|

September 2017 Trading & Investment Strategy

|

|

By:

|

August 31, 2017

|

|

|

|

|

Market at a Glance - 8/31/2017

|

|

By:

Christopher Mistal

|

--

|

|

|

|

8/30/2017: Dow 21892.43 | S&P 2457.59 | NASDAQ 6368.31 | Russell 2K 1391.32 | NYSE 11805.07 | Value Line Arith 5645.59

Psychological: Confused. According to the most recent

Investors Intelligence Advisors Sentiment survey bulls are at 49.5%, bears are at 19.1% and correction is at 31.4%. Although there are substantially less bulls now than there were in July, they are slightly outnumbered by bears and those expecting a correction. This nearly even split suggests now is not a good buying opportunity.

Fundamental: Stalled. Little has changed over the last five weeks. Q2 GDP has been revised up to 3%, but the longer-term trajectory still remains murky. The unemployment rate remains in the low 4% range and existing home sales fell to their lowest level in a year in July. The Trump Administration has put the brakes on new regulation and rolled back some, but major policy initiatives have still not become law. At some point stock market valuations could matter again.

Technical: Bouncing. At mid-August, Stochastic, relative strength and MACD indicators applied to DJIA, S&P 500 and NASDAQ were all negative and at or near oversold levels. This set the stage for the rebound occurring now. Previous all-time closing highs loom large and are likely to provide significant resistance. If all three indexes can breakout to new highs together, then the rally has a fair chance of continuing otherwise the rally will likely stall.

Monetary: 1.00-1.25%. Fed Chair Yellen’s highly anticipated speech at Jackson Hole focused less on monetary policy and more on financial regulation reform. Her view that any changes should be “modest” likely means she will be replaced when her term ends in February as the Trump Administration would prefer a more aggressive roll back. The uncertainty created by who will replace her could ultimately have a negative impact on the market.

Seasonal: Bearish. Since 1950, September is the worst performing month of the year for DJIA, S&P 500, NASDAQ (since 1971), Russell 1000, and Russell 2000 (since 1979). September’s rankings improve modestly in post-election years, but average performance is still negative across the board.

|

September Outlook: Worst Month Primed for Overdue 10% Correction

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

--

|

|

|

|

As the unofficial close of summer nears this market that has been unwilling to go down since last fall may be running into a host of obstacles that could lead to a typical September/October correction of at least 10% and potentially more. It has now been 567 calendar days since the last 10% correction, which is nearly two months past the

average 515 days between corrections. While the topping process has been elusive up until now, several factors are lining up that could force the market lower.

First off, it’s

September, the most tumultuous month of the year highly prone to corrections and market declines, especially at month end and the week after Triple Witching. With the market seemingly refusing to correct since the election, it is set up for the typical late-Q3/early-Q4 swoon.

Sentiment remains complacent with bulls running near 50%. There are bears and skeptics out there, but “buying the dip” continues to be the norm. Technicals and internals are less than robust with the indices leaking higher on a dwindling Advance-Decline line, decreasing new highs and expanding new lows. Reports of late cycle employment, productivity and housing data plateauing and beginning to roll over are also concerning.

News from the geopolitical front is anything but encouraging. The White House has not been able to deal with anything on its agenda from healthcare reform to tax reform to infrastructure spending or much else for that matter. The standoff with North Korea is not encouraging and now the Hurricane Harvey disaster will require a lot of attention and money out of the feds.

Meanwhile our

Three Peaks and a Domed House Top Pattern (3PDH) scenario continues to play out. We may not see a full completion of the pattern back to the February 2016 point 14 low, but a 10% correction back to turn-of-the-year levels is quite likely and a full blown bear is not out of the realm of possibilities, but that make not happen until next year. Not on the 3PDH chart below we have moved point 23 to the August 7 high.

Pulse of the Market

As August comes to a close, DJIA (S&P 500, NASDAQ and Russell 2000) have all recovered from mid-month lows (1) and with the exception of S&P 500 and Russell 2000 are poised to finish with modest full-month gains. Strength over the past two weeks is on the verge of turning DJIA’s faster and slower moving MACD indicators (2) positive. Earlier in the month, DJIA traded above 22,000 for the first time ever and that old high could prove a challenge for the current rally.

DJIA (3) and has recorded a weekly gain in ten of the last fourteen weeks, S&P 500 (5) has logged nine weekly gains over the same time period and both are on course for another gain this week. During this streak of weekly strength, traders and investors have not shied away from buying on Fridays. DJIA has been up ten of the last fourteen (4). But, follow through on subsequent Mondays has been spotty with DJIA down seven and up seven. NASDAQ has not fared as well recently with four weekly losses out of the last five (6).

NYSE Weekly Advancers and Decliners (7) continue to be mostly a mixed bag. One exception to this observation occurred during the week ending August 11 when Decliners heavily outnumbered Advancers, 2527 to 561. This was the greatest number of Weekly Decliners since January 15, 2016. At that time, the market did not hit bottom until February 11.

After increasing throughout most of July, NYSE Weekly New Highs (8) quickly dried up in August while NYSE Weekly New Lows quickly expanded. Last week (and most likely this week) that trend reversed. As is often the case in later stages of a bull market, the number of Weekly New Highs tends to fade with each new fractionally higher, high. This fading participation generally warrants caution.

The spread between the 90-day Treasury Rate and the 30-Year Treasury Rate (9) appears to be bottoming out. Mid-month weakness triggered a retreat in short-term rates that outpaced the decline in long-term rates. Continued flattening of the yield could be an issue for banks and potentially even the Fed.

|

September Almanac: Poorest Performing Month

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

August 24, 2017

|

|

|

|

Since 1950, September is the worst performing month of the year for DJIA (–0.8%), S&P 500 (–0.5%), NASDAQ (–0.5%) (since 1971), Russell 1000 (–0.6%), and Russell 2000 (–0.5%) (since 1979). September was creamed four years straight from 1999-2002 after four solid years from 1995-1998 during the dot.com bubble madness. In post-election years, September’s overall rank improves modestly in post-election years going back to 1953 (second, third or fourth worst month depending on index). Average losses are little changed. Although September 2001 does influence the average declines, the fact remains DJIA and S&P 500 have declined in 9 of the last 16 post-election year Septembers.

![[September Post-Election Year Stats]](/UploadedImage/AIN_0917_20170824_September_PE_table.jpg)

Although the month has opened strong 13 of the last 22 years, once tans begin to fade and the new school year begins, fund managers tend to clean house as the end of the third quarter approaches, causing some nasty selloffs near month-end over the years. Recent substantial declines occurred following the terrorist attacks in 2001 (Dow: -11.1%) and the collapse of Lehman Brothers in 2008 (Dow: -6.0%). Solid September gains in 2010; DJIA’s 7.7%, S&P 500’s 8.8% were the best since 1939, but the month suffered nearly the same magnitude declines in 2011, confirming that September can be a volatile month.

September Triple Witching week is generally bullish with S&P 500 advancing twice as many times as declining since 1990, but is has suffered some sizable losses. Triple-Witching Friday was essentially a sure bet for the bulls from 2004 to 2011, but has been a loser four or five of the last five years, depending on index. The week after Triple Witching has been brutal, down 22 of the last 27, averaging an S&P 500 loss of 1.0%. In 2011, DJIA and S&P 500 both lost in excess of 6%.

In recent years, Labor Day has become the unofficial end of summer and the three-day weekend has become prime vacation time for many. Business activity ahead of the holiday was more energetic in the old days. From 1950 through 1977 the three days before Labor Day pushed the DJIA higher in twenty-five of twenty-eight years. Bullishness has since shifted to favor the two days after the holiday as opposed to the days before. DJIA has gained in 16 of the last 23 Tuesdays and 16 of the last 22 Wednesdays following Labor Day.

| September (1950-2016) |

| |

DJI |

SP500 |

NASDAQ |

Russell

1K |

Russell 2K |

| Rank |

|

12 |

|

12 |

|

12 |

|

12 |

|

12 |

| #

Up |

|

26 |

|

29 |

|

25 |

|

18 |

|

21 |

| #

Down |

|

41 |

|

37 |

|

21 |

|

20 |

|

17 |

| Average

% |

|

-0.8 |

|

-0.5 |

|

-0.5 |

|

-0.6 |

|

-0.5 |

| 4-Year Presidential Election Cycle Performance

by % |

| Post-Election |

|

-0.7 |

|

-0.6 |

|

-0.3 |

|

-0.7 |

|

-0.7 |

| Mid-Term |

|

-1.0 |

|

-0.4 |

|

-0.8 |

|

-1.1 |

|

-0.6 |

| Pre-Election |

|

-1.0 |

|

-0.9 |

|

-0.9 |

|

-1.0 |

|

-1.6 |

| Election |

|

-0.4 |

|

-0.2 |

|

-0.04 |

|

0.2 |

|

0.8 |

| Best & Worst September by % |

| Best |

2010 |

7.7 |

2010 |

8.8 |

1998 |

13.0 |

2010 |

9.0 |

2010 |

12.3 |

| Worst |

2002 |

-12.4 |

1974 |

-11.9 |

2001 |

-17.0 |

2002 |

-10.9 |

2001 |

-13.6 |

| September Weeks by % |

| Best |

9/28/01 |

7.4 |

9/28/01 |

7.8 |

9/16/11 |

6.3 |

9/28/01 |

7.6 |

9/28/01 |

6.9 |

| Worst |

9/21/01 |

-14.3 |

9/21/01 |

-11.6 |

9/21/01 |

-16.1 |

9/21/01 |

-11.7 |

9/21/01 |

-14.0 |

| September Days by % |

| Best |

9/8/98 |

5.0 |

9/30/08 |

5.4 |

9/8/98 |

6.0 |

9/30/08 |

5.3 |

9/18/08 |

7.0 |

| Worst |

9/17/01 |

-7.1 |

9/29/08 |

-8.8 |

9/29/08 |

-9.1 |

9/29/08 |

-8.7 |

9/29/08 |

-6.7 |

| First Trading Day of Expiration Week: 1990-2016 |

| #Up-#Down |

|

18-9 |

|

15-12 |

|

11-16 |

|

15-12 |

|

12-15 |

| Streak |

|

U1 |

|

U1 |

|

U1 |

|

U1 |

|

U1 |

| Avg

% |

|

-0.1 |

|

-0.1 |

|

-0.3 |

|

-0.1 |

|

-0.2 |

| Options Expiration Day: 1990-2016 |

| #Up-#Down |

|

14-13 |

|

15-12 |

|

17-10 |

|

16-11 |

|

18-9 |

| Streak |

|

D2 |

|

D5 |

|

D4 |

|

D4 |

|

D4 |

| Avg

% |

|

0.03 |

|

0.1 |

|

0.1 |

|

0.1 |

|

0.2 |

| Options Expiration Week: 1990-2016 |

| #Up-#Down |

|

16-11 |

|

18-9 |

|

18-9 |

|

18-9 |

|

17-10 |

| Streak |

|

U1 |

|

U1 |

|

U4 |

|

U1 |

|

U2 |

| Avg

% |

|

0.01 |

|

0.2 |

|

0.2 |

|

0.2 |

|

0.3 |

| Week After Options Expiration: 1990-2016 |

| #Up-#Down |

|

6-21 |

|

5-22 |

|

10-17 |

|

6-21 |

|

8-19 |

| Streak |

|

U1 |

|

U1 |

|

U1 |

|

U1 |

|

U1 |

| Avg

% |

|

-1.1 |

|

-1.0 |

|

-1.0 |

|

-1.0 |

|

-1.5 |

| September 2017 Bullish Days: Data 1996-2016 |

| |

5,

8, 12, 18, 27 |

12,

13, 18, 27, 28 |

1,

8, 12-14 |

1,

12, 13, 18 |

1, 7, 12, 13 |

| |

|

|

18,

20 |

27,

28 |

18, 28 |

| September 2017 Bearish Days: Data 1996-2016 |

| |

19,

22, 25, 29 |

22,

25, 29 |

15,

22, 29 |

22,

25, 29 |

20, 22, 26 |

| |

|

|

|

|

|

|

September 2017 Strategy Calendar

|

|

By:

Christopher Mistal

|

August 24, 2017

|

|

|

|

|

Stock Portfolio Updates: Short Positions Begin Paying Off

|

|

By:

Christopher Mistal

|

August 17, 2017

|

|

|

|

Right on seasonal cue we are once again witnessing a pickup in market volatility. Today alone the CBOE Volatility index (VIX) jumped over 30% to close over 15. After reaching historic lows as recently as late July, we could likely see larger than usual spikes in the coming weeks to months. Fresh struggles for the Trump Administration combined with heightened tensions on the geopolitical stage, and domestically, are throwing a wrench in all the goldilocks economic outlooks.

Based upon the following weekly bar chart of the VIX with its corresponding seasonal pattern displayed in the lower pane of the chart, market volatility is likely to continue to escalate at least until sometime in early October. Last year, Presidential Election uncertainties keep the VIX elevated well into November.

Ever since issuing our Seasonal MACD Sell Signal for DJIA and S&P 500 in May and in June for NASDAQ we have been taking steps to prepare for a stretch of market volatility and market weakness in the Almanac Investor Stock and ETF Portfolios. We missed some market upside by exiting in May/June, but we are already beginning to see the benefits of taking defensive moves then.

Many of our recently established short stock positions are performing well while gold, silver and bond related positions in the ETF portfolio are also performing as anticipated. We believe the portfolios remain well-positioned to weather market volatility and expect to maintain the current posture until our Seasonal MACD Buy Signal confirms when it is safe to be more aggressive sometime after October 1.

Stock Portfolio Updates

Over the past month since last update, S&P 500 climbed 1.0% higher while Russell 2000 slipped 2.9% as of yesterday’s close. The Almanac Investor Stock Portfolio’s blend of cash, long and short positions climbed 1.2% over the same time period excluding dividends and any trading costs. Our Large-Cap portfolio performed best, up 4.7% while Mid-Caps climbed 2.4%. Small-Caps edged 0.1% higher.

Four out of five long positions in the Small-Cap portfolio slipped modestly lower in tandem with Russell 2000 weakness. As illustrated on page 110 of the 50th Anniversary Stock Trader’s Almanac 2017, top chart, small-caps have historically lagged large cap-performance throughout the month of July and into August. This weakness usually briefly reverses around the Labor Day holiday, but is typically short-lived as end-of-Q3 portfolio restructuring triggers small-cap weakness once again.

Unlike last month, Rocky Mountain Chocolate Factory (RMCF) and our two small-cap shorts, PDF Solutions (PDFS) and Ascendis Pharma (ASND), pushed the small-cap portion of the portfolio higher. PDFS second quarter earnings report was the key driver in its decline as it missed both earnings and revenues estimates by relatively wide margins. All small-cap positions are on Hold.

Second best overall Mid-Cap performance was not completely devoid of pain. Two out of three long positions slipped modestly lower. Only Scotts Miracle-Gro (SMG) climbed higher. Furthermore, two short trades, Impax Laboratories (IPXL) and Spark Therapeutics (ONCE) traded up to resistance, were added to the portfolio and continued to climb higher. IPXL and ONCE were both stopped out for 9% losses. Other Mid-Cap short positions fared much better. Blueprint Med (BPMC) now has a 16.2% gain and Ironwood Pharma (IRWD) is showing a 24.5% profit. BEL, HALO and MLNX are also in the green. The lone losing open mid-cap position is Foundation Med (FMI). All mid-cap positions are on Hold.

Large-caps continue to dominate. UnitedHealth (UNH), Southern Copper (SCCO) and Arista Networks (ANET) all continued to move higher over the past month. Even The Hershey Company (HSY) climbed modestly higher, although it is still down from its original purchase price. UNH, SCCO, ANET and HSY are all on Hold. Due to recent gains, stop losses for UNH, SCCO and ANET have also been raised.

Our four large-cap short trade ideas are mixed, two are up and two are down. Mattel Inc (MAT) and Mosaic (MOS) are working well, both showing double digit gains. Sealed Air Corp (SEE) and Tesla Inc (TSLA) are both modest losers. SEE has been stuck in a trading range between approximately $42 and $50 for over a year so its downside could be limited unless it breaks down through $42 on heavy volume. SEE’s upside appears limited by valuation and declining annual revenues.

The TSLA short trade had been working rather well until its Q2 report was released. Top and bottom line numbers were better than expected although the company still burned through $1.16 billion in cash in the quarter. TSLA could bounce higher, but it appears at least some of the momentum that propelled the stock to nearly $400 per share earlier in the year is gone. The company is going to be facing some stiff competition in the very near future and not just from other auto makers, but also in the battery market. TSLA short trade is on Hold.

All other positions, not mentioned above, are currently on Hold. Please refer to the updated portfolio table below for Current Advice about each specific position. Please note that many stop losses have been updated.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in, ANET, BUSE, CCS, HSY, MHO, RMCF and SMG.

|

Bulls Flee The Street, Market Succumbs to Cold War-Style Saber Rattling

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

August 10, 2017

|

|

|

|

As the market appears to be succumbing to the negative news flow and sits on the brink of a steeper decline we hope you have been heeding our warnings of the market’s increased vulnerability to this sort of thing during this perennially weak period of the year from August to October. The major averages are only off about 2-3% since their recent respective all-time highs, but most of that came today, so there is time to protect your portfolio with further defensive maneuvers if need be.

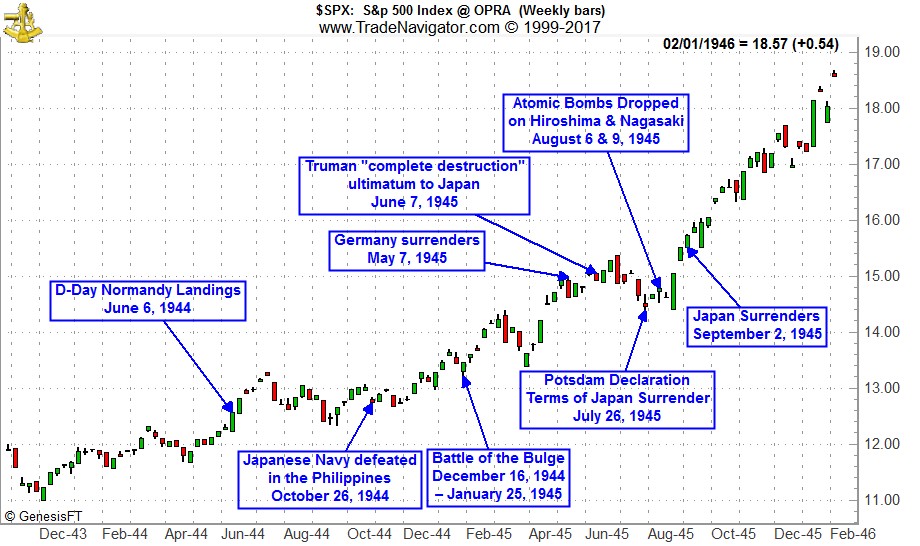

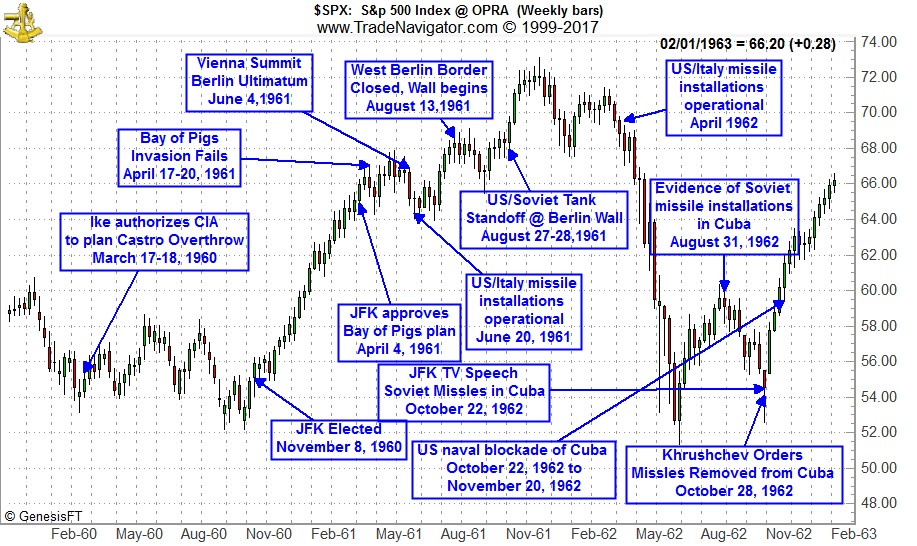

There’s been a lot of chatter comparing Trump’s “Fire and Fury” threat to North Korea with Truman’s Ultimatum to Japan on June 7, 1945 and the subsequent Potsdam Declaration defining the terms of Japan’s surrender. JFK’s battle of words and strategy with Khrushchev during the Cold War revolving around the Cuban Missile Crisis and the Berlin Wall have not been discussed as much recently, but are of similar ilk.

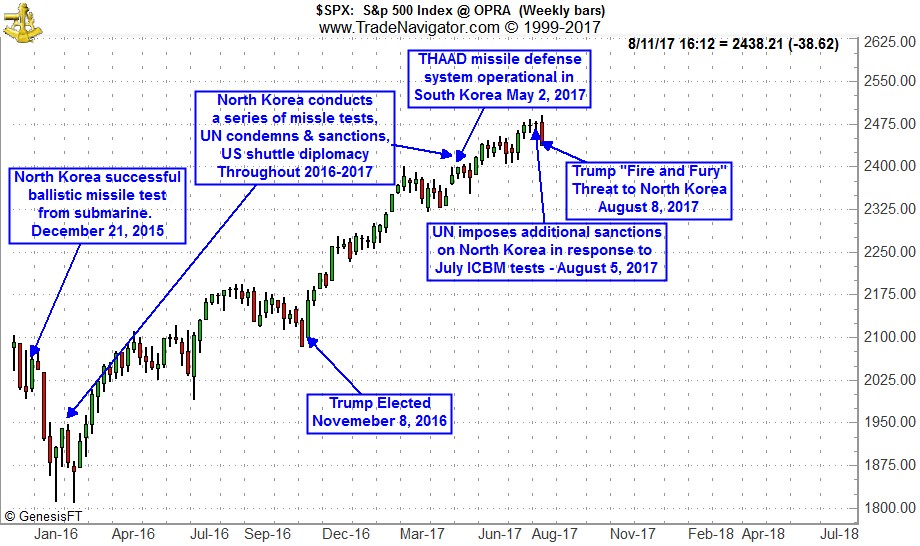

So we put together a few charts with facts and events plotted out against the S&P 500 to see what this latest standoff with North Korea could mean for stocks. Today’s selloff suggests the market is starting to take this current foreign policy conundrum more seriously.

In the case of Truman and Japan, the world had been at war for several grueling years and the market was rising steadily for three years from the 1942 low by the time Truman warned Japan in June of 1945. When JFK came in the market had bottomed just before he won the election in October 1960 and was rallying on his election.

The murkiness of Cold War machinations and the convoluted chain of events let the market rally until late 1961 to early 1962 until the impact of the newly erected Berlin Wall and U.S. missile installations in Italy and Turkey pissed the Soviets off that they put their own missile installations in Cuba. And as JFK and Khrushchev played real life Stratego the market fell apart.

People forget that North and South Korea are still at war and have been since the 1950s. They have been living with a cease fire and the protective DMZ ever since. Precisely how big of a threat does North Korea actually present to the U.S. and its allies is a difficult question to answer. But if this goes on it seems like it would play out more like the Cuban Missile Crisis, since we are currently not at war and the market has been on a tear under a new president who won in a tight race like JFK.

The market’s response today, DJIA down 0.93%, S&P 500 off 1.45% and NASDAQ shedding 2.13% does not appear to confirm North Korea as a major, significant or imminent threat. Today’s declines are not even the worst day of the year, May 17th was the worst. Perhaps the real reason why the market has avoided “panic selling” is because the U.S. most likely has more than sufficient missile defense capabilities in place. Yes, we can be concerned that these systems have not actually shot down a missile launched by North Korea, but they have had many successful tests.

Just searching “ballistic missile defense” on the web turns up a wide array of platforms and systems readily available. The U.S. has land based systems and sea-based capabilities. Terminal High Altitude Area Defense (THAAD) missile defense system is a land based system. The older Patriot system (recall Gulf War I) also has land-based anti-ballistic missile capabilities. Our sea-based system is called Aegis Ballistic Missile Defense System (ABMD) and it is deployed on at least five Ticonderoga class cruisers and twenty-five Arleigh Burke class destroyers. It is probably safe to assume that at least one or two of these Navy assets are not that far from North Korea.

We could debate the known and tested capabilities of these missile defense systems along with their potential effectiveness, but as a U.S. Navy veteran, Chris is also confident that their full capabilities are most likely not fully in the public domain. If and when the time comes and they are called upon to neutralize an incoming threat, they will most likely succeed. To even get to the point where our missile defense systems are called upon, a lot must go technically perfect for North Korea as well and this is something they have yet to repeatedly demonstrate.

Our Tactical Seasonal Switching Strategy currently has the Almanac Investor Stock and ETF Portfolios in a defensive posture with a mixture of long, short and defensive positions along with some cash. Well-chosen defensive positions in healthcare, utilities and bonds have ensured the portfolios have not fallen meaningfully behind the major indexes during their grind modestly higher over the past few months while still being well-aligned to survive any further weakness lurking ahead. History may not repeat itself exactly, but there sure are numerous similarities throughout. Our Seasonal MACD Buy Signal will confirm when it is safe to be more aggressive sometime after October 1.

|

Seasonal Sector Trades: Swiss Franc Mid-Summer Rally

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

August 03, 2017

|

|

|

|

The Swiss franc correlates well with gold’s price moves. Gold is generally strong in this time period, so traders may want to watch this relationship between gold and the Swiss franc. The “Swissie”, which is the trader talk for the currency, has been a safe haven currency in the past, especially during times of financial and geopolitical instability. Due to Switzerland’s neutral stance and ability to close its borders, it has been well protected, as history shows.

![[August Long Swiss Franc (December) Trade History Table]](/UploadedImage/AIN_0917_20170803_SF_History.jpg)

However, under normal market conditions, the “Swissie” does demonstrate some repeatable patterns against the U.S. dollar. One tendency for a relatively predictable move is in August. Traders want to go long this seasonal best trade on or about August 8 and hold until right around mid-October. In the 42-year history of this trade, it has worked 29 years, for a success rate of 69.0%. This trade’s worst loss, in 2011, was the result of central bank intervention and could have been avoided through the use of technical indicators or a basic trailing stop loss.

![[Swiss Franc (SN) Weekly Bars and Seasonal Trend Chart]](/UploadedImage/AIN_0917_20170803_SF_Seasonal.jpg)

The chart above shows the front-month, continuously linked, non-adjusted Swiss franc futures weekly price bars on top and the line in the lower pane shows its 42-year average seasonal price move. Seasonal strength beginning in early August and lasting through mid-October is shaded in yellow. Last year this trade was profitable in the early stages, but faded as the U.S. dollar began to rally ahead of Election Day. This year the Swiss France has been steadily climbing higher as the U.S. dollar has been in a downtrend since peaking in early January.

CurrencyShares Swiss Franc (FXF) is an easy and cost effective way to execute this trade outside of the forex market. FXF has just under $160 million in assets and an expense ratio of 0.40%. Trading volume can be on the light side at times, but does pick up nicely when the Swiss France makes a move.

Currently, Stochastic, relative strength and MACD indicators are negative. FXF had a brisk run from just above $94 in mid-May to over $100 in mid-July. Since mid-July, FXF has pulled back and appears to be looking for support. FXF could be considered on dips below $97.00 with corresponding signs of improvement from its technical indicators. If purchased, an initial stop loss at $95.25 is suggested. This trade idea will be tracked in the Almanac Investor ETF Portfolio.

|

ETF Trades: Energy’s Bounce Likely Over

|

|

By:

Christopher Mistal

|

August 03, 2017

|

|

|

|

Oil’s historically weak seasonality begins in the beginning of September, usually lasts until the end of November and is based upon the AMEX Oil index (XOI). The average price decline of XOI during this period over the last 15 years has been 4.7%. This trade appears to be setting up well this year although a little earlier than usual. First, MACD, stochastic and relative strength indicators applied to XOI are all on the verge of turning negative. Second, crude oils bounce off its mid-June low appears extended and on the verge of stalling. And third, inventories are still plentiful.

Aggressive traders may consider Direxion Energy Bear 3x (ERY) or ProShares UltraShort Oil & Gas (DUG) to take advantage of the sectors historically weak period however, both of these funds are leveraged and volatility is magnified. An outright short position in SPDR Energy (XLE) is the path we will take in the Almanac Investor ETF Portfolio. XLE has been trending lower since last December. Like crude oil, XLE has also enjoyed a modest bounce, but it’s stochastic, relative strength and MACD indicators are all turning negative, confirming the bounce is likely over. XLE could be shorted near resistance around $68.07 or on a breakdown through support around $64.23. A stop loss around $69.40 is suggested and profits can be taken if XLE falls below $55.

ETF Portfolio Updates

Although DJIA, S&P 500, NASDAQ and Russell 2000 have climbed to new all-time highs, they have only been marginally higher than their respective previous highs. A few percentage points of potential gains have been left on the table by our Tactical Seasonal Switching Strategy, our defensive positions have been holding up well. XLP, XLV, TLT, XLU, AGG and GLD all have slight to modest gains at yesterday’s close. iShares Silver (SLV) has been improving lately and the loss on this position has shrunk to 2.5%. All seven of these “Worst Months” defensive positions are on Hold.

Now that the worst two consecutive month span (August to September) has arrived it would not be surprising to see the market take a breather or even pullback. Should the market pullback, then the defensive positions will likely perform their jobs even better than they have during the recent move higher.

Short trades in SPDR Materials (XLB), iShares DJ Transports (IYT), SPDR Financials (XLF) and First Trust Natural Gas (FCG) are currently underwater. The biggest loss is owned by XLF, off 7.2% since being presented. XLB, IYT, XLF and FCG are all on Hold.

Last month’s new ETF Trade ideas, in biotech and high-tech (IBB & IYW) have not yet traded below their respective buy limits. The buy limits are intentionally well below current levels as we would like to pick them up during any bout of weakness that could occur sometime during the next two months. IBB and IYW are only fractionally higher than one month ago so we have not missed any major break out higher. IBB and IYW can still be considered on dips below their buy limits.

The second half of July S&P 500 short trade using ProShares UltraShort S&P 500 (SDS) was never executed as SPDR S&P 500 (SPY) did not fall below our trigger price. The SDS trade is now cancelled.

All other positions not mentioned above are currently on Hold. Please see table below for current advice and stop losses.

Disclosure Note: At press time, officers of the Hirsch Organization, or accounts they control held positions in AGG, COW, DBA, GLD, SLV, TLT, XLP and XLV.