|

Market at a Glance - 12/16/2021

|

|

By:

Christopher Mistal

|

December 16, 2021

|

|

|

|

12/16/2021: Dow 35897.64 | S&P 4668.67 | NASDAQ 15180.43 | Russell 2K 2152.46 | NYSE 16849.09 | Value Line Arith 9563.33

Seasonal: Bullish. January is the fifth best month for DJIA and S&P 500 since 1950. #1 NASDAQ month since 1971. However, since 2000, January has been notably weaker and in Midterm years average performance for DJIA and S&P 500 turns negative. Santa Claus Rally ends on January 4, First Five Days concludes on January 7 and lastly the January Barometer at month’s end. All three combined form our January Trifecta Indicator. Results for all will be sent via email Alert as they conclude.

Fundamental: Mixed. Q4 GDP is now estimated to be 7.2% by the Atlanta Fed’s GDPNow model, down from earlier estimates. Inflation metrics are elevated and running at multi-decade highs. Omicron variant is spreading rapidly and could lead to further supply chain disruptions. However, employment metrics remain positive and trending in the favorable direction while corporate earnings have been solid and are projected to remain so.

Technical: Rebounding. Late November/early December weakness hit DJIA hardest as it dipped below its 200-day moving average. S&P 500 and NASDAQ only briefly violated their respective 50-day moving averages. DJIA, S&P 500 and NASDAQ appear to be at various stages of forming “W” bottom patterns as long as the closing lows of December 1 are not breached. If all three are successful, then new highs are likely again in the near-term. Failure by one or more could lead to further weakness.

Monetary: 0 – 0.25%. In response to well-above target inflation, the Fed is accelerating the pace of tapering bond purchases and has also pulled forward its expectations for actual rate hikes. Should current trends remain relatively intact for the next year, the Fed could increase its lending rate to 0.75 to 1% during that period in small increments. Clearly higher than present, but from a historical perspective still low and substantially supportive.

Psychological: Neutral. According to

Investor’s Intelligence Advisors Sentiment survey Bullish advisors were at 43.9%. Correction advisors stand at 31.7% while Bearish advisors are at 24.4% as of their December 15 release. Thus far the typical year-end rally and its associated bullish sentiment is being challenged by the Fed and omicron. Where the market goes next is likely to be the direction sentiment takes. Current sentiment suggests a cautiously bullish stance.

|

2022 Forecast: Early Year High, Worst Six Months Correction & Q4 Rally

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

December 16, 2021

|

|

|

|

As we laid out in our

2021 Forecast Best Case scenario last year Covid-19 vaccines rolled out rather well in 2021 allowing lockdowns and most restrictions to be removed. Additional fiscal stimulus and an extremely accommodative Fed kept the economy humming and the market rallying. As illustrated in the chart of our Four Horsemen of the Economy below unemployment dove from the early pandemic peak rather precipitously. Leisure, hospitality and travel did not surge per se, but they sure did rebound.

With 10 trading days left in the year the market is on pace to deliver somewhere in the range of our Base and Best Case scenarios for 2021 with DJIA up 17.3% year-to-date at today’s close, S&P 500 up 24.3% and NASDAQ up 17.8%. That’s Best case for DJIA and S&P and Base Case for NASDAQ.

Omicron, inflation and the Fed’s tapering of its accommodative asset purchase program have been giving the market jitters the past few months and creating some volatility. Yesterday the Fed came clean on inflation being more persistent, but they also remained rather dovish, reiterating their measured pace of tapering asset purchases and patience with raising rates. This flexibility and reassurance that they are keen on curtailing rampant inflation while remaining supportive of the tentative economic outlook in the face of the enduring pandemic was bullish for Wall Street.

We are still bullish for yearend and anticipate the results of the Santa Claus Rally to help solidify our outlook for next year. The Santa Claus Rally has been in the news quite a lot lately as everyone is looking for an excuse to remain bullish. But what everyone is really referring to is the usual last half of December rally.

The Santa Claus Rally was defined by Yale Hirsch in 1972 as the last five trading days of the year and the first two trading days of the New Year. S&P 500 averages 1.3% over the 7-day period, but the real importance of the SCR is as our first seasonal indicator of the year ahead. As the late, great Yale Hirsch’s famous line states, “If Santa Claus should fail to call, bears may come to Broad and Wall.” Perhaps we should rename it “The Santa Claus Indicator?”

