Defeated Congressmen stayed in Congress for all of the following session. They were known as “lame ducks.”

Since 1934, Congress convenes in the first week of January and includes those members newly elected the previous November. Inauguration Day was also moved up from March 4 to January 20.

January’s prognostic power is attributed to the host of important events transpiring during the month: new Congresses convene; the President gives the State of the Union message, presents the annual budget and sets national goals and priorities.

These events clearly affect our economy and Wall Street and much of the world. Add to that January’s increased cash inflows, portfolio adjustments and market strategizing and it becomes apparent how prophetic January can be. Switch these events to any other month and chances are the January Barometer would become a memory.

JB vs. All

Over the years there has been much debate regarding the efficacy of our January Barometer. Skeptics never relent and we don’t rest on our laurels. Disbelievers in the January Barometer continue to point to the fact that we include January’s S&P 500 change in the full-year results and that detracts from the January Barometer’s predicative power for the rest of the year. Others attempt to discredit the January Barometer by going further back in time: to 1925 or 1897 or some other arbitrary year.

After the Lame Duck Amendment was ratified in 1934 it took a few years for the Democrat’s heavy congressional margins to even out and for the impact of this tectonic governing shift to take effect. In 1935, 1936 and 1937, the Democrats already had the most lopsided Congressional margins in history, so when these Congresses convened it was anticlimactic. Hence our January Barometer starts in 1938.

In light of all this debate and skepticism we have compared the January Barometer results along with the full year results, the following eleven months results, and the subsequent twelve months results to all other “Monthly Barometers” using the Dow Jones Industrials, the S&P 500 and the NASDAQ Composite.

Here’s what we found going back to 1938. There were only 10 major errors. In addition to the nine major errors detailed above: in 1946 the market dropped sharply after the Employment Act was passed by Congress, overriding Truman’s veto, and Congress authorized $12 billion for the Marshall Plan.

Including these 10 major errors, the accuracy ratio is 87.3% for the 79-year period. Including the 9 flat year errors (less than +/– 5%) the ratio is 75.9% — still effective. For the benefit of the skeptics, the accuracy ratio calculated on the performance of the following 11 months is still solid. Including all errors — major and flat years — the ratio is still a respectable 68.4%.

Now for the even better news: In the 48 up Januarys there were only 3 major errors for a 93.8% accuracy ratio. These years went on to post 16.1% average full-year gains and 11.7% February-to-December gains.

Let’s compare the January Barometer to all other “Monthly Barometers.” For the accompanying table we went back to 1938 for the S&P 500 and DJIA — the year in which the January Barometer came to life — and back to 1971 for NASDAQ when that index took its current form.

The accuracy ratios listed are based on whether or not the given month’s move — up or down — was followed by a move in the same direction for the whole period. For example, in the 79 years of data for the S&P 500 for the January Barometer, 60 years moved in the same direction for 75.9% accuracy.

The Calendar Year ratio is based on the month’s percent change and the whole year’s percent change; i.e., we compare December 2015’s percent change to the change for 2015 as a whole. By contrast the 11-month ratio compares the month’s move to the move of the following eleven months. February’s change is compared to the change from March to January. The 12-month change compares the month’s change to the following twelve months. February’s change is compared to the change from March to the next February.

Though the January Barometer is based on the S&P 500 we thought it would clear the air to look at the other two major averages as well. You can see for yourself in the table that no other month comes close to January in forecasting prowess over the longer term.

There are a few interesting anomalies to point out though. On a calendar year basis DJIA in January is slightly better than the S&P. 2011 is a perfect example of how the DJIA just edges out for the year while the S&P does not. For NASDAQ April, September and November stick out as well on a calendar year basis, but these months are well into the year, and the point is to know how the year might pan out following January, not April, September or November. And no other month has any basis for being a barometer. January is loaded with reasons.

Being the first month of the year it is the time when people readjust their portfolios, rethink their outlook for the coming year and try to make a fresh start. There is also an increase in cash that flows into the market in January, making market direction even more important. Then there is all the information Wall Street has to digest: The State of the Union Address, FOMC meetings, 4th quarter GDP, earnings and the plethora of other economic and market data.

Myths Dispelled

In recent years new myths and/or areas of confusion have come to light. One of the biggest errors is the notion that the January Barometer is a stand alone indicator that can be used to base all of your investment decisions for the coming year on. This is simply not true and we have never claimed that the January Barometer should or could be used in this manner. The January Barometer is intended to be used in conjunction with all available data deemed relevant to either confirm or call into question your assessment of the market. No single indicator is 100% accurate so no single indicator should ever be considered in a vacuum. The January Barometer is not an exception to this.

Another myth is that the January Barometer is completely useless. Those that believe this like to point out that simply expecting the market to be higher by the end of the year is just as accurate as the January Barometer. Statistically, they are just about right. In the 79-year history examined in this article, there were only 23 full-year declines. So yes, the S&P 500 has posted annual gains 70.9% of the time since 1938. What is missing from this argument is the fact that when January was positive, the full year was also positive 87.5% of the time and when January was down the year was down 58.1% of the time. These are not the near perfect outcomes that true statisticians prefer, but once again, the January Barometer was not intended to be used in a vacuum.