Our outlook for next year is less than sanguine. The market faces several obstacles for next year. Valuations are rich and year-over-year economic and corporate comparisons will be nowhere near as easy as this year versus the 2020 pandemic numbers. While the Fed has promised patience and a slow pace it is now rather clear that they will be making a concerted effort to remove quantitative easing by mid-year and begin slowly raising rates.

This punchbowl of free money sloshing around and the past decade or ZIRP (zero interest rate policy) has been feeding the bull and allowing valuations to get historically high. When the Fed Kool-Aid is gone the party is likely to quiet down. We are not expecting anything sinister or a deep nasty bear market, but a reversion to the mean and a decent correction cannot be ruled out.

Market internals and technicals are also concerning as we have failed to break out to new highs since the beginning of November – S&P did make a marginal new high, but it has not held yet. As the old Blood, Sweat & Tears classic track “Spinning Wheel” taught us: “What goes up must come down.”

There are also some geopolitical concerns as Russia masses troops on the Ukrainian border, basically challenging NATO and the U.S. In the recent video summit Putin and Xi Jinping exuded solidarity and planned a meet and greet at the Olympics. Meanwhile China continues to stiff-arm the U.S. on many fronts as the West snub China on the Olympics. Iran and North Korea continue building their nuclear capacity and foment hostility.

But imminent pressure on the market is most likely to come from Washington as is often the case in the battleground that is the midterm election year. President Biden’s approval rating has plummeted since the botched withdrawal from Afghanistan and many are not pleased with how he is handling international affairs and are opposed to Covid mandates. All this has hardened Republican opposition and is likely to boost their resolve and support in the midterm elections. And that is what makes midterm years a bottom picker’s paradise.

Midterm election years are usually a volatile year for stocks as Republicans and Democrats vie for control for Congress, especially under new presidents. Incumbent presidents usually lose seats in the House of Representatives (see 2022 STA page 28) and with the razor thin margins Dems have in both the House and Senate they could easily give up control of Congress in the midterms.

The chart here of the “S&P 500 Midterm Election Year Seasonal Pattern Since 1946” does not paint a rosy picture for 2022. Along with the pattern for all years and all midterm years since WWII we have overlaid the patterns for 1st term midterm years, Democratic president midterm years as well as the 2nd year of new Democratic presidents.

All midterm years average an S&P 500 gain of about 6%, Democratic president midterm years average about 4%, but 1st term midterm years average a loss of -0.6% and the 2nd year of new democratic presidents have been down -2.3% on average. All four tend to hit an early year high in April at the end of the Best Six Months with a low point during the Worst Six Months May-October.

Four Horseman of the Economy

Up until recently our lead horsemen DJIA along with S&P 500 and NASDAQ have been steadily making new highs, but we are seeing a few chinks in the armor as DJIA may be beginning to flatten out in the Four Horsemen Chart below. The major averages are likely to notch more new highs before they submit to the usual midterm year correction as market internals indicate some broader market weakness.

Consumer spending and retail sales have been hot for the past year, but have pulled back recently as inflation continues to rise. Consumer confidence is concerning as it failed to break above 100 and has been falling steadily since April. If Covid shifts to a more endemic phase like the flu managed with vaccines and therapies as many experts have been indicating and the economy and life continues to return to normal – and inflation cools down by mid-2022 as we expect – then confidence will return to the consumer.

On the good news front the Unemployment Rate continues to decline and remains at a healthy low level of 4.2% seasonally adjusted (3.9% not seasonally adjusted). The “Help Wanted” signs are everywhere and most anyone who wants a job can find one. Wages also continue to rise so when the holdouts from the pandemic come back to work they should be well paid. Initial jobless claims up-ticked recently off the post-pandemic low, but this does not concern us as the level remains low and the trend is lower.

Finally, our inflation horseman as measured by our 6-month exponential moving average calculations on the CPI and PPI have risen sharply since summer 2020, which should not come as a major shock considering the massive government spending and quantitative easing we’ve had over the past 18 months or so. CPI is at the highest levels since 1991 and PPI, fueled higher by supply chain disruptions, is at levels not seen since the peak of the stagflation days in early 1975. As Covid turns endemic and manageable and supply chains bottlenecks are loosened, the Fed should be able to quell inflation sometime in the middle of next year.

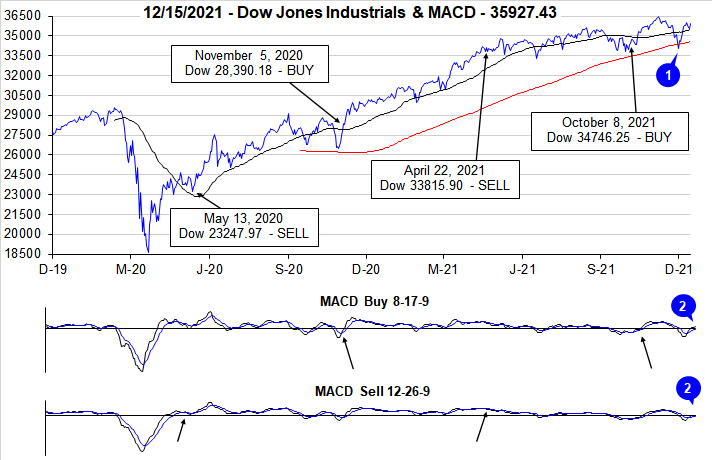

Pulse of the Market

Omicron and a pivot by the Fed towards a more hawkish policy stance spoiled this year’s typical late-November/early December market rally. DJIA began its retreat during the post-Thanksgiving, shortened trading day by tumbling over 900 points. Selling then accelerated the following week as Fed Chairman Powell gave testimony to members of Congress. At the trough of DJIA’s selloff it had plunged below its 50- and 200-day moving averages (1). This initial reaction to omicron and the Fed ultimately proved excessive and DJIA quickly rebounded to reclaim both moving averages and our key level of 35600. DJIA’s recent surge off its early-December lows has turned its faster and slower moving MACD indicators (2) bullishly positive. This could be an early indication that the typical yearend rally is resuming.

DJIA’s November weekly losing streak extended into December but came to an end on the third day at four weeks (3). Rather bullishly, DJIA’s losing streak did not have a Down Friday/Down Monday (DF/DM) occurrence. Historically DF/DM’s have preceded further losses over the next 90 calendar days. Although this does not completely rule out the possibility of additional weakness in the near-term, it does improve the odds that December finishes reasonably well. S&P 500 (4) and NASDAQ (5) fared better over the last five weeks with only three weekly declines.

As one may suspect, NYSE Weekly Advancers and Weekly Decliners (6) were consistent with the market’s overall moves. Decliners outnumbered Advancers during losing weeks while the opposite occurred in advancing weeks. Caution flags generally get raised when this relationship does not appear.

Weekly New Highs (7) continued to contract into December but may have turned the corner last week as New Lows hit their highest level since the start of the global pandemic last year in March. If the market does resume its pre-omicron rally look for confirmation from an expanding number of New Weekly Highs and shrinking New Weekly Lows. Last-minute tax-loss selling could inflate New Weekly Lows in the near-term which is fine as long as Highs are also increasing.

Despite inflation running at multi-decade highs and a Fed pivoting towards a hawkish policy stance, the 30-year Treasury yield (8) is still under 2%. It would seem that bond traders are the last group to insist that current inflation is not likely to last significantly longer or go higher. No matter the reason why, rates are still low when compared to historical levels. Low rates have generally been a positive for stocks, and as long as they remain subdued the market will likely manage to work its way through recent volatile trading.

2022 Forecast

Base Case: 65% Probability – Current trends remain reasonably intact through the end of 2022. Fed ends QE and starts slowly raising rates. Covid persists, but vaccines and therapeutics slowly push its impact toward manageable/managed. Expect an early year high, followed by a Worst Six Months correction and a Q4 rally. S&P 500 likely finishes 2022 up 5-10%. DJIA similar, NASDAQ modestly weaker.

Best Case: 25% Probability – Current trends see further substantial improvement throughout the year. Covid is managed; supply chains run smoothly pulling down inflation and Fed drifts towards a neutral bias. S&P 500 likely finishes 2022 up 10-17%. DJIA similar, NASDAQ modestly weaker.

Worst Case: 10% Probability – Current trends see significant deterioration, omicron and/or new variants delay managing Covid. Inflation does not moderate instead stagflation sets in. Mild bear market for S&P 500 with 2022 ending down 10-20%. DJIA similar, NASDAQ not as bad yet still negative.

We will be keeping you fully abreast of all readings from our three January Trifecta Indicators: Santa Claus Rally, First Five Days and the full-month January Barometer and will make adjustments on the close of January 2022. So unless the market crumbles quickly in the near term be prepared for gains to be harder to come by in 2022 and be ready to pounce on the usual midterm bottom. Longer term our May 2010 Super Boom Forecast when the Dow was around 10,000 for the Dow to reach 38,820 by the year 2025 may still be ahead of schedule. (Check out the update of the Super Boom Forecast in the April 11, 2019 subscriber alert on our website.)

Happy Holidays & Happy New Year, we wish you all a healthy and prosperous 2022!

|

January Almanac: Indicator Trifecta Could Reshape 2022

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

December 23, 2021

|

|

|

|

Publication Note: Today’s Alert will be our last regularly scheduled Alert of 2021. Our next email will be on January 4, 2022. However, if market conditions warrant an interim update, one will be sent. Happy Holidays and Happy New Year!

January has quite a reputation on Wall Street as an influx of cash from yearend bonuses and annual allocations has historically propelled stocks higher. January ranks #1 for NASDAQ (since 1971), but fifth on the S&P 500 and DJIA since 1950. January is the last month of the best three-month span and holds a full docket of indicators and seasonalities.

DJIA and S&P rankings did slip from 2000 to 2016 as both indices suffered losses in ten of those seventeen Januarys with three in a row, 2008, 2009 and 2010 and then again in 2014 to 2016. January 2009 has the dubious honor of being the worst January on record for DJIA (-8.8%) and S&P 500 (-8.6%) since 1901 and 1931 respectively. The early stages of the Covid-19 pandemic spoiled January in 2020 & 2021 as DJIA, S&P 500, Russell 1000 and Russell 2000 all suffered declines in 2020. In 2021, DJIA, S&P 500 and Russell 1000 declined.

In midterm years, January ranks near the bottom since 1950. Large-caps have been the worst with S&P 500 ranking #10 (third worst) with DJIA and Russell 1000 ranking #9. Technology and small-cap shares fare slightly better in the rankings, but small-cap average performance is still negative and NASDAQ is only barely positive.

On pages 112 and 114 of the Stock Trader’s Almanac 2022 we illustrate that the January Effect, where small caps begin to outperform large caps, actually tends to start in mid-December. Early signs of the January Effect can be seen when comparing iShares Russell 2000 (IWM) to SPDR S&P 500 (SPY) since around December 15. Historically, the majority of small-cap outperformance is normally done by mid-February, but strength can last until mid-May when indices typically reach a seasonal high.

The first indicator to register a reading in January is the Santa Claus Rally. The seven-trading day period will begin on the open on December 27 and ends with the close of trading on January 4. Normally, the S&P 500 posts an average gain of 1.3%. The failure of stocks to rally during this time has tended to precede bear markets or times when stocks could be purchased at lower prices later in the year.

On January 7, our First Five Days “Early Warning” System will be in. In midterm election years this indicator has a poor record. In the last 18 midterm election years 8 full years followed the direction of the First Five Days. The full-month January Barometer has a slightly better record in midterm election years with 10 of the last 18 full years following January’s direction.

Our flagship indicator, the January Barometer created by Yale Hirsch in 1972, simply states that as the S&P goes in January so goes the year. It came into effect in 1934 after the Twentieth Amendment moved the date that new Congresses convene to the first week of January and Presidential inaugurations to January 20.

The long-term record has been stupendous, an 84.5% accuracy rate, with only 11 major errors since 1950. Major errors occurred in the secular bear market years of 1966, 1968, 1982, 2001, 2003, 2009, 2010 and 2014 and again in 2016 as a mini bear came to an end. The tenth major was in 2018 as a hawkish Fed continued to hike rates even as economic growth slowed and longer-term interest rates fell. Historical levels of support from the Fed and Federal governments in 2020 quickly undid the market damage caused by the Covid induced economic shutdown. Currently, 2021 will be the 12 major error for the January Barometer. The market’s position on the last trading day of January will give us a better read on the year to come. When all three of these indicators are in agreement it has been prudent to heed their call.

|

January 2022 Strategy Calendar

|

|

By:

Christopher Mistal

|

December 23, 2021

|

|

|

|

|

2021 Free Lunch Stocks Served: 26 New Lows Make the Grade

|

|

By:

Jeffrey A. Hirsch & Christopher Mistal

|

December 18, 2021

|

|

|

|

Publication Note: On Thursday, December 23nd we will deliver to you our last regularly scheduled Alert of 2021 covering the January 2022 Almanac and Strategy Calendar. Our next email will be on January 4, 2022 (Santa Claus Rally results). However, if market conditions warrant an interim update, one will be sent. Happy Holidays and Happy New Year!

Our “Free Lunch” strategy is purely a short-term strategy reserved for the nimblest traders. Traders and investors tend to get rid of their losers near yearend for tax loss purposes, often driving these stocks down to bargain levels. Our research has shown that NYSE stocks trading at a new 52-week low on or about December 15 will usually outperform the market by February 15 in the following year. We have found that the most opportune time to compile our list is on the Friday of December quarterly options and index futures expiration – AKA Triple Witching Day.

This strategy takes advantage of several year-end patterns and indicators. First, the stocks selected are usually technically, deeply oversold and poised for a bounce, dead cat or otherwise. Second, all of the stocks are of the small- and mid-cap variety that will benefit from the January Effect which is the tendency for small-caps to outperform large-caps from mid-December through February. Lastly, the strategy spans the usually bullish Santa Claus Rally and the First Five Days of January.

To be included in this list, the stock must have traded at a new 52-week low on Friday, December 17, 2021. To remain on this year’s list, the stock had to still be trading at $1.00 or higher as several online trading platforms place additional restrictions on a trade when shares are below $1.00. Furthermore, the stock must have traded at least 100,000 shares on average over the past 20 days and have a market cap of at least $100 million, but not greater than $10 billion. Then, any stock that was not down 50% or more from its 52-week high to the 52-week low reached on Friday was also eliminated. Additionally, since the number of stocks making new 52-week lows on December 17, 2021 was large we screened for stocks that had trading volume on Friday that was 2x the average daily volume over the past 20 days on NYSE, AMEX and NASDAQ. No China domiciled companies are included on the list. Finally, preferred stocks, funds, splits, special high dividends and new issues (SPAC and/or other mergers) were eliminated. No stocks from the American Stock Exchange made the cut.

Our suggested guidelines for trading these Free Lunch stocks is to initiate a position at a price no greater or less than 3% of Friday’s closing price and to implement an 8% trailing stop on a closing basis from your execution prices. If the stock closes below 8% of the execution price or a subsequent high watermark, then the stock would be closed out of the portfolio. If any of these stocks trade in a window between -3% to +3% of Friday’s closing price on Monday, December 21, it will be tracked in the Almanac Investor Stock Portfolios using the trade’s execution price with an 8% trailing stop on closing basis.

If you buy these stocks, please note the following:

1. Consider selling them as soon as you have a significant gain and utilize stop losses.

2. The stocks all behave differently and there is no automatic trigger point to sell at.

3. Standard trading rules from the Almanac Investor Stock & ETF Portfolios do not apply for these stocks.

4. We think you should be out of all of these stocks between the middle of January and the middle of February.

5. Also, be careful not to chase these stocks if they have already run away.

DISCLOSURE NOTE: Officers of the Hirsch Organization do not currently own any of the shares mentioned. However, we may participate in the Free Lunch Strategy.

|

Stock Portfolio Updates: Trimming Large-Cap Defensive Positions

|

|

By:

Christopher Mistal

|

December 09, 2021

|

|

|

|

Even though recent market action makes it feels like 2021 has been a challenging year, it certainly has not been. In fact looking at the S&P 500 performance in 2021 compared to various 1-year seasonal patterns since 1949, this year has been great. Even after today’s setback S&P 500 is still up more than double its average performance over the last 72 years. When compared to average post-election year performance the outsized gains of 2021 thus far are even more impressive.

![[S&P 500 Seasonal Patterns Chart]](/UploadedImage/AIN_0122_20211209_SP500_Seasonal_Chart_2021.jpg)

Omicron spoiled typical late-November bullishness and sparked the recent pullback, but as new data becomes available each day, the omicron variant is likely less of a concern for the market than the Fed. Persistent inflation is testing the Fed’s credibility and based upon recent comments its patience as well. Where the market goes from here may be decided by the Fed at its next regularly scheduled meeting on December 14 and 15. If they can manage to strike a perfect balance, then the market is likely to continue its typical Q4 rally through year-end. However, should the Fed choose to move too aggressively toward a tightening policy stance it could trigger more pain for the market in the near-term.

Stock Portfolio Updates

Over the last three weeks since last update through yesterday’s close, S&P 500 advanced a modest 0.3% while Russell 2000 declined 4.4%. Over the same time period the entire portfolio slipped 0.3% lower, excluding dividends and any fees. Small-cap positions were responsible for the overall decline, off 1.0%. Large-cap positions were up 0.3% on average while Mid-cap names collectively rose 2.4%.

Small-cap weakness was primarily the result of USA Truck Inc (USAK). Last update we elected to raise its buy limit and promptly add it to the portfolio following USAK’s respectable Q3 earnings report released in late-October. The timing of the adjustment proved to be less than opportune as a little over a week later the Omicron variant hit triggering a broad market retreat in late-November that spilled over into early-December. As a result, USAK was stopped out on December 1 when it closed below its stop loss of $17.13. Shares of USAK have since rebounded with the broad market but remain well below recent highs. There is no new recommendation for USAK at this time.

On a positive note, MGP Ingredients (MGPI), successfully bucked the broad market trend on December 1. As major indices declined on the day, MGPI jumped higher to close up 7.8%. It was during this day that MGPI first reached double its original price. Per standard trading guidelines (located at the bottom of the portfolio table below), half the original position was sold that day. MGPI is on Hold.

Entravision Communications (EVC) is another position that made a noticeable move since last update–in the wrong direction. Taking a closer look at EVC revealed no meaningful change in its current condition or near-term outlook. Prior to its recent retreat shares had logged massive year-to-date gains and the recent market selloff appears to have been used to take some of the profits off the table. EVC is on Hold.

Overall our Mid-cap positions held up well during the recent market pullback. Standouts in the portfolio include Valmont Industries (VMI), Green Brick Partners (GRBK) and Pacira BioSciences (PCRX). All three positions logged gains over the last three weeks while major indexes were flat to lower. Per last month’s update, AAON Inc (AAON) was added to the portfolio using its average price on November 19. At yesterday’s close, AAON was up 8.7%. VMI, GRBK, PCRX and AAON are on Hold.

Large-cap positions also held up well over the last three weeks through yesterday’s close. Many positions actually managed to climb modestly higher and at the depths of the market’s selloff no position was stopped out. Per last update,

Verizon (VZ) was stopped out on the close on November 18. The original position has been closed out for a modest 6.4% loss excluding dividends and trading fees while a new position has been added using VZ’s average price on November 19. The reasoning behind adding to VZ and T were covered in

November’s Portfolio Update. VZ and T could experience further weakness through yearend as a result of their competition’s perceived advantage in 5G and possibly due to tax-loss selling.

VZ and T are on Hold.

With the possibility of the Fed accelerating the end of QE and potentially hiking interest rates sooner and quicker, we are going to trim our holdings in defensive utilities holdings. Traditionally these positions have benefited when interest rates were declining and have tended to languish when rates are rising. Sell Half of each position in Ameren Corp (AEE), DTE Energy (DTE), Duke Energy (DUK), Exelon (EXC), Southern Company (SO) and in the Mid-cap portfolio; Black Hills Corp (BKH). For tracking purposes half of each position will be sold using its respective average daily price on December 10.

Please see table below for updated stop losses and current advice for positions not covered above.

|

ETF Portfolio Updates: Omicron Startles Market

|

|

By:

Christopher Mistal

|

December 02, 2021

|

|

|

|

Tomorrow morning the Bureau of Labor Statistics will release its Employment Situation report for November. Depending upon your preferred source, the consensus estimate is for a gain of approximately 550,000 net new nonfarm jobs. That would be in line with the 534,000 that ADP reported yesterday. Historically, the market has responded favorably to the jobs report released in December. S&P 500, NASDAQ, Russell 1000 and Russell 2000 have all advanced sixteen times in the last twenty-one years. DJIA’s record has one more loss. Average gains range from a low of 0.38% by DJIA to a solid 0.77% by Russell 2000. Sizable losses in 2018 do drag down historical average performance, but the overall trend spanning the last twenty-one years remains bullish.

![[Market Performance on December Jobs Day Table]](/UploadedImage/AIN_0122_20211202_Dec_PR_Day_table.jpg)

Key levels for DJIA and Russell 2000 mentioned in

last Tuesday’s email Alert were breached during the selloff. S&P 500 and NASDAQ did retreat as well, but the market appears to be trying to find support. Should tomorrow’s jobs report come in anywhere near expectations it could be the needed catalyst to build further on today’s gains.

Sector Rotation ETF Portfolio Update

Since the shortened trading day after Thanksgiving when the new Omicron covid variant was first announced the market has been in something off a tailspin. As of yesterday’s close every position in the Sector Rotation portfolio except SPDR Gold (GLD) and SPDR Technology (XLK) has declined. Since the beginning of the pandemic early last year this has essentially been the markets go to move when governments place restrictions on economic activity. Stay-at-home tech positions generally hold up and advance while the rest just seems to get ignored or sold. Then as time passes and the worst-case scenario does not unfold everything begins climbing again. This day-to-day volatility ends up testing the most discipled traders and investors. However, as we have seen time after time recently, market weakness has been relatively short-lived, and losses have generally been quickly reversed. Today’s gains could be the beginning of the latest reversal or at a bare minimum the bottoming process.

Prior to Thanksgiving, SPDR Biotech (XBI) was stopped out when it closed below its stop loss of $122.37 on November 22. XBI has been closed out of the portfolio using its average price of $117.50 on the following trading day. We have been long-time fans of the sector and are going to look to get back into XBI near current levels up to a buy limit of $114.90. If purchased a stop at $99.90 is suggested. Biotech’s historically bullish period runs through March and the new Omicron variant has the potential to draw investors back into the sector as it is noticeably less pricy now than it was at the start of this year.

iShares Semiconductor (SOXX) traded above its auto-sell price for the first time on November 18 and was sold that day at $533.36 for a 19.8% gain since being added to the portfolio in early October. SOXX appears to be consolidating after October’s surge. If you are still holding SOXX in anticipation off another move higher, as an alternate to outright selling the position, consider a trailing stop. As a reminder, semiconductor historical seasonal strength has come to an end in early December.

Historical seasonal strength in telecom also come to and end in December, usually near month end. With this in mind, we will look to close out the position in iShares DJ US Telecom (IYZ). Aside from its dividend, IYZ has not been all that rewarding. Sell IYZ. For tracking purposes IYZ will be closed out using its average price on December 3.

Energy is another sector that has been hit by Omicron. Last month’s new trade idea in the sector, SPDR Energy (XLE) was added to the portfolio using its average price of $58.15 on November 5. XLE can be considered near current levels up to its buy limit. History suggests that freshly added travel restrictions will likely not last and crude oil demand will remain firm while supply is still restrained. A quick crude oil recovery is likely which should be bullish for the companies held in XLE.

Perhaps this pullback is different, but that could be said about them all. In all likelihood we will see something similar to the recent past, a dip and a relatively quick recovery. Most recently, September’s losses were quickly recovered in October. Even the bear market that came with the beginning of the pandemic was quickly reversed. For those that can tolerate the volatility, every position in the Sector Rotation portfolio, except GLD, can still be considered at or near current levels. Please see following table for suggested buy limits, stop losses and auto-sell prices (where applicable).

Tactical Seasonal Switching Strategy Portfolio Update

Overall gains in the Tactical Seasonal Switching portfolio have retreated since last update but remain positive. Invescos QQQ (QQQ) is still the best performing position, up 7.3% as of yesterday’s close. SPDR S&P 500 (SPY) was up 3.0% while SPDR DJIA (DIA) and iShares Russell 2000 (IWM) bore the bulk of the sell off, down 1.9% and 3.9% respectively.

In spite of the recent weakness, our overall outlook remains bullish for the Best Months. The announcement of Omicron seems more like a reminder that the pandemic and its associated volatility are not over yet. Even before the Black Friday market selloff, covid cases had been on the rise as the market was climbing higher.

Anticipated early December tax-loss related selling may not manifest or maybe be muted and limited to underperforming slices of the market this year as the market has already endured a modest pullback. Consistent with Sector Rotation portfolio suggestions, all positions in the Tactical Switching portfolio can also be considered at or near current levels up to their respective buy limits.

As a reminder, these positions are intended to be held until we issue corresponding Seasonal MACD Sell Signals next year after April 1 for DJIA and S&P 500 and after June 1 for NASDAQ and Russell 2000. As a result, no stop loss is suggested on these positions